I still remember the day I lost $400 hard earned money because of a centralized stablecoin's "temporary" depegging. It was back in 2023, and I had naively trusted that the "stable" part of stablecoin actually meant something. Spoiler alert: it didn’t. USDC dropped to $0.88 out of nowhere after the whole Silicon Valley Bank mess. And just when I thought I could move to something safer, BUSD another so called “trusted” stablecoin was getting canceled by regulators. The entire space felt like quicksand. And don’t even get me started on HUSD that one just flat-out collapsed and never came back. These were all supposed to be the “safe” options. Joke’s on me.

That experience sent me down a rabbit hole searching for a truly decentralized stablecoin that wouldn't leave me at the mercy of some corporate entity's banking relationships or regulatory troubles. After months of research and experimentation, I realized something that genuinely surprised me: HBD, or Hive Backed Dollar. Mind you , I've been part of Hive Ecosystem before 2024, but I never realized the true value of HBD and what we have in the ecosystem.

I've been using HBD since early 2024, and I'm still shocked that more people aren't talking about it. Here's the thing while everyone's obsessing over USDT's latest controversy or USDC's banking partners, there's a stablecoin that's been quietly operating with remarkable stability, genuine decentralization, and get this a 15% APR savings feature.

So grab a coffee (or whatever beverage floats your boat), and let me tell you why HBD is the best, most decentralized stablecoin you've probably never heard of.

Trust the Coin, They Said. It’s 'Stable,' They Said.

Before we get into what makes HBD special, let's take a quick look at the current stablecoin market. It's... not great.

The stablecoin ecosystem is dominated by a few major players:

USDT (Tether): The largest by market cap, but constantly plagued by questions about its reserves and transparency issues. Remember those New York Attorney General investigations? Yeah, not exactly confidence-inspiring.

USDC (USD Coin): Supposedly more transparent than Tether, but still entirely dependent on Circle and Coinbase's banking relationships. When Silicon Valley Bank collapsed in 2023, USDC briefly depegged, causing chaos across the crypto markets.

DAI: Often touted as "decentralized," but let's be real, it's heavily collateralized by USDC these days, which just reintroduces the same centralization risks with extra steps.

BUSD: Binance's stablecoin that was forced to shut down in the US due to regulatory pressure. Need I say more?

The fundamental problem with these stablecoins is that they're either directly centralized (with a company controlling the minting/burning) or indirectly centralized (dependent on other centralized systems).

To be honest, I used to think this was just the price we had to pay for stability. I was wrong.

What Makes HBD Special: Decentralization That Actually Works.

So what exactly is HBD? Simply put, it's the native stablecoin of the Hive blockchain, designed to maintain a peg to the US dollar through some genuinely clever mechanisms.

What I find most fascinating about HBD is that it achieves stability without relying on centralized reserves or oracles. Instead, it uses a system of decentralized conversions and community governance that's been battle-tested since its inception.

The Conversion Mechanisms: Two-Way Streets

HBD maintains its peg through two primary conversion mechanisms:

HBD to HIVE Conversion: You can convert your HBD to $1 worth of HIVE tokens with no extra fees. The conversion takes 3.5 days to process, and uses the median price over that period to determine the amount of HIVE you receive. This helps prevent market manipulation and ensures fair pricing.

HIVE to HBD Conversion: You can also convert HIVE to HBD, though this comes with a small % fee. This is a collateral-based conversion you get your HBD immediately, and the process finalizes after 3.5 days.

These two mechanisms create natural market forces that help maintain the peg. If HBD trades below $1, arbitrageurs can buy it cheaply and convert it to $1 worth of HIVE, making a profit. If it trades above $1, the reverse happens.

I've personally used these conversion mechanisms several times, and they work exactly as advertised. No middlemen, no centralized approval process – just code executing on a decentralized blockchain.

