Alright, for this edition of Hive 101, where I research and catalogue my learnings about the Hive blockchain, I'm going over a bigger topic. I'll deep dive into several sub-topics covered here in future posts, but the more research I did the more I wanted to go for the meat & potatoes. So what I'm covering today is the overall tokenomics of Hive.

"Tokenomics" means different things to different people. Many projects only talk about distribution when it comes to tokenomics, which in my opinion is a SMALL part of the story. The more important aspect of tokenomics is the set of mechanisms in place that drive ongoing supply (via faucets and sinks) and demand (via utility) for a coin.

For those of you who know a lot more about Hive than I do, please comment on whether there's anything I've misspoken about or missed! I will be sure to make corrections to this article to ensure it's accurate.

Let's dive in.

Hive initial distribution - a brief history

When Hive forked off of the Steem blockchain in March 2020, it inherited the balances of the Steem blockchain (save for a few select accounts that were associated with Justin Sun's hostile takeover of Steem, including Steemit Inc's ninja-mined stake which was ~20% of supply at the time). As a result Hive started with about 320M tokens when it forked off of Steem.

There were no pre-mines or ICO for Steem, so the early distribution came from high inflation from both mining (Steem had PoW at the beginning, before switching it off to fully embrace Delegated Proof of Stake) and earning, as well as the ninja-mine that went primarily to the Steemit Inc founders (Ned Scott, Dan Larimer, and a few other insiders). Again however, that ninja-mine stake was removed at the Hive fork.

So when we remove the ninja-mine and the early PoW mining, we can conclude that Hive "distribution" basically equals inflation: i.e. the people who are getting distributed Hive are the ones who are earning it through its inflation mechanisms.

There's a whole lot more to the history, but for the sake of this article which focuses on tokenomics, that's all I'll cover as far as the initial distribution is concerned.

