On September 18th I read an article titled: If I could only invest in one company for the rest of my life, this would be it. The article went on to make the investment case for HIVE Blockchain that had just listed on the Toronto stock exchange that day. On September 19th, I purchased shares and got in for 1.05 USD (converted). I rode HIVE up for 348% in about 5 weeks and hit the brakes when its relative strength index was in the mid 80's signifying a correction would follow, since it was massively overbought.

Since the correction that followed, I've been building back up my position as a long term holding. And it just keeps getting better with each press release.

HIVE Blockchain is the purest play on the growth of blockchain technology; blockchain mining. Their largest investor is none other than the world's largest crypto mining company Genesis Mining. They exist to link the financial markets to the blockchain and chose to list on the Toronto stock exchange because it is where the worlds resource mining companies list and there is an industry built around financing speculations. In many ways I see their business operating similar to a royalty company like Royal Gold or Altius Minerals. These companies have a relatively small number of employees and they raise or borrow money to fund mines in exchange for a royalty.

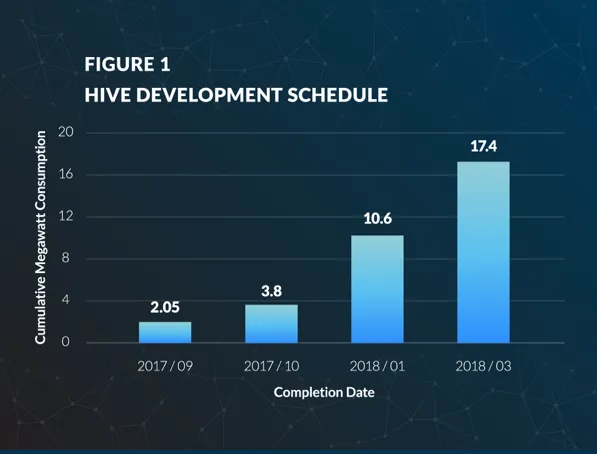

HIVE Blockchain is off to a fast start. On November 29th they published their 2nd quarter (ending September 30th) financial results and some incredible progress. Prior to the quarter, they took in $71.5M Canadian dollars in investment. They expanded their 2.05MW mining capacity in Iceland and expanded into Sweden as well. They essentially contract with Genesis Mining to build their mining capacity and then hire them to operate it. They laid out their rapid expansion of mining capacity to 17.4MW by March of 2018.

( )

)

Q2 press release

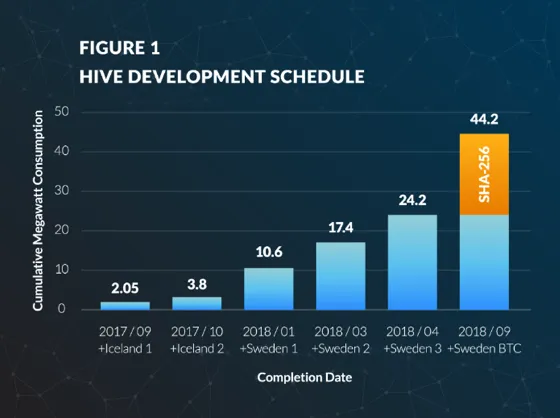

Last week they had another press release disclosing a consortium of investors had agreed to do a private placement for $100M. These private placements are common in the mining industry and allow the issuing of shares outside of the market and a clean way to raise funds for expansion and/or business purposes. Then this week they announced the private placement was upsized to $115M CAD. The funds will allow them to massively expand their mining capacity to 44.2MW and diversify from GPU consensus algorithm mining (Etherium, etc.) into SHA 256 Diversity algorithm mining (Bitcoin).

Press release December 13th

It's incredible to me how quickly they are able to get funding and build out their mining capacity. What is even more incredible is the profit they announced for just 12 days of mining in their Q2 release. Revenue was 170,810 USD and profit from operations was $112,959 or $9413/day. This profit was based on only having 2.05MW of installed capacity.

I'm going to project potential annual profits at the 44.2MW mining capacity they will likely have by September 2018.

(44.2MW-2.05MW)/2.05MW = 20.56X their current capacity. If 2.05MW of mining capacity equals a daily profit of $9413, then we should expect 20.56 x $9413 = $193,540 of profit per day at the 44.2MW capacity. If we multiply this daily profit by 365 days, we get $70,642,269 USD!! Can their be a better business than this?

I imagine they have 3-5 employees, with one being a lawyer. They set up this company on the Toronto stock exchange, raise money and source mining operations from scratch that produces over $70M in annual profits. In addition to only holding the mining assets and collecting the incredible profits, they get to hold onto their mined cryptocurrencies and potentially hold them for appreciation in one of the biggest mega trends of this century.

Today they have around 229M shares outstanding. The most recent $115M CAD investment will raise this by a little over 36M shares. However, these shares come with a full warrant that enables the new shareholders to buy one additional share of stock by September 2019 at $3.9 CAD/share for every share they purchased in the private placement. This means that in 2019 they will certainly have an additional 36,507,900 shares purchased for total proceeds of $142,380,810, leaving 239.450M + 36.507x2 = 312,465,800 shares outstanding.

I wonder if they will every need to raise money again after 2018. It looks like a perpetual money machine.

I more than doubled my investment today. I suggest you do your own research and make your own conclusion.

Shares trade on the Toronto TSXV with ticker HIVE.V and Over The Counter (OTC) in the US as PRELF.

For those who don't want the hassle of directly buying crypto currencies, I'm not sure there is a better investment to gain full leverage to the oncoming growth in blockchain technology.

Good investing.