Goldman Sach - 3% S&P500 Returns next decade

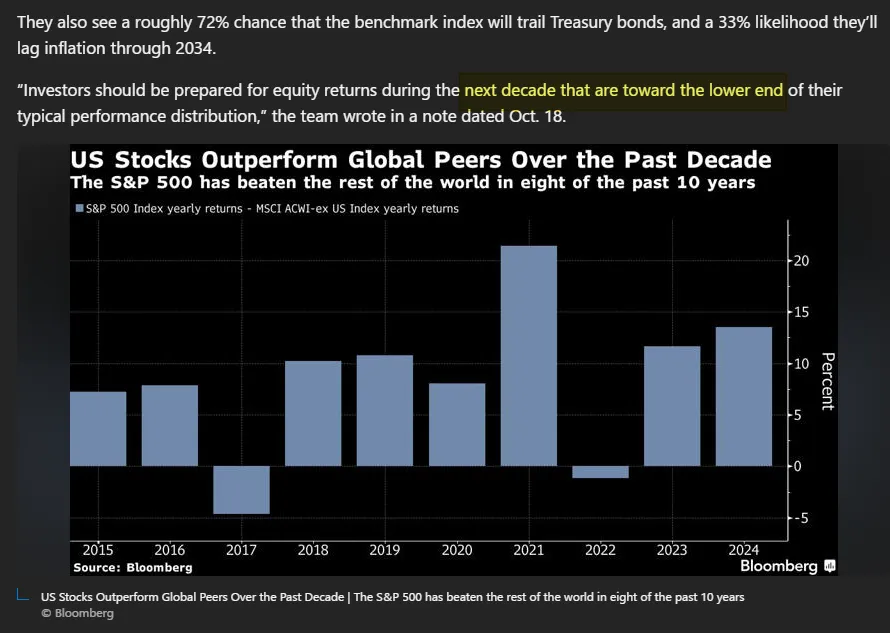

Shortly after 2008-2009, the market (S&P 500) was under 670 points. At the start of 2010, the market recovered to around 1120. Over the next decade (from Jan 2010 to Dec 2019), the market returns higher than average returns giving most people annual (average) returns between 12% and 13%. The decade ended at over 3200.

Fast forward to 2024, and we are hitting new highs in 2024 with the S&P500 at nearly 6000 points. The problem is when all you know is returns that are over 20% frequently with the YTD for 2024 at over 22%, you might not want to hear what Goldman Sach is predicting.

A return of 3%-5% a year from the stock market seems so "strange" for most people to hear. After the lost decade from "2001 to 2009", most people have enjoyed the ride from 2010 to 2024! This is why the news will be hard for people to gasp.

The "regression toward the mean" will happen eventually. If the markets are too GOOD, markets have a way of self-correcting themselves. This is found in all asset classes like real estate, stocks, baseball cards, arts, and others.

What to do based on your situation:

Near retirement and using drawdowns of principal.

If you were planning to retire and using a standard 4% withdrawal, this decade of low returns may DRAIN your account balance faster than you expected. The reason is most of history, the data uses the average 10%-11% annual returns. This assumption worked if that decade fell within the average. However, if GOLDMAN is right, this is something you need to consider as you are planning your retirement.

Near retirement and have plenty of money.

If your account has over 30 times your annual expenses, you might be fine as you have plenty of assets that can generate income for your living expenses. You can do this with bonds, REIT, T-Bills/IBond, or HYMMA, etc. People in this boat can do 2% drawdowns plus a mix of living off the passive income of from investments.

In the first situation, some folks who did not save 25x of their annual expenses and wanted to do 4%-6% drawdowns are the ones who will reconsider their plan.

Between 5-12 years from retirement.

The challenge here is you will be retiring when the market will not be helping you "compound" your assets. This can factor into the "when" you should retire. You might want to work for a few more years. If you had your eye set on retiring early at 62, you might need to rethink aiming for age 67 or even age 70. Much of it will depend on how much you have and what lifestyle you can afford. You will have to decide if you need to work more or reduce the amount you spend in retirement.

For the top 10% of the population that is on target for early retirement, this will not impact your plans even if you are between 5-12 years away. You did a great job in preparing for this nearly 2 or 3 decades ago!

Over 13+ years from retirement.

If you are in this group, you can think of being in the ASSET accumulation phase. With each paycheck, you are buying assets at a cheap price compared to what the asset will be worth 15 years or 30 years down the road.

