Has Vtalik Buterin finally solved the ICO problem? In this topic I take a look at the new whitepaper which outlines a new method for launching ERC-20 tokens on the Ethereum blockchain.

The New Ethereum ICO Whitepaper

Here's the white paper: https://people.cs.uchicago.edu/~teutsch/papers/ico.pdf

It’s short & dense. Not easy reading, but very important information for those who want to invest or even launch their own tokens.

With the recent SMT announcement - anybody who is thinking of starting a token on steem has a responsibility to keep up with the latest philosophy on token sales. This is a rapidly evolving area of blockchain, and it’s not fun - but you need to pay attention.

The way a new token is launched is one of the most important variables of its success. With that said, let’s take a look at this whitepaper.

——

Prefer Twitter?

You can read this as a Twitter Thread if you prefer:

https://twitter.com/heymattsokol/status/914892062650183680

- heymattsokol

the below thread is a transcript, adjusted for the Steemit format.

A Layman's Summary of the Whitepaper

[1] May as well live-tweet this - gonna take notes via Twitter as I read through the new Ethereum ICO whitepaper. here we go! #blockchain

[2] One problem w/ ICOs is that the buyers have to rush in without enough info, and sellers don't know who is buying.

[3] Furthermore, the entire Ethereum blockchain can be clogged for hours when one popular ICO goes live. This is not desirable.

[4] Quote: ”Uncapped sales... provide buyers little clue as to the fraction of total tokens their contribution will ultimately purchase.”

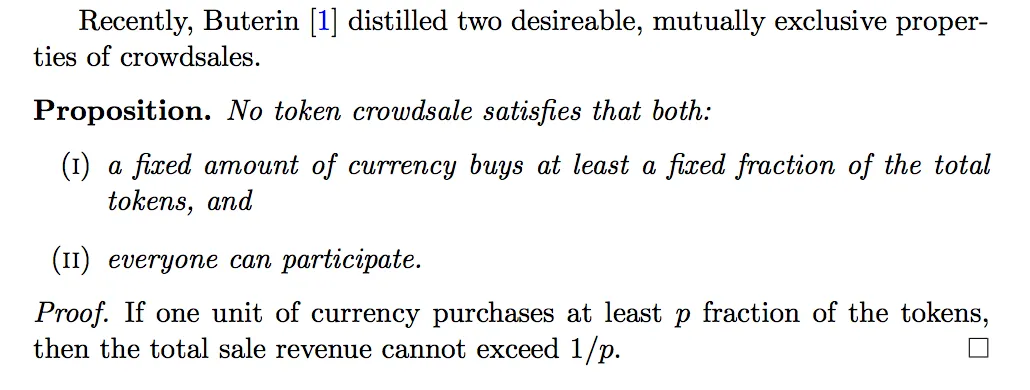

[5] The basic summary of the problem is elegantly stated here:

[6] In other words, you either limit participation (which is bad) or people have NO idea what % of tokens they're buying (which is bad).

[7] worth mentioning the EOS approach - to spend a whole year ICO-ing - is a really blunt & awkward (but effective?) way of addressing this.

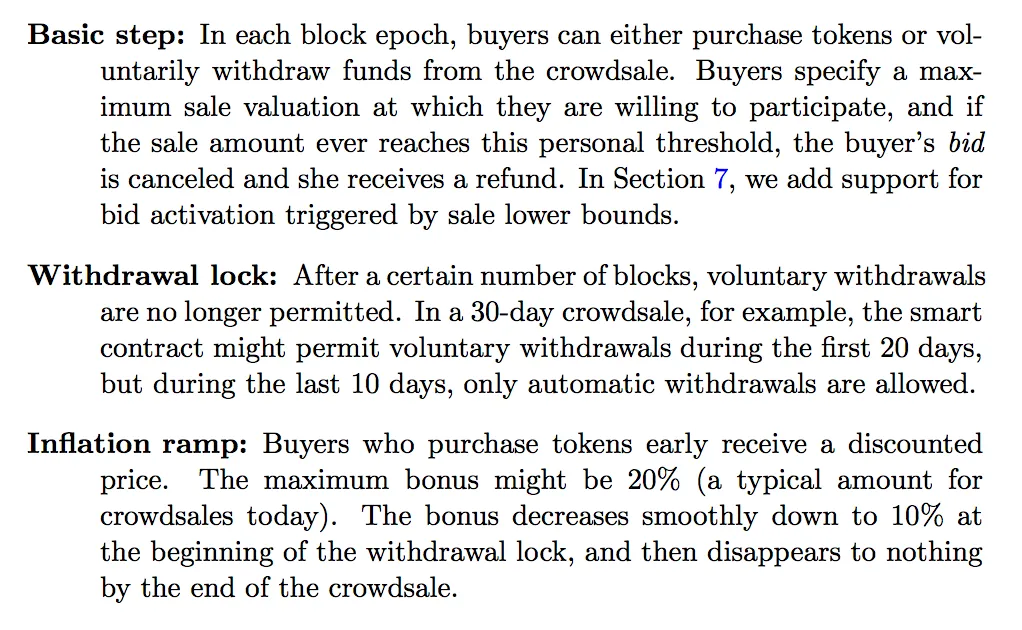

[8] The new approach, in summary, is to let people make their "bids" known w/o committing to buying - buy happens only if conditions are met:

[9] quote: ”potential buyers may enter & exit crowdsale based on behaviors of other buyers... moving valuation towards a market equilibrium”

[10] No good way to summarize this - here's an overview of how an ICO would function at a 20,000 foot view:

[11] People can submit multiple bids too - "I'll pay X if these conditions are met, or Y if these other conditions, or Z if these... etc”

[12] & [13] All buyers satisfy following: 1. Demand is inverse to supply 2. Preference for liquid markets 3. Reliance on social influences 4. Preference for simplicity. 5. Pseudonymity.

[14] If this system operates as planned & works as expected, all buyers receive a result that matches what they asked for w/ their bids.

[15] They either get % of token sale at a price that satisfies them, or, they do not purchase anything because the price isn’t satisfactory.

[16] Voluntary withdrawal of bids goes away in last 1/3rd of token sale to prevent misinformation attack (making huge bid & withdraw at end)

[17] The last two sections of the paper go into game-theory about how to minimize risk of attacks... having a hard time parsing it now.

[18] So I'll conclude here. I hope you found that helpful! It's a very technical white paper, but worth reading. FIN

—

Hope that helps! If you think I got anything wrong, please let me know in the comments and I’ll edit this post to be more accurate. Let me know what you think - is this new approach to ICOs going to be better for buyers & sellers?