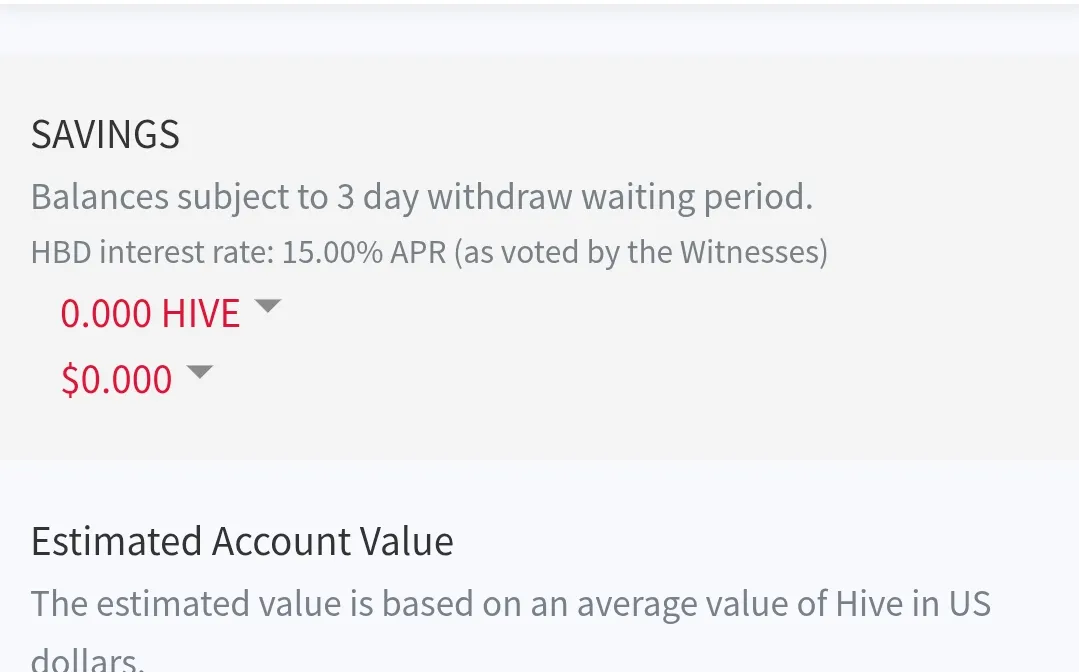

The 15% APR Savings Account: Wait, What?

Now here's where things get really interesting. HBD offers a savings account feature with a current APR of 15%. Yes, you read that right, fifteen percent.

(I'm not gonna lie, when I first heard about this, I thought it was not real, if something sounds too good to be true, it usually is.)

But the HBD savings account is legitimate and has been functioning for years. Here's how it works:

- You place your HBD into the savings account

- It starts earning interest at the current rate (15% APR as of July 2025)

- There's a 3-day unlock period if you want to withdraw

The interest comes from the blockchain's inflation, not from some unsustainable lending scheme or risky investment strategy. It's a feature that was deliberately built into the system and approved by the community through decentralized governance.

I'm planning to buy some HBD and lock them up in savings for over a year, and watching it grow at 15% has been one of the most satisfying passive income decision one would ever make in crypto.

The Haircut Rule: Preventing Over-Debt

One of the cleverest aspects of HBD is the "haircut rule" – a mechanism that prevents the system from becoming over indebted.

The rule is simple: if the debt ratio of HBD to HIVE exceeds 30%, the conversion rate from HBD to HIVE is automatically adjusted downward. This ensures that the system never becomes insolvent, even in extreme market conditions.

Think about that for a second. While other stablecoins were collapsing during market crashes, HBD had a built-in mechanism to maintain system solvency. It's like having an automatic circuit breaker that prevents catastrophic failure.

We as a community have seen this mechanism tested during some pretty volatile periods for HIVE, and it's performed exactly as designed. That's the kind of resilience you want in a stablecoin.

Real-World Use Cases: How I Use HBD (And How Others Do Too)

So those are the technical details, but how does HBD actually work in practice? Let me share some of my experiences.

My HBD Journey

I first started using HBD as a way to park some funds while I was between investments. The 15% APR was the initial attraction. I mean, who wouldn't be interested in that kind of return on a stablecoin?

But what kept me using HBD was the reliability. I've used it to:

- Store value during market downturns (much better than holding volatile crypto)

- Send money to other Hive users with zero fees and near-instant transactions

- Pay for services within the Hive ecosystem

- Earn passive income through the savings account

One particular instance stands out. Last year, I needed to send money to a friend overseas who was also into crypto. The traditional banking system wanted to charge us ridiculous fees and would have taken days. Instead, I sent HBD directly to his Hive account from my other Hive account and it arrived instantly, with zero fees, and he was able to either use it and convert it to his local currency through various on/off ramps.

Try doing that with a bank transfer. Or even with Bitcoin, for that matter.

