In this volatile market investors are looking for a space in stock to invest. Here is a fundamental research done on TCS which gives a good growth since last 10 years and still performing as a top wealth creator for investors.

TCS is the second 100 billion dollar company in India after Reliance industries. Since past 10 years it is the top most company in IT sector and performing a very good growth year on year. Risk reward is favorable and also provides a very good return on investment.

• Market Cap: 765,772 Cr.

• Current Price: 2,000

• 52 weeks High / Low 2012.00 / 1210.33

• Book Value: 241.80

• Stock P/E: 28.06

• Dividend Yield: 1.25 %

• ROCE: 75.57 %

• ROE: 30.03 %

• Sales Growth (3Yrs): 9.16 %

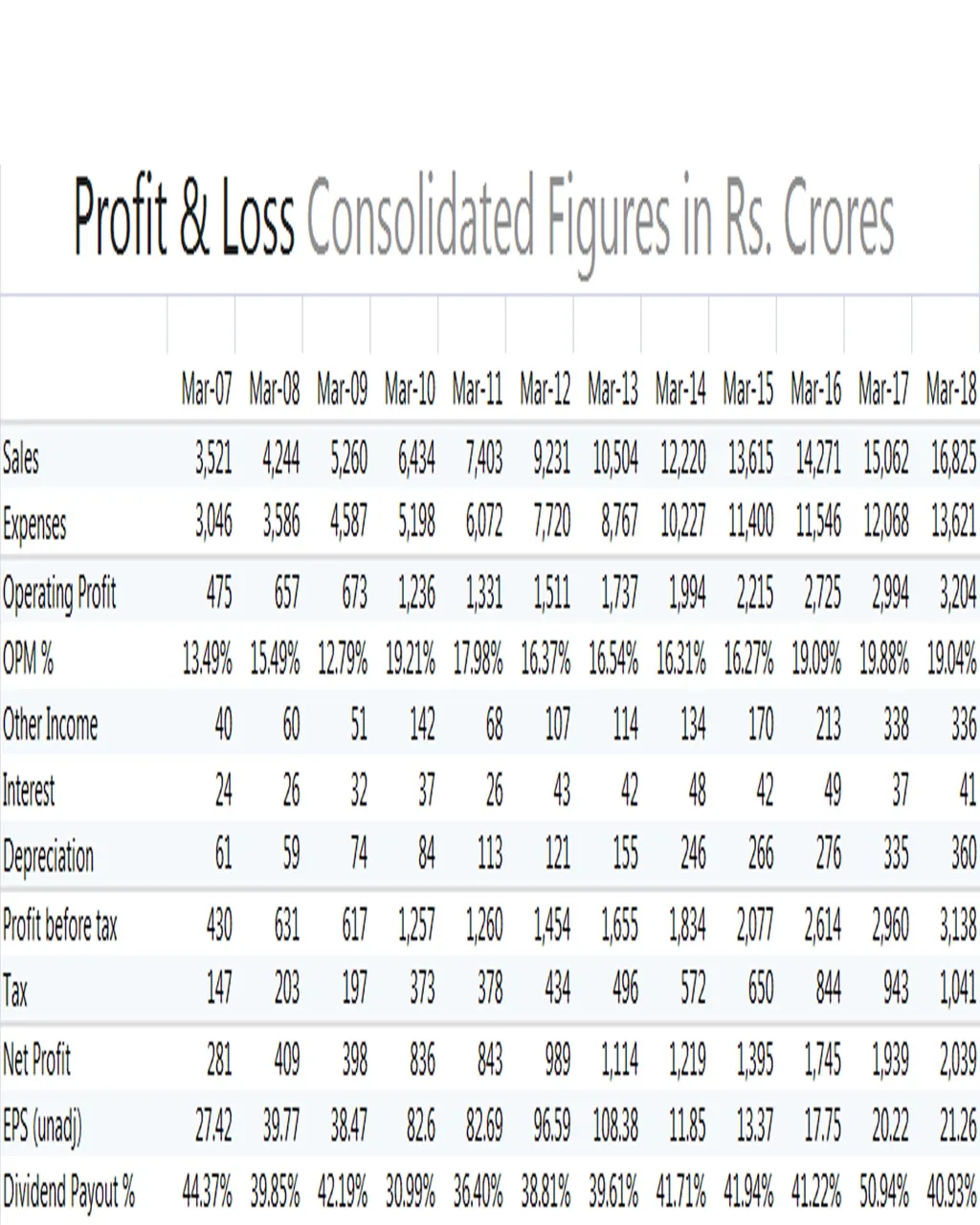

below is the profit and loss statement of the company

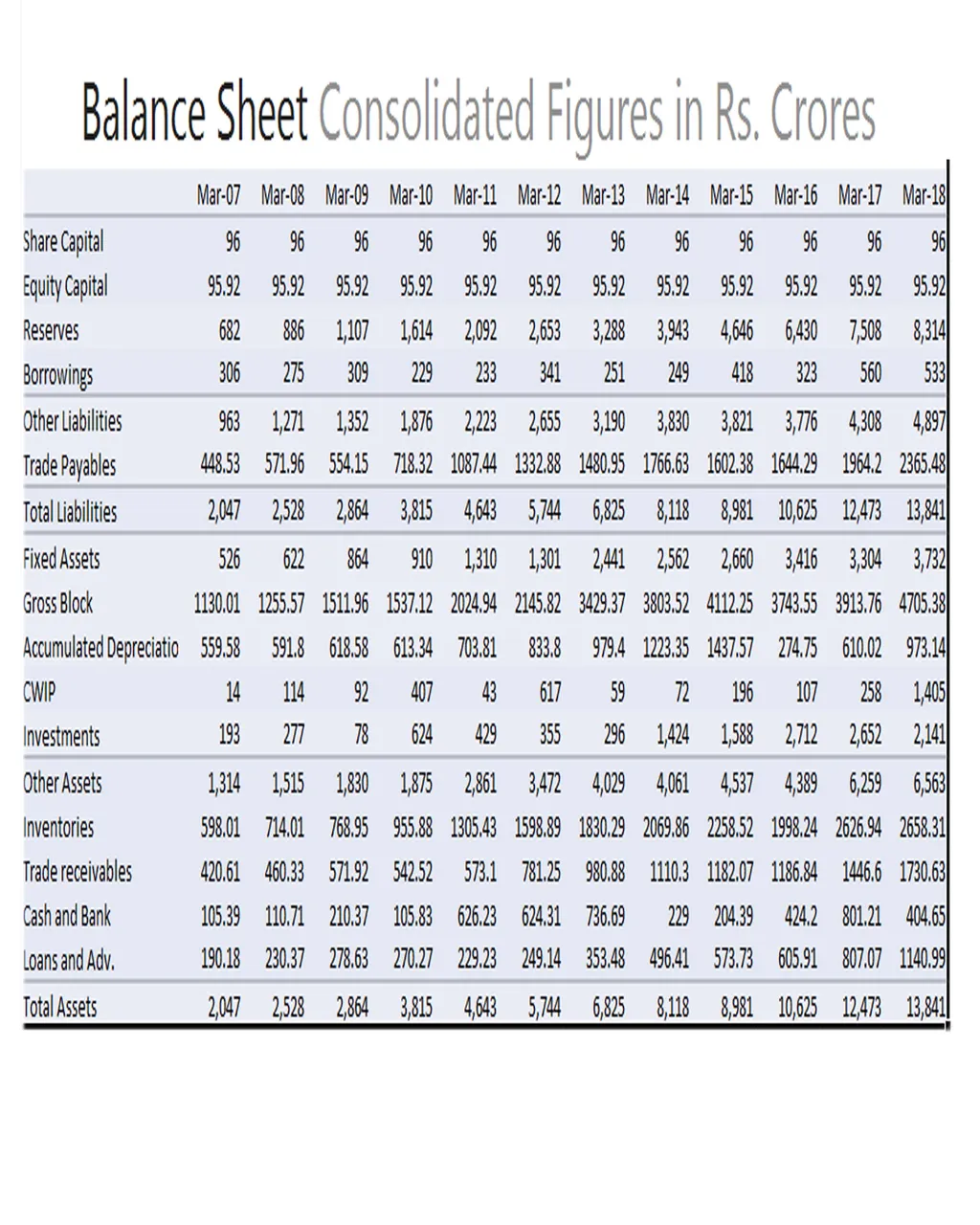

and here is the balance sheet of the company

Return on Equity

10 Years: 36.14%

5 Years: 36.03%

3 Years: 33.99%

Please up vote and comment your views regarding this post and if you need any help then please comment below