So much going on this week, I'll skip the cut and paste intro and get right into it.

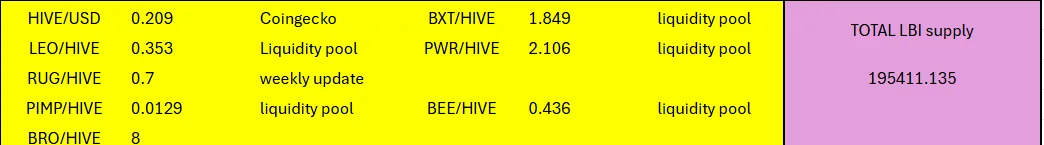

Token prices at cut-off time:

Last weeks report:

@lbi-token/lbi-weekly-holdings-and-income-report-week-52-week-ending-27-july-2025-aua

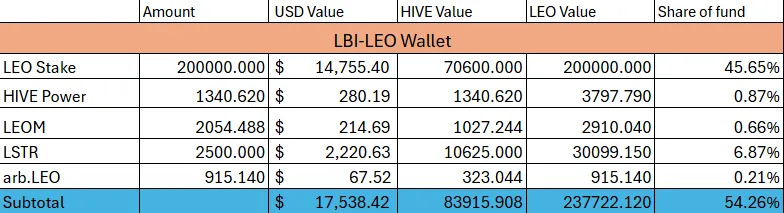

@lbi-leo wallet

Big changes here. Over the week, I have sold off our liquid LEO. The majority of it was used to buy LSTR. @leostrategy's token is available at a big discount to its asset backing, and we are in position. We now hold 2500 LSTR, that we paid 10,625 HIVE for. LSTR is selling faster and faster, and it could be a matter of days (possibly weeks but I think by this time next week they will be sold out) before it sells out. Anyway, we are set, and still hold 200,000 LEO in our main wallet. Wallet is up nearly $3000 again this week, and it's now over half of our fund total value. And I pulled a bunch of funds out into other wallets this week - taking profits on LEO's big climb and strengthening our diverse fund.

I know the LSTR move will be controversial amongst some LBI holders, but I stand by the move. We can't be a "LEO Backed Investment" fund and NOT own LSTR in my view. Had to be done, and quickly as the opportunity could vanish any day.

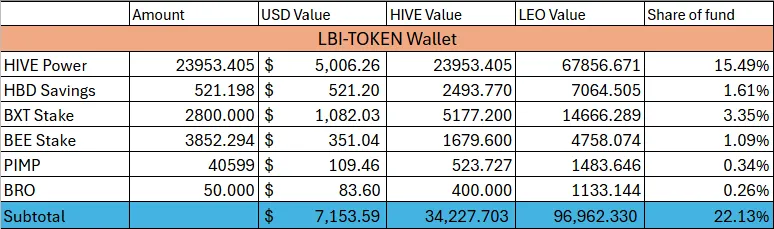

@lbi-token wallet

Lots of smaller, but still important changes here. Sold a few (200 BXT). Yield is down a lot and it seems to not be recovering. Sold our swap.gifu. Not much happening and I took an L to have funds for other things. Sold a few BRO into some solid price action, still hold 50. More about BRO later in the report. Added some BEE as its yield from the delegation is still strong.

All in all, the wallet is down around $1000. Some of that is from moving funds to other wallets from the above sales, and some is from the weaker asset prices (particularly HIVE) over the week.

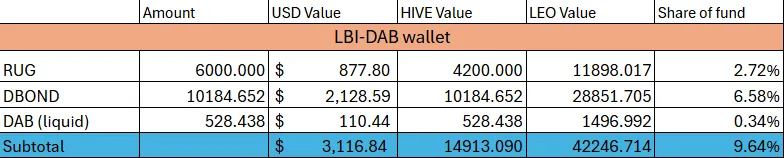

@lbi-dab wallet

Here is where some of the LEO profit taking has ended up. Bought 1300ish DBONDS over the week, to catapult us over 10K and into top spot on the rich-list. Minted 33 DAB this week, and that should be more into the future. Probably done for now buying DBONDS, as I've pretty much cleaned out everything sitting below the 1 HIVE pegged value. Will let this wallet return to organic growth now for a little while.

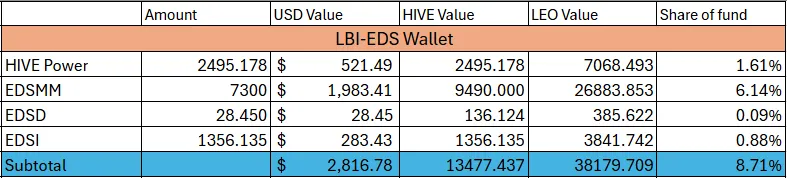

@lbi-eds wallet

Not much new for this wallet. Just minting EDSI and collecting the weekly payout. I'd normally sell the EDSI minted above 25 for the week to add EDSD but EDSI price is not strong at the moment and I won't sell them below 1 HIVE peg. Minted 31 for the week. Wallet is down $400 over the week in value, thanks mostly to the HIVE drop.