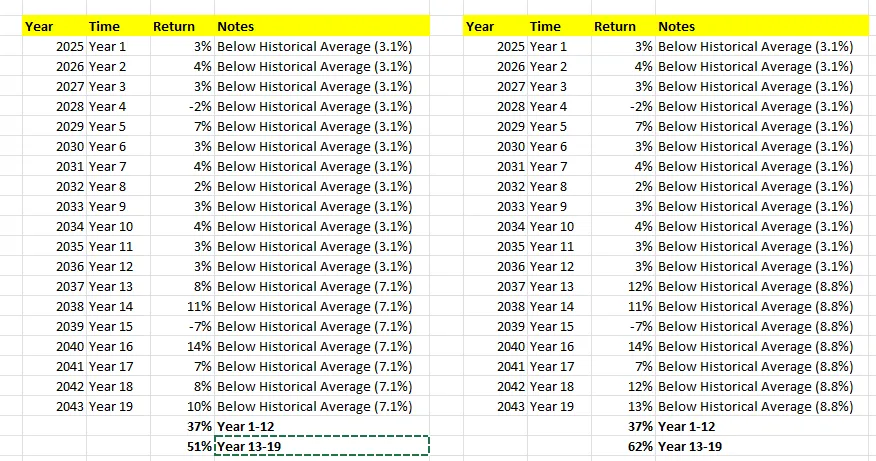

Let me try to explain it this way using two very pessimistic models over the next 19 years:

- Let's assume the next 12 years is a 3.1% return (which is 2 years longer than Goldman predicted).

- Let's assume the next 7 years are better (but still under the historical 10% return).

In both pessimistic models, you can see that you are accumulating assets from years 1-12. That gives you plenty of time to collect hundreds or thousands of shares (or 100s of thousands of dollars). Then between years 13-19, the market is only SLIGHTLY better with either a 7% or 9% annual return.

In both models, your asset only changed about 37% in value from year 1 to 12. But from year 13-19, it will be 51% or 62% more.

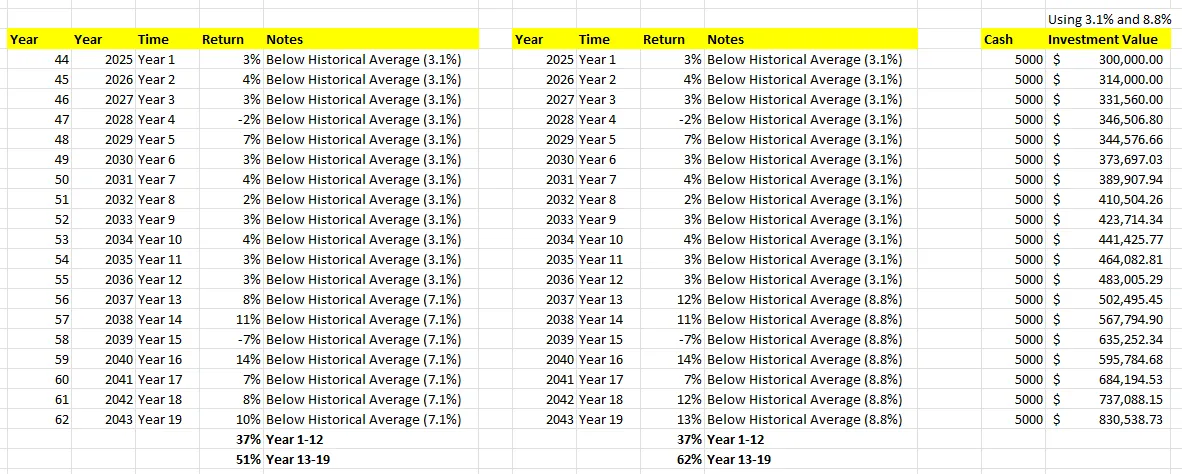

- You are age 44 in this example.

- You are saving 5K a year going forward.

- You had 300K saved already, this is what it would look like with the low RETURN in the future

By the age of 62, you will have 830K (which is more than 2.76x than the 300K you had in year 1).

Now, if we assume that the market will be closer to 9-11% return in the year after 13, that balance will be much larger.

What am I doing?

I'm in a group that is over 13+ years away from retirement. So I'm not changing what I'm buying. I actually selling off some of my dividend stocks and buying more QQQM over the next few years.

On top of that, I'm still in the asset accumulation phase. I'm not worried about how the markets will perform over the next 20 years. I know for sure it will be worth more than what it is worth today.

The next thing that I will continue to do is use OPTION to hedge my portfolio. My option strategy would do better if the market were returning between -5%- to 5% a year. I use covered calls, put credit spread, and iron condor and each of those will do well if markets stay within that narrow range. My option strategy loses money when the market is moving by the biggest percentages (in either direction).

Let's see what happens in 2025.

Have a profitable day!