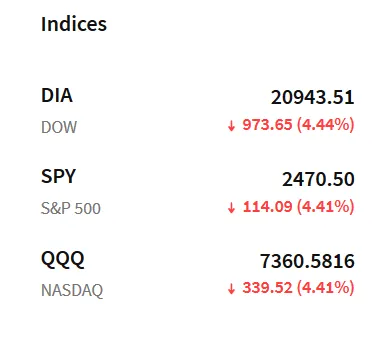

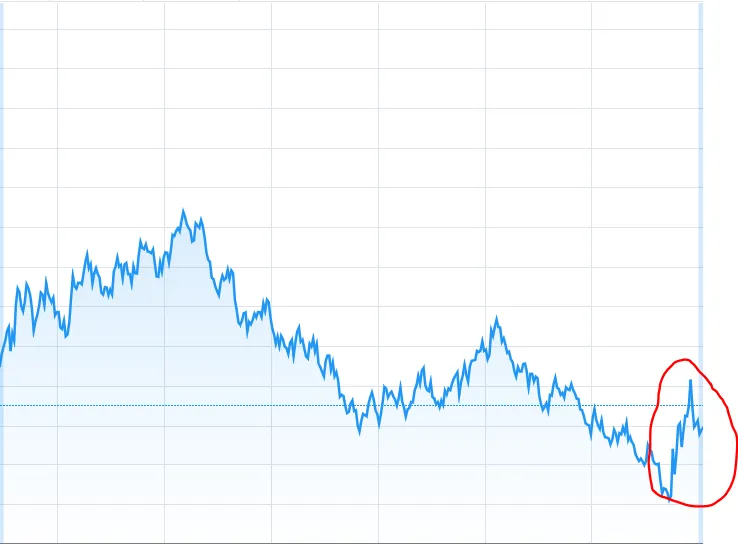

There where moments today where it seem the market would hold on to its low and recover. I went on a trade long spy via calls and within minutes was stuck with a lost. Through the rest of the day I was waiting for a higher low and a higher high. When it came I was at break even and maybe even a cent above my buy in cost. Rather than selling I held and the stock never regain to that level again. My trade was executed around 11:30am and I saw it breakeven around 2pm. Regrettably spy continue to fall and I had to determine how to cut lost.

Trading Mistakes

The trade was not going my way but I hate to lose. Yet the lose was less than a fraction of a percent of my portfolio but I went on a mindset to regain the lose immediately. Decided to go short spy with puts but the drop was steady while prices pop here and there. I had in my mind to go big but get out quick to make my day profitable. I went 10x my first trade with puts and because I was determined to regain my lost my entry in puts were at asking price, so I over paid for them. Fortunately the market continue to grind lower but it was difficult for me to break even since I had a terrible entry.

In the mean time I closed out my calls for a lost and was not knee deep only in puts. The time to breakeven for the day did not take too long, but I had over extended myself in trading with regards to risk management. I knew the trend was down, but since spy had already been down 800+ for the day I was late to the short and could have potentially encounter a bear rally. Indeed a bear rally came but not before I closed out on my puts for a decent gain. I ended the day positive but missed most of the route down since I was playing bull most of the day. I could have trapped myself in a difficult position if I had held and went through that bear rally, but wise I am enough not to be greedy and got away unharmed.

However it was a bad day for me overall. I was focus on the mirco with stock prices while the macro news was hinting on further bad things to come for America. The challenges with the virus, the due date of renters paying rent while economy has come to a halt, and corporations near bankruptcy due to lack of cash holding to pass through the current slow down. I simply chased the trend near its end and was playing with fire. The revenge trade is what some describe it. Where they trade and went with a lost but unwilling to settle to play another day they go and trade more in hopes of earning back their lose as soon as possible.

The revenge trade blinded me from picking a good entry into my puts trade as all I was focus to do was to earn back my lost. Then with the trading day near its end I held in hopes to earn green. Add on top the realization that today's market may end near its lows I chased to the down side, only to later witness a closing day bounce. I got out of the trade because moments after I entered I realized how poorly I had placed my trade. Immediately I was in the red, and do to position size the lose was significant. My goal then was to get out as quickly as I saw profit, which in a matter of minutes occurred and I sold. However the trend down continue and I left a significant amount on the table. The final minutes of trading had spy pot which in end meant I was right to have closed out the trade even though it was early.

Someone did worse than me?

I saw in a bog about Dave Portnoy who today bought Boeing stocks and is currently in the red some $450k. That is basically someone's house value in a matter of hours gone. What was he thinking?