@lbi-pwr wallet

Here is the other wallet that picked up a bunch of funds from skimming profits off LEO. 800 PWR added to our stake, worth 1600 HIVE. Also doubled our HP here, adding 1200 over the week. The goal is to keep building the HP so the wallet can grow in a self sufficient manner and the big delegation from the main account can be used for other things. Still a fair way to go for that, so I'll be on the lookout for ways to add further funds in here.

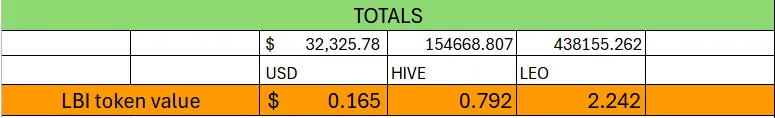

TOTALS

Total fund gained $1500 in value despite HIVE dropping like 10% or so. LEO really has kicked in to high gear, and the next few weeks should be a fun ride. Our LSTR position is set, so I won't be buying any more now. Might even take some profits on the last 500 I just bought when it's LP is set up and proper price discovery begins - not sure yet.

We are steadily approaching 1 LBI = 1 HIVE, and will reach that point at some stage if LEO keeps outperforming HIVE. We are over $32000 fund value in total. Happy days.

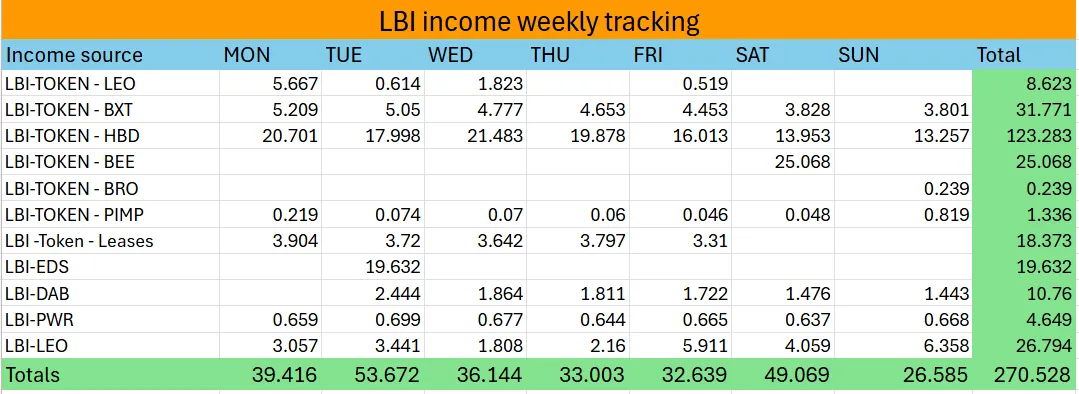

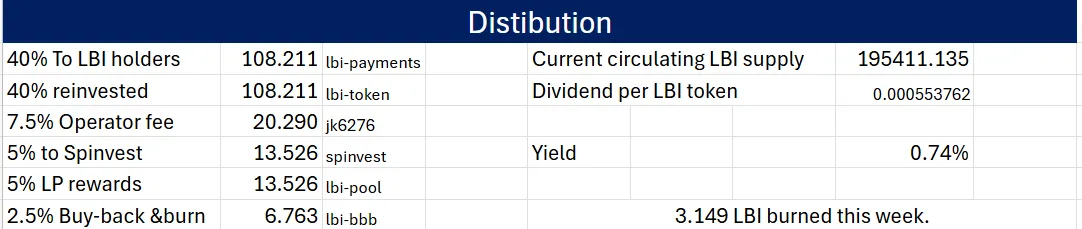

INCOME

Well income sucks, we are down so much in terms of the number of LEO. But its not all bad.

Haha, just spotted a typo in the heading - that I've been using for months and months and no-one has noticed. Anyway, I'll fix it for next week.

Back on topic, the dividend run is around $8 in value, similar to the last few weeks. Not much, but while the number of LEO tokens is much smaller, the value hasn't changed much overall.

3.149 LBI burned.

Other news

BRO/LBI pool

BRO/LBI liquidity pool now open. If you hold both tokens, consider adding them here. @raymondspeaks is on a mission to set up lots of LP's for his BRO token, so I put up half the BEE required for us to join the fun. Waiting to here back from our coder about making sure LBI in this pool get included in the dividend run. I'm confident that can be done by next week, but can't promise anything yet. I'll add some LEO rewards to the pool in time.

From my point of view I think that these kind of pools could become an interesting way to build a position in two different projects. This one for example, will earn LBI dividends as LEO, BRO dividends (I think) as HIVE from BRO, and likely some LEO from pool rewards from us. And you are backing two projects with very different styles and goals to diversify your position a bit. I hope to see many LBI and BRO holders add some liquidity into this pool to make it useful.

The more liquidity our investment tokens have, the more attractive they become as investments because the exit plan for holders is not clouded by a lack of liquidity. Anyway, it'll be up to the BRO's and LBI's to see if this is worthwhile.

So we now have 2 pools, LBI/LEO and LBI/BRO.

That's it for this weeks round up of all things LBI. I feel like I've forgotten something, but got to get it out and head of to work soon.

Feedback, concerns, questions all welcome.

Cheers,

JK.

...

I know what I forgot - I've ended our HP leases from the main account, and reduced the PWR delegation a bit. Going to shift those delegations to @leo.voter to try give our income a bit of a boost.