Volatility

Most popular digital currencies such as ETH, BTC among many others are way to volatile to be used as everyday currencies. The value of such digital asset can fluctuate a lot, sometimes even more than 30% in a matter of days. Therefore it's obvious that every blockchain out there who wants to lead a serious business, should be at least thinking of implementing their own stable currency. However, it's not as easy as it seems to be, fortunately we have real world examples, around which we can start brainstorming and potentially come up with a better outcome.

There are many high potential blockchain applications that won't work optimally if there's no stability around it.

For instance:

- Finance

- Betting

- Merchant Services

- Prediction Markets

All the above mentioned examples must have stability in order to make their business sustainable and predictable. Not having something to rely on makes it way to risky for business owner to switch on the untraditional concepts.

Just imagine having an ability to invest in your favorite project that could guarantee safe returns, minimal risk of losing your initial investment, thus enabling you to feel more comfortable when putting your money and time in something you believe in. That would be a major breakthrough that could bring the investors.

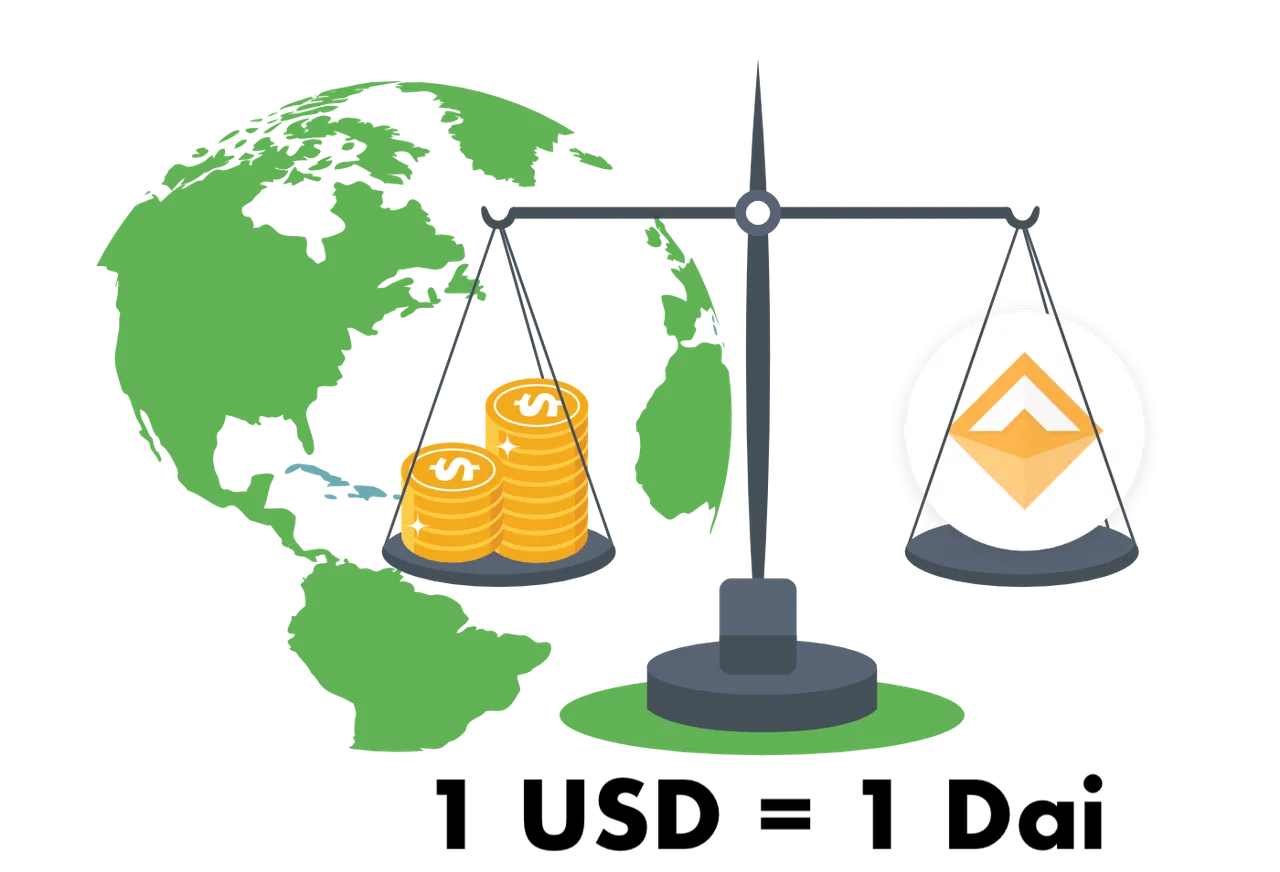

DAI and How it Works

Maker is a smart contract platform on Ethereum that backs and stabilizes the value of Dai through a dynamic system of Collateralized Debt Positions (CDPs), autonomous feedback mechanisms, and appropriately incentivized external actors.

The MakerDAO Collateralized Debt Position (CDP) is a smart contract which runs on the Ethereum blockchain. It is a core component of the Dai Stablecoin System whose purpose is to create Dai in exchange for collateral which it then holds in escrow until the borrowed Dai is returned.

Maker basically enables anyone to leverage Ethereum in order to generate Dai on the Maker Platform. Once created, Dai can be used as any other currency, regardless if one wants to send it to others, pay for goods and services or even hold it long term as a new way of saving.

This way, you don't need to be afraid of markets going up and down, neither you need to trust centralized stable coins such as (USDT). The reason I'm emphasizing on this lays in the fact that Tether, firm that stands behind USDT was convicted to be backed only 74% by fiat equivalents.

Hypothetically speaking, if market responded rationally it would mean that 1 USDT would have a value around 0.74% instead of being priced at full 1$. Basically they were using the same practice as FED does, printing money out of thin air.

People are fucking animals that will always find a way to game the system, therefore malicious behavior is mitigated by the code itself.

STEEM DAI

Although SBD should have served as a stable currency ensuring overall stability, it most certainly showed that's not the case. Pump and dumps extracted value of STEEM thus created a huge gap that eventually made inflation bigger than it should be. Of course, it's relevant to say that it's anomaly and not a general practice, but there shouldn't be any anomalies when talking about stability and other peoples money.

If we manage to invent something like STEEM dai we would have all killer preconditions for every tech savvy business owner to take part in our ecosystem. Free and fast transactions, stability and low cost blockchain. Like what else one needs for his business to strive?

I hope i haven't made any mistake when explaining how it works. Keep the ball running!