Source @Lordbutterfly

Hi,

I've stumbled on the former Twitter, on a post by @lordbutterfly, the big guy, who even has a bigger heart for Hive, than a lot of people I know from the chain. He is asking the Hive community, to write a post for Bruce Fenton, who is the CEO of Chainstone Labs. He has his own website at https://brucefenton.com/, if you wish to learn more about it.

@lordbutterfly asked to write a post about HBD, and why HBD is the best, most decentralized stablecoin you've never heard of, and post it under the bellow tweet or X-post how it is called now.

Source @brucefenton

Well, I wrote a post a couple of days ago about HBD, which can be found here: Post about HBD , but I will go a little deeper into HBD.

So I will start here:

Dear Mr. Fenton,

till now, or up till now, you might not have heard of HBD, or Hive-Backed Dollar, which is the stable coin, of the Hive blockchain. The Hive Blockchain is decentralized, as the witnesses that are responsible for keeping it up, are chosen by the stakeholder of the Hive coin. This has to be staked, in order to be able to vote for a witness, that signs the blocks on the chain. The transactions on the chain are free, so it has zero fees, where the witnesses that sign the block, get an incentive in terms of Hive tokens, every 3 seconds. It is a very fast chain, with zero fees.

Now to the HBD.

What it makes it unique, it is that HBD is governed by the witnesses and the Hive-Protocol. It is fully on chain, does not need KYC, so it is fully censorship resistant. There is no need for KYC to redeem, create or save HBD.

The repository can be found under: https://gitlab.syncad.com/hive/hive

Not to bore you with a long novel, I will go into the main aspects:

- fully decentralized

- Censorship resistance, as it is not issued by any company, only by the chain. - no KYC

- backed by Hive

- collateral ratio is set at 30% - this gives stability - If the virtual HBD supply reaches or exceeds 30% of the virtual HIVE supply, it stops printing HBD.

- zero fees in using it

- 3 second block time

- Hive is created by converting it to HBD, and by yeld on staked tokens

Will go deeper into the next two features:

- the very competitive yeld of 15% ARR

- how the peg is kept

The 15% yeld is defined by the witnesses. This ensures that the liquidity is removed from the wallets, as the tokens need to be staked. Also, it creates demand, incentivizing users to buy and hold it, which helps support the peg.

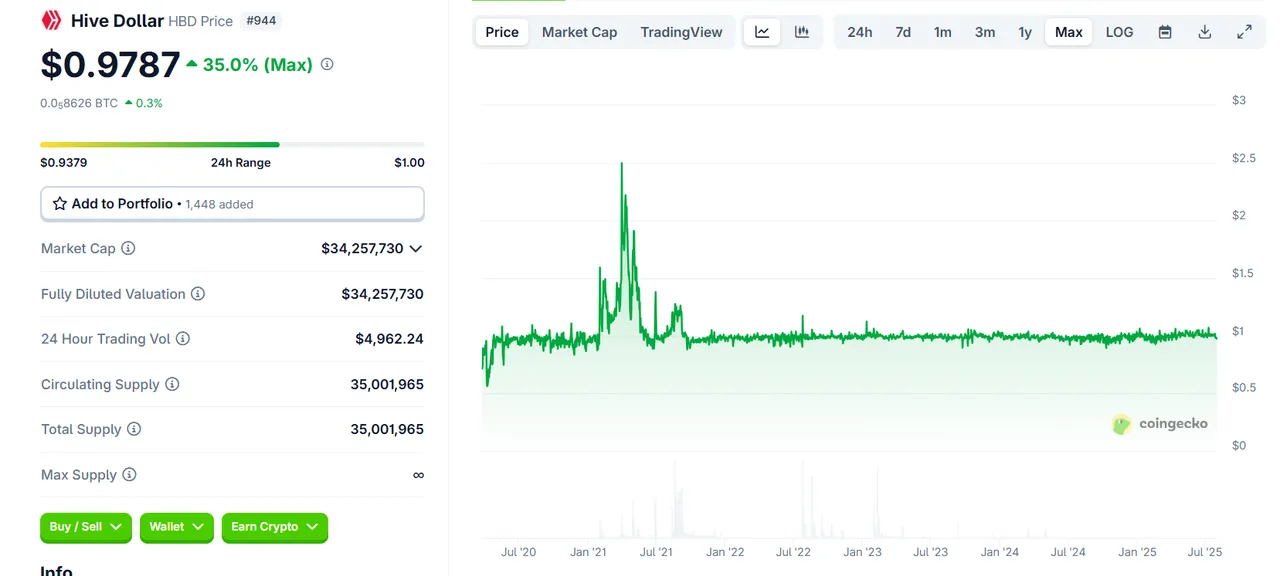

Now coming to the peg. You can see on the historic chart below, that since 2021, the HBD was relatively stable. This is because, beside the code mechanism, the decentralized community, opened a new mechanism of control, with the @hbdstabilizer account, which is funded by the community, to trade HBD when needed, to keep it at peg. When HBD falls below the threshold, it is bought from the market, and when it climbs, it is sold on the market. It is also converting HBD to Hive constantly. As the account was funded with community funds, it sends back on a daily basis to the @hive.fund account.

Source Coingecko - HBD

So, to sum it up, HBD, is decentralized, censorship resistance, has a good mechanism to keep the peg, fully on chain, a very good and stable yeld, and does not rely on FIAT custody, as it is fully on chain.

If you have any questions, please let me know, would gladly support.