HIVE inflation

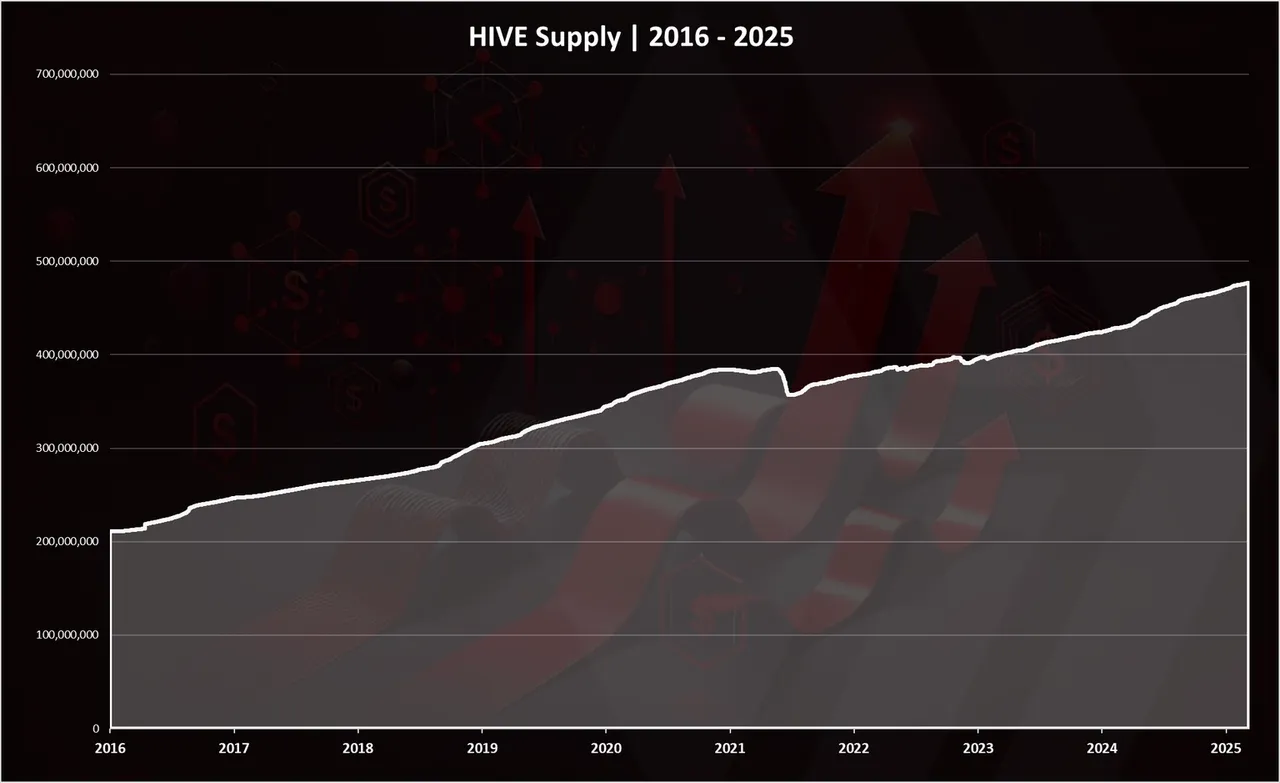

I looked around for a dynamic chart of Hive supply over time, but wasn't able to find one. However, fortunately, @dalz puts together fantastic posts going over many aspects of Hive, including this recent post on Hive inflation which contains the following chart:

In this chart, Dalz has done several corrections to the historical Hive supply data, including removing the ~80M ninja-mined tokens. It's also backfilled to the Steem genesis to give more historical data. Super useful, thank you Dalz 🙏

Hive "Faucets" (i.e. how HIVE gets added to circulation)

So where does inflation on Hive come from? In a nutshell, it comes from block rewards allocated for authors, curators, witnesses, and stakers, as well as distributions from the DHF (Decentralized Hive Fund).

According to the Hive whitepaper, the intended split is as follows:

- 65% is used to fill the reward pool for content producers and content curators (split equally).

- 15% goes to HP stakeholders. Note that this is a SMALL inflationary reward on vested HIVE. The bucket itself is 15%, but the APR from this is much lower than 15%.

- 10% goes to "witnesses" (block producers & validators).

- 10% goes to the Decentralized Hive Fund (DHF) (a decentralized treasury).

Those are the "planned inflation" mechanisms. Another for additional Hive to be created is if a user converts HBD (Hive-backed dollars) back to Hive (more on HBD later).

Hive "Sinks" (i.e. how HIVE gets removed from circulation)

There are a few ways HIVE can be removed from circulation:

- Hive→HBD conversion: When a user converts HIVE to HBD, 5% of the HIVE in the transaction is effectively burned.

- Account creation fees: When creating a new Hive account, users pay a HIVE fee (currently ~3 HIVE) which is burned.

- Null transfers: HIVE sent to a

@nullaccount is burned. This can come from content creators choosing@nullas a beneficiary for their post rewards, or can happen through community drives (aka "burn barrels") where users are encouraged to send dust (small amounts of HIVE) to null to fight inflation. - Hive DAO operations: The DHF and

@hbdstabilizer(which is a system build to keep the value of HBD stable) often convert HIVE to HBD. For example,@hbdstabilizerregularly transfers large amounts of HIVE to the DHF which are then converted into HBD, which works as a sink.

Inflation summary

Thanks to Dalz's fantastic post, we can see that the overall result of the various inflation mechanisms in play was that approximately 2.5M HIVE were added to circulation in each of the last two months (May and June 2025). That equates to a little over 80k HIVE/day.

The "projected" inflation for HIVE in 2025 is 5.5%, though we're currently at >7% year-to-date.

Note that inflation actually decreases by ~0.01% every 250k blocks and is designed to asymptotically reach 0.95% / year eventually (projected to be roughly in ~10-11 years).

HIVE utility

Now to answer the question "why would someone buy HIVE?". For many tokens, the primary answer is "because I think the price will go up!". However I like to think of it more in terms of UTILITY. What actual or intrinsic value does HIVE have that would make me want to buy it?

Since HIVE has a fee-less transaction model (powered by Resource Credits which I covered in a previous article), "gas" fees aren't its core utility (unlike ETH or many other big layer 1 coins).