Community Uses

Fellow Hivers have found even more creative uses for HBD:

- Content creators on Hive blogs receive HBD as payment for their work

- Developers building on Hive often get paid in HBD for their contributions

- Small businesses within the ecosystem use it for day-to-day operations

- Traders use it as a stable parking spot between trades

I've seen community members use HBD for everything from funding charitable projects to paying for graphic design work. The zero-fee transactions within the ecosystem make it incredibly practical for these kinds of use cases.

Challenges and Limitations: Let's Keep It Real

Alright, I've been singing HBD's praises for a while now, but I wouldn't be giving you the full picture if I didn't address some of the challenges and limitations.

Limited Liquidity and Exchange Support

This is probably the biggest hurdle for HBD right now. While you can trade it on exchanges like Upbit and MEXC, it doesn't have the same level of liquidity or exchange support as the major stablecoins.

This can make it harder to move large amounts in and out of HBD without affecting the market price. A friend of mine ran into this issue when trying to convert larger sums – you need to be patient and break it into smaller transactions some times, though that is changing gradually.

Adoption Barriers

Let's face it – Hive itself isn't as well-known as Ethereum or Solana, which means HBD starts with a built-in adoption disadvantage. Many people simply haven't heard of it, and those who have might be hesitant to use a stablecoin from a less mainstream blockchain.

There's also a learning curve. Understanding the conversion mechanisms, the haircut rule, and how to use the savings account takes a bit of time. It's not complicated, but it's different from how other stablecoins work.

Potential Regulatory Concerns

While HBD's decentralized nature is one of its greatest strengths, it could also attract regulatory scrutiny in the future. As governments around the world crack down on crypto, particularly stablecoins, HBD's lack of centralized control might be seen as either a feature or a bug, depending on the regulatory perspective.

That said, I believe HBD's design actually makes it more resilient to regulatory challenges than centralized alternatives. There's no single point of failure, no company that can be shut down, and no central reserves that can be frozen.

The Future of HBD: Where Do We Go From Here?

Despite these challenges, I'm incredibly optimistic about HBD's future. Here's why:

Growing Awareness

I've noticed a steady increase in discussions about HBD in various crypto communities over the past year. As more people become disillusioned with the centralization risks of mainstream stablecoins, alternatives like HBD are getting more attention.

The recent controversies surrounding USDT and USDC have only accelerated this trend. People are actively looking for more decentralized options, and HBD fits the bill perfectly.

Ecosystem Expansion

The Hive ecosystem continues to grow, with new applications and services being built on top of the blockchain. Each new addition increases the utility of HBD and expands its potential user base.

Projects like @threespeak (decentralized video platform) and @splinterlands (blockchain game) and many more bring new users to Hive, many of whom discover and start using HBD as a result.

Technical Improvements

The Hive development community is constantly working on improvements to the blockchain and its native assets. Recent proposals have focused on enhancing HBD's stability mechanisms and increasing its utility within and beyond the ecosystem.

One particularly exciting development is the potential for cross-chain bridges that would make it easier to use HBD on other blockchains. This could significantly increase adoption and utility.

Conclusion: The Stablecoin We Deserve

So there you have it – HBD is a genuinely decentralized stablecoin with unique features that set it apart from the crowd. It offers:

- True decentralization through community governance and code-based mechanisms

- Impressive stability maintained by conversion operations and the haircut rule

- Attractive returns through the 20% APR savings account

- Fee-less transactions within the Hive ecosystem

- Resilience against market crashes and regulatory challenges

Is it perfect? No. Does it have challenges to overcome? Absolutely. But in a world where most "stablecoins" are neither stable nor decentralized, HBD stands out as something special.

I've been using HBD for over a year now, and it's become an essential part of my crypto strategy. If you're tired of the centralization risks and regulatory uncertainties of mainstream stablecoins, I'd strongly encourage you to give HBD a try.

Getting started is simple:

- Create a Hive account through sites like Hive.blog or PeakD.com

- Acquire some HIVE through an exchange like Upbit or MEXC

- Convert some HIVE to HBD using your wallet's conversion feature

- Optionally, move your HBD to savings to start earning that sweet 15% APR

The Hive community is also incredibly welcoming and helpful. If you have questions or run into issues, there are always people willing to help in various Discord servers and Hive communities.

So what do you think? Are you ready to try the best stablecoin you've never heard of? I'd love to hear your thoughts and experiences if you do.

Until next time,

A fellow Hiver who believes in truly decentralized finance

P.S. If you found this article helpful, consider supporting me by upvoting it. And if you have questions about HBD or want to discuss further, drop a comment below – I'm always happy to chat about this stuff!