At the moment, the best way to buy LEO exposure right now is by buying LSTR tokens. The @leostrategy project has come a long way lately, and it's tokens are currently selling at a big discount to its asset backing.

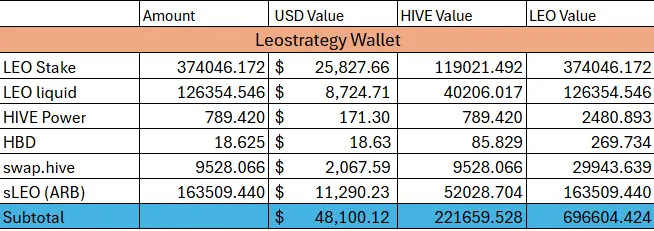

So let's take a look at a snapshot of the holdings Leostrategy have currently. I'll lay it out like it is one of our wallets, to make it clear. I've set this up simply to watch, and because I have put some of LBI's funds into LSTR.

A little while ago, the possibility of a deal for LBI to pick up a big position in LSTR was on the table. Anyway, that deal was not to be, but with the way markets have moved over the last few weeks (particularly LEO) has made LSTR a much more attractive proposition.

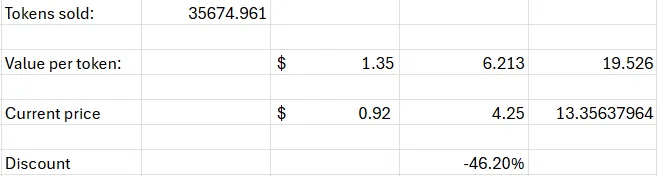

Let's look at some numbers:

(Disclaimer - this is a fast moving market at the moment, these numbers are correct at the time of this post, but could be outdated very quickly)

LEO is currently at 0.3182 HIVE

HIVE is currently at 0.217 USD

LSTR has currently sold 35674.961 tokens at 4.25 HIVE each.

Here is what @leostrategy's current asset holdings are:

Now lets work that out per token:

So, at the point of this snapshot, LSTR is currently being sold at a 46% discount to its asset backing. You can literally buy a token worth $1.35 for $0.92. Buying 1 LSTR right now is like paying swapping 13.356 LEO for 19.526 in LEO value.

I could not sit back and not buy some LSTR for LBI. We now own 1,400 LSTR and sit 4th on the rich-list. I sold LEO to buy them. Sorry, not sorry.

These 1,400 LSTR cost 5,950 HIVE. $1,288 in USD terms. I have used some of the proceeds from the LEO sales to top up other LBI divisions. Let's just use the current prices to work out how much LEO we used. Let's call it 18,700 LEO

If we value LSTR at its asset backed value rather than it's 4.25 HIVE market price currently, our tokens are worth 8698 HIVE, or 27336 LEO, or $1890 USD.

So LBI could book an instant value increase to our balance sheet of $602 if we value LSTR in our books at asset backed value rather than 4.25 HIVE each.

Buying LSTR is such a no-brainer at the moment.

Cheers,

JK.

P.S. Not financial advice obviously - just reporting what LBI has done, and will probably do more of.