HIVE has several utilies:

- Access to resource credits (RC): Assuming you want to participate in dApps on the Hive blockchain (for example by playing @Splinterlands!), you'll need Resource Credits, which are given to Hive stakers. And of course if you want to post and/or curate (upvote & downvote) content on Hive, that also requires RCs.

- Content governance & curation rewards: HIVE stake (aka "Hive Power" or HP) gives users voting power on content. A larger stake means greater influence on reward shares for content you curate, as well as a larger share of curation rewards.

- Consensus governance: HIVE stake lets users vote for witnesses (block producers) who validate blocks and set protocol parameters.

- DHF governance: HIVE stake is used to vote on DHF proposals which determine where treasury funding goes (by voting proposals up or down).

- Collateral for HBD: HIVE is the underlying asset backing HBD.

- Delegation: Since HP can be delegated (to provide other users with RC or voting power for example), that can also be seen as utility. Though it's duplicative of the above utilities, the point is that you can DELEGATE that utility to others.

- Account creation / delegation: New accounts created on-chain require a small HIVE burn (though as I've just learned, account creation can sometimes happen without a burn when done by a "sponsored or subsidized account" including some of the major front-ends). In any case, this is a small one.

So while HIVE is not like ETH or SOL in that its primarily a fee token, it IS required for participation on the Hive blockchain and therefore does have intrinsic value that is tied to the growth of the Hive blockchain (e.g. more dApps & content on Hive means greater demand for HIVE).

HBD

I'm going to need to write a whole article on Hive-backed Dollars (HBD) so this is going to be just a high-level summary.

HBD is an algorithmic stablecoin backed by HIVE, and has the following characteristics:

- HBD→HIVE: HBD holders can convert HBD into $1 of HIVE, based on the median price of HIVE over the 3.5-day conversion period.

- HIVE→HBD: HIVE holders can swap HIVE for HBD, receiving HBD equal to half the value of the HIVE (50% is kept as collateral) and for a 5% fee (which is burned)

- Debt ratio cap (aka "the haircut rule"): The protocol enforces that total HBD cannot exceed a certain percentage (current set at 30%) of HIVE's market cap; If the cap is exceeded, it prevents additional HBD from getting minted to prevent "over-debt"

- Savings interest rate: To encourage users to hold HBD, a witness-voted rate (currently 15%) is given out to HBD holders who lock their HBD in savings. This inflation is funded from newly minted HIVE which is ADDITIONAL to the buckets we looked at earlier. This is a variable source of inflation which exists to drive demand for HBD.

- HBD stabilizer: The DHF funds a market-making bot (

@hbdstabilizer) which trades HIVE↔HBD on the internal market. If HBD drops below $1, it uses DAO-held HIVE to buy HBD. The stabilizer focuses on defending the lower peg. When HBD is above $1, peg restoration relies on users minting new HBD via conversions.

In essence, HBD is "backed" by HIVE through convertibility and strict debt limits.

HBD, and its associated interest rate, serve to attract users, capital, and dApps into the Hive ecosystem. If users want HBD, they inevitably interact with HIVE as well, which drives adoption of the Hive ecosystem.

The interest is a topic of much debate, and its effect on inflation seems to be monitored carefully.

If you want to see a quick dashboard on key HBD mechanics, here's a fantastic overview: https://hive.ausbit.dev/hbd.

Summary

To summarize, Hive's tokenomics focus around controlled inflation that funds content creation, curation, and governance, with utility tied to network participation rather than transaction fees. It is, in my opinion, very thoughtfully designed, and while I didn't dig into the details of all of the mechanics I would say in principle everything seemed quite sensible.

I learned a ton about Hive while doing the research for this post, and hope that I was able to clearly cover some of the key concepts in HIVE's tokenomics. There are a few topics I didn't cover much (in particular the role of the DHF) and I will do future, more detailed posts on those topics in the future.

If you have any comments, feedback, questions, or corrections, please let me know.

Images in this post were generated using Midjourney AI