To see the light, you must first look through the darkness. A Vigilant analysis, is the only appropriate analysis.

I have decided I am going to start publishing blockchain oriented content about the WeedCash network. The complexities of the mining algorithm and curation cycles will be mutually affected by certain market factors. I have engaged in similar works in the past while I was mining Zcash, the posts are from 2016-2018, i can throw them in the comments if you're interested.

Market Factors to Watch

This will help you understand why supply and demand, along with contributing roles of large share holders driving the factor commonly referred to as luck will end up playing out in the long run.

The first thing I do is read current events about a currency I like to speculate about, as the public opinion is the #1 driver of price in any digital currency project, in my opinion. After I have done the social interpretation I move onto the math. Luckily here on Hive it is a social network, so that was the easiest part, just reading the blogs on the blockchain can provide a great insight into the direction the community is heading.

In the case of WeedCash diversification and on-boarding (much like Hive) has become the main driving factor, everyone is excited to share and that is great. This consensus has endured for sometime now, with a steady growing user base.

The lower the price, the better for on-boarding, the higher the price, the more likely investors have inflated the value within a very small demographic much like how a real estate bubble works in housing markets.

In the case of WeedCash a recent parabolic increase in price followed by a healthy retracement would satisfy most investors interests, but perhaps are waiting for another drop closer to a ratio of 0.38 from the top of the recent trend.

Complexities of Mining WeedCash

One of the hardest parts of understanding the distribution of wealth in this Hive-Engine currency spectrum is the many mathematical factors. Content creation is obviously the best way to make friends on Hive, but there is also some lesser known ways to profit and farm the yield as its known.

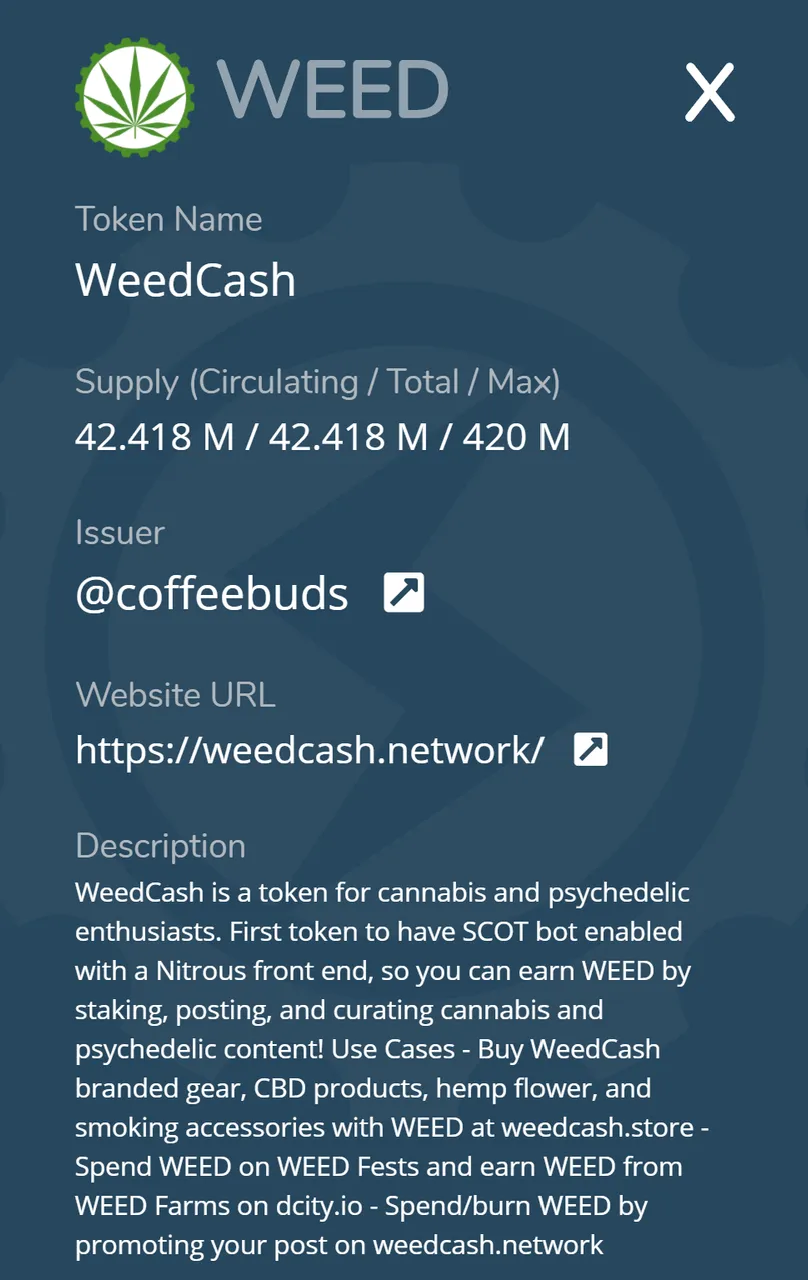

If you look up the WeedCash info on https://hive-engine.com this is what you will see. It mentions enthusiasts in the first line so its safe to assume a wide variety of people may be interested in this. There is just one issue I am going to point out here that some people may be over looking if they really want to get their hands in the game of WeedCash. There is an important factor not mentioned in the WeedCash token description, HPOS.

Hybrid Proof of Stake

There is a Hybrid Proof of Stake algorithm which will make this a more complicated form distribution than other tokens that are staked. Many of us are used to earning interest on staked tokens, BUT what if I told you there was extra interest added for usernames also holding WEEDM and WEEDMM?

This is precisely the case and you can read about it here. You can take advantage of the increased rewards by holding some of all 3 of the tokens, depending on the price of Miners and Mega Miners (WEEDM & WEEDMM on Hive Engine), you will be able to leverage an increased amount of interest by staking both.

Footnotes

- As a 2016 Hive member I would like to remind people that the algo used in the Hive Engine Tokens can drastically vary and simply curating your rewards in these alternative front ends may not be enough to satisfy your original Hive spirit

- Being unaware of this hybrid PoS system lead me to some confusion about the purpose of the WeedCash currency, but it seems the developer @richardcrill is confident in the equal distribution of tokens via this hybrid PoS system

- The WeedCash Market Overview is a grassroots exploration of the WeedCash coin distribution, i encourage you to ask any questions about distribution of wealth on the WeedCash Network so I can inquire deeply into these concerns as a fellow Hive users with zero affiliation or contract with the developers, as a 3rd party to vet for the principals of trust

- I am going to be doing some complex math equations and prices are very volatile so unlike the Zcash mining profitability reports I used to publish, I will have to use some running averages to accommodate for volatility

If you know how to get Hive-Engine Tokens onto trading view I will do some charts but at the moment I am limited to explaining the ratios I see with a bottleneck.

100 Weed Bounty

Turn the bitcoin logo into a weedcash logo!