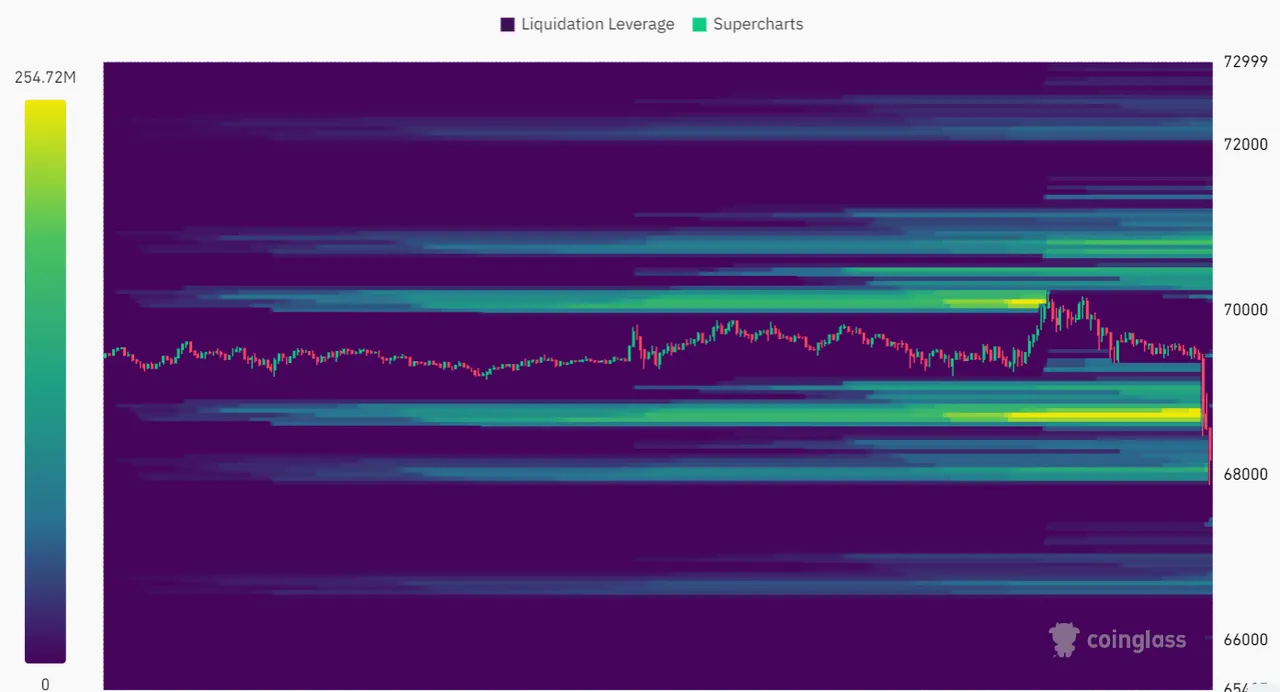

I've been using this Liquidation Heatmap on top of my current trading system just to see whether it gives me an edge.

None of this is financial advice.

Areas where there's a concentration of "heat" tend to be magnets for price. It's a good fit with support and resistance theory and supply and demand theory. I don't really subscribe to one idea.

