Yikes, Hivers - Not a good start to the week.

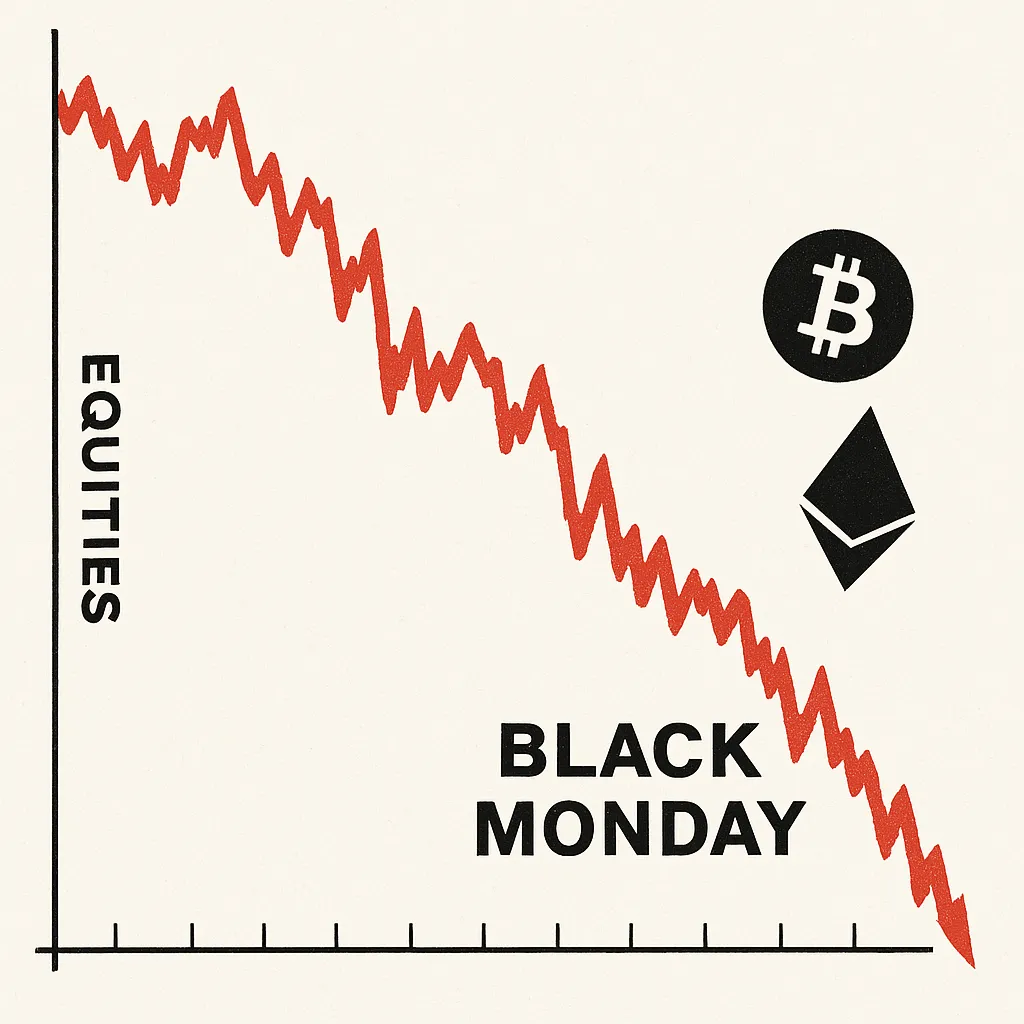

Last week was brutal for anyone exposed to global equity markets. Often, daily or even weekly market fluctuations come and go without really affecting our day-to-day lives. But this time feels different—like we’re living through one of those rare events that history will remember.

Investors often refer to key moments that reshaped the financial world: 1929, 1987, 2001, 2008. These weren’t just dips—they were seismic events that sent shockwaves through the global economy. In fact, one could argue that the creation of Bitcoin was a direct response to the conditions that led to the 2008 financial crisis.

Let’s be honest—there have been warning signs for a while now. The recovery following the short-lived 2022 recession had a “swoosh” shape, bouncing back quickly but unevenly. Over the past year, I’ve written repeatedly about the risk of a liquidity crunch. Central banks, in an attempt to cool overheated markets and fight inflation, started pulling money out of the system. But there was always the concern: pull too much, too fast, and you risk choking the economy. “Watch unemployment” became the mantra. Economies have been faltering by many metrics, but the markets showed surprising resilience. Then came Trump.

In the run-up to the 2024 election, I remember hearing Elon Musk and Trump speak at rallies and interviews. I had a gut feeling: this is going to cause a crash. Elon, during his appearance on Joe Rogan, openly said, “People will need to experience some short-term pain.” Trump’s rhetoric was even more direct: “The market will crash under Harris. We’ll make you rich and great again”—followed by the occasional slip-up: “But a lot of pain will be felt first.”

I can see the rationale behind some of their plans—long-term restructuring, bringing jobs home, rebalancing trade—but implementation matters. The U.S. isn’t just another economy. It’s the world’s reserve currency and the epicenter of global financial power. Never before has a country in that position willingly subjected itself to such an aggressive, self-imposed shock. And at the same time, it's picking diplomatic fights around the globe—trying to force the world to the negotiating table through sheer might.

All of this comes as the era of U.S.-dominated unipolarity is fading. The rise of China and India signals a shift to a multipolar world. The months ahead will test how much influence the U.S. really has left.

Which brings us to today.

Going into the weekend, I held a bit of hope—maybe Trump would strike a more conciliatory tone, offering relief to families and incentives to companies to avoid mass layoffs and bring manufacturing home. But instead, he went golfing. Again. That pretty much sums it up.

Some people may support his policies. Maybe, maybe, they’ll position the U.S. better for future generations. But the way this is being done—with such arrogance, callousness, and disregard for the suffering it will cause—is what will accelerate the pain. His confrontational style, lack of empathy, and penchant for antagonizing other world leaders will only make things worse.

Last week was rough. This one is already shaping up to be worse.

Let’s stay strong, Hivers. We’re living through a watershed moment—one that will shape the world for decades to come. Our resilience and sense of community will matter more now than ever.