Well, that happened a little faster than I thought it would. As you can see from the chart, we broke the 100 day moving average support and quickly fell to the 200 day moving average support line. It does not look like the 200 day support held, but I expect a dead cat bounce back up to that support line in the next week or so.

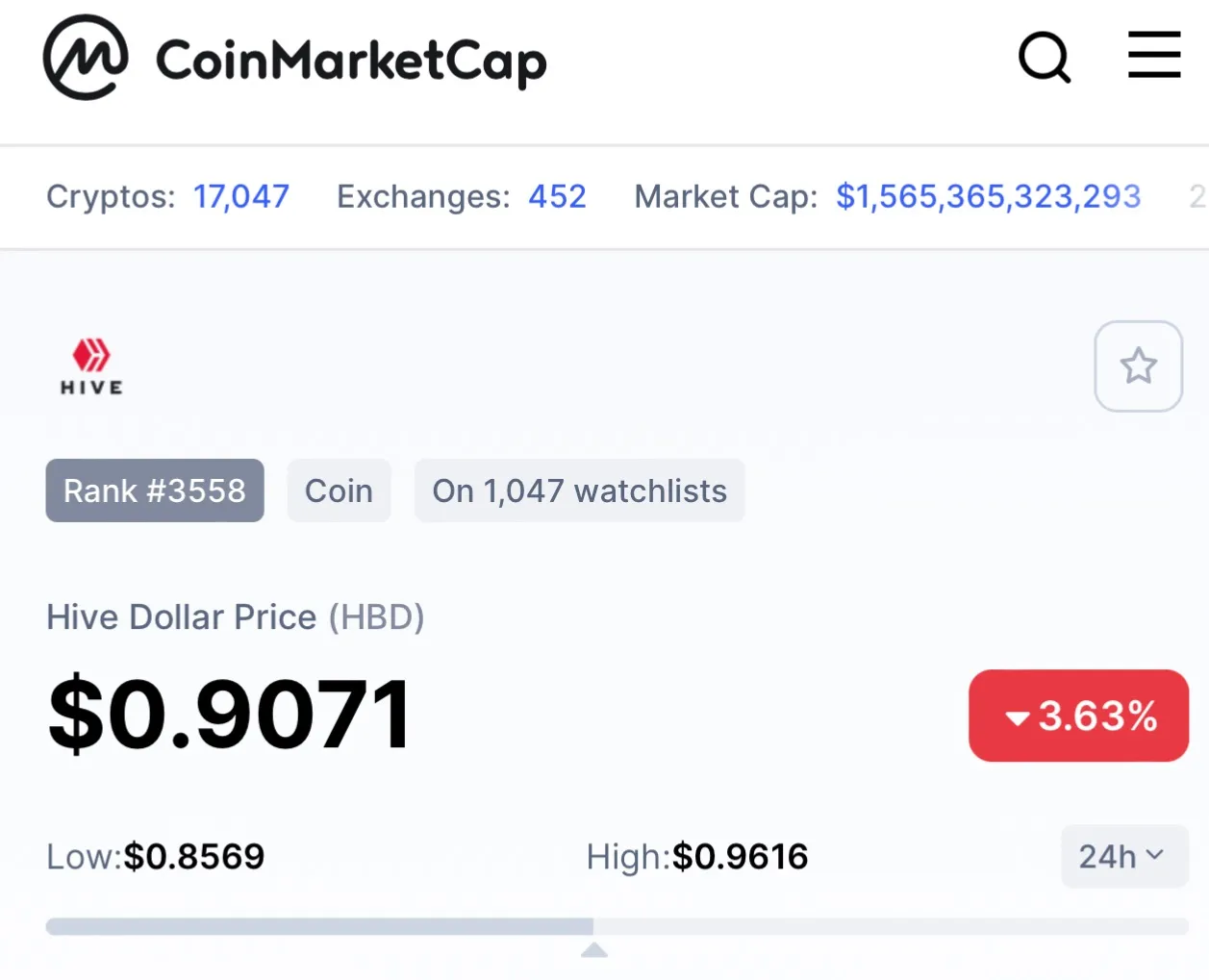

I have started to move my HBD out of savings and need to figure out what my play is from here. One interesting wrinkle is HBD is sitting at $0.90.

One option is to try to capitalize on that difference and use the on chain mechanism to convert HBD to HIVE and then back to HBD using the internal market. I do not know much about that and need to investigate this further. Looks like I have 3.5 days to do some thinking. With an internal AMM, I think this would be an easier decision.

It is also worth noting that the 25 day moving average is going to death cross with the 100 day moving average so things are not looking great for HIVE at the moment.

With two airdrops, this was pretty predictable, which is why when the airdrop date was announced, I started a power down so I could move over my HIVE into HBD for the ride down. So far, so good on my timing. Now I just need to figure out where the bottom will end up.

I would love to finish the year with at least 200,000 HIVE. Something else on my radar is the debt ratio. With the falling HIVE price, we are sitting close to I think 5%, so if this continues to fall, that is something I need to consider as well.

Crypto sure does move quickly.