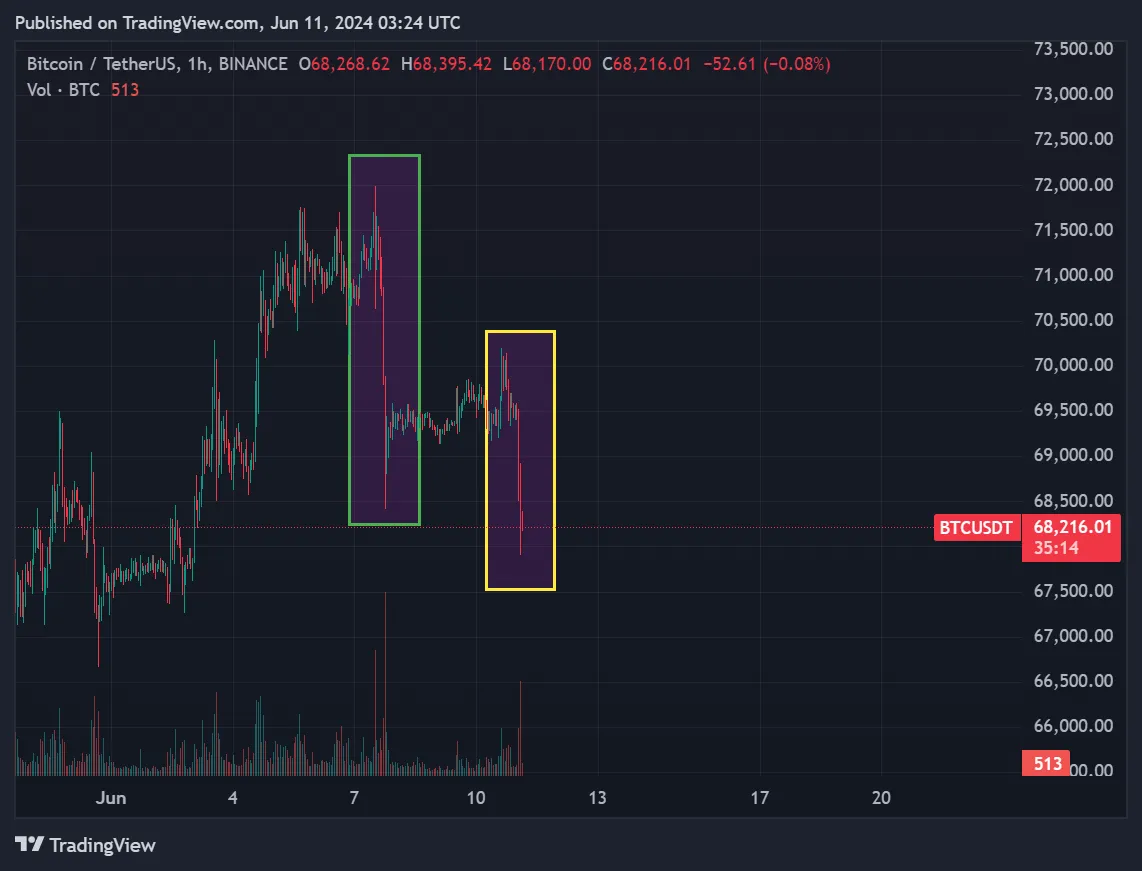

When I saw BTC making a dip (in green), the first instinct was to buy the sale but then wisdom came from trading for months and that wisdom says don't fall for it. Now there's no way to tell that price would be going sideways right after the initial drop, I could just be catching a falling knife if I went in, so better do nothing and see where it goes than lose money into FOMO.

The price went sideways over the course of the weekend prepping for Monday's opening, so when I saw the market not doing much, I just went nah, just wait. There's an FOMC meeting coming up within the week so I'm not expecting any big moves until the day prior to it or during the day because these economic events shake up US stock markets and crypto. And the current drop in yellow proved to be the right choice.

I could still made the wrong choice and see the price of BTC rocket up making all time highs during that first dip but unlike before, I wouldn't beat myself for being wrong while trying to stick to my trading system. The fact that no one can acurately say where the market is heading is more than enough to pardon making calculated mistakes than blindly gambling your money.

But my thought process isn't limited to just looking at charts, I could go into the boring details about the fundamentals but nobody got time for that.

Some global macroeconomic news include US real estate housing not collapsing, US stocks making ATHs, and even the employment rate increase for May 2024

US Bureau of Labor Statistics May Report

Total nonfarm payroll employment increased by 272,000 in May, higher than the average monthly gain of 232,000 over the prior 12 months. In May, employment continued to trend up in several industries, led by health care; government; leisure and hospitality; and professional, scientific, and technical services.

China unloads a record high US bonds from its stockpile in an effort toward de-dollarization.

June 9, 2024: Saudi Arabia didn't renew the Petro-Dollar Deal

I go over these materials before committing the real money. And if unsure, there's always the paper trading route where I make believe I got thousands of dollars to burn and could still sleep well at night knowing I'm wrong.

I'm waiting for the results of how the market reacts tomorrow:

June 12, 2024: US Fed Rate Decision Making Time

Each of those scribbles and links will lead one to more rabbit holes in the grand scheme of things but the million dollar question is probably: should I buy Hive now?

I'm joking.

Between BTC vs Hive, Hive has been bleeding away and it's easily seen in Hive Engine's SWAP.BTC trend. To put it bluntly, converting you Hive gains to BTC at the start of the year could've been the best move but this is all in hindsight. Now I'm here to spread some FUD or sell Hopium/Copium, it's just the market doing its thing and it is what it is.

For a peace of mind about missing out on the meme coin rallies, I suggest you just avoid social media where people flex their gains. It doesn't make you feel good if you got left behind, and the people flexing are probably hiding and equal or more loss from their portfolio. I'm just saying this space has a lot of smoke and mirrors.

Broaden your views, there's a greater market out there outside crypto that also influences crypto.

Thanks for your time.