The Myth vs. Reality: Easy Crypto Earnings

Everyone loves the idea of earning money while doing nothing, and in the world of crypto, "passive income" often gets painted with that same brush. While cryptocurrency offers incredible opportunities to make your assets work for you, it's crucial to separate the hype from the actual mechanics. Let's bust some common myths and give you the real talk on getting started safely.

Myth 1: "Liquid Staking is Effortless, Risk-Free Income"

The Myth: Just lock up your crypto, and watch the rewards roll in, no effort needed. The video shows delegating tokens to validators and receiving rewards (0:11-0:16), making it seem simple.

The Reality: Liquid staking involves delegating your cryptocurrency to a "validator" (like an accountant for the blockchain) who helps secure the network. In return, you earn rewards. While the process itself is automated by "DeFi protocols" (0:57-0:58), it's not entirely risk-free. Your staked assets are subject to the crypto market's usual ups and downs, and there's a small risk associated with the validator's performance or potential smart contract vulnerabilities on the platform you use.

A Simple Alternative/Starting Point: Start with well-established and audited liquid staking platforms. Before you commit, understand the specific cryptocurrency you're staking and its price volatility. Begin with a small amount you're comfortable with. Reputable exchanges often offer simplified staking options, making it easier to dip your toes in without deep technical knowledge.

Myth 2: "Lending Crypto Guarantees High, Safe Returns"

The Myth: Lending out your crypto is like putting money in a savings account, but with much higher interest. The video mentions lending tokens through "lending protocols" to earn interest (0:23-0:25).

The Reality: Lending protocols allow you to lend your cryptocurrency to others, who then use it as collateral for loans. You earn interest on the crypto you lend. While interest rates can be attractive, this isn't a traditional bank account. Risks include smart contract bugs that could compromise your funds, and in extreme market conditions, borrowers might face liquidation, which can indirectly affect lenders if the system's safeguards fail. The value of the crypto you lend can also fluctuate.

A Simple Alternative/Starting Point: If you're looking for stability, consider lending "stablecoins" (cryptocurrencies designed to hold a stable value, usually pegged to the US dollar) on reputable lending platforms. This reduces price volatility risk significantly compared to lending volatile assets like Bitcoin or Ethereum, though smart contract risks still exist. Always research the platform's security history and audit reports.

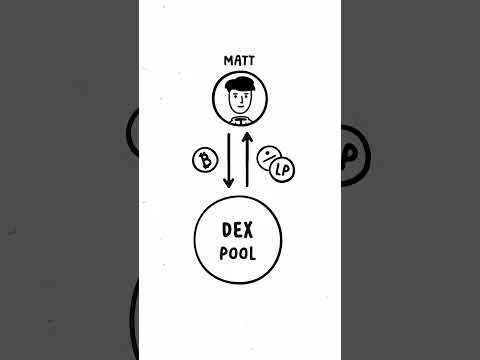

Myth 3: "Providing Liquidity to DEXes Means Instant, Easy Profits"

The Myth: Just add your tokens to a "DEX pool" (0:32-0:34) and earn trading fees, plus extra rewards from "yield farms" (0:39-0:43) without any downsides.

The Reality: Providing liquidity to a "Decentralized Exchange" (DEX) means you contribute pairs of tokens to a pool that enables others to trade. You earn a share of the trading fees. However, this comes with a unique risk called "impermanent loss." This happens when the price ratio of the tokens you deposited changes significantly, meaning the value of your assets withdrawn from the pool might be less than if you had simply held them outside the pool. Yield farming, while offering additional rewards, often involves more complex strategies and higher risks.

A Simple Alternative/Starting Point: For beginners, consider starting with stablecoin pairs if you explore providing liquidity on a DEX. This largely eliminates impermanent loss risk, though you still need to be aware of smart contract risks and transaction fees. For most newcomers, simply holding a diversified portfolio or exploring basic staking options is a more straightforward entry point.

While DeFi protocols can automate the connection between demand and supply (0:57-0:58), making income truly passive in terms of effort, it's never truly passive in terms of understanding and risk management. Always do your own research, start small, and never invest more than you can afford to lose. The world of crypto is exciting, but knowledge is your best asset!