#Bitcoin is up ~1.5% since I started the BitArb fund. That's a great return for a two-week period. However, this number doesn't tell the whole story. The chart below does.

It was a very volatile two weeks, and I loved it because conditions like these are perfect for capitalizing on Bitcoin's volatility.

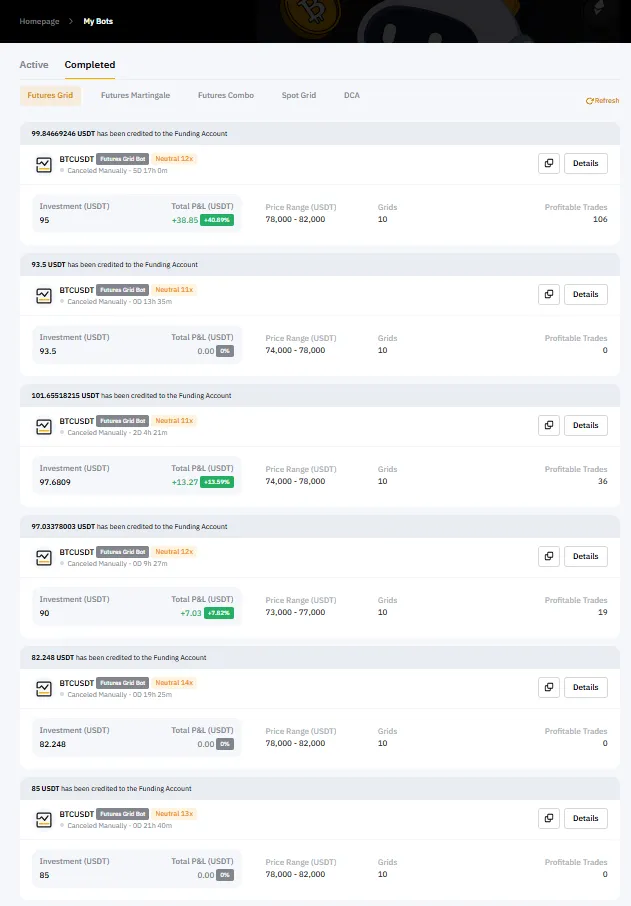

Since my last post, I’ve created and terminated five more trading bots. These bots executed 161 profitable trades. Combined with seven trades from previously terminated bots, that’s a total of 168 profitable trades from terminated bots to date.

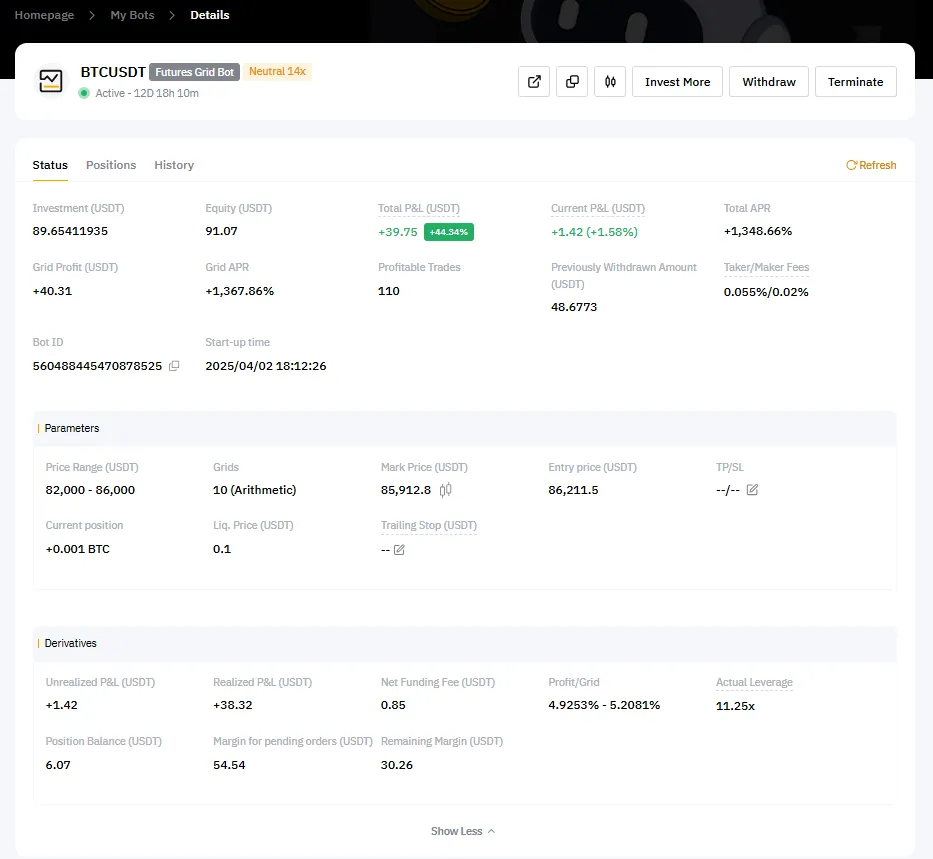

I still have one active trading bot operating in the $82,000–86,000 price range, which has made 110 profitable trades so far. In total, my trading bots have executed 278 profitable trades over the past two weeks. Each trade generates approximately 435 satoshis in profit, resulting in a total of about 121,000 satoshis in profit from all bots to date.

Not everything went smoothly. My trading bot, operating in the $82,000–86,000 range, nearly faced liquidation several times, with a liquidation price around $72,600. To mitigate potential loss of exposure during a sharp market drop, I placed limit orders near that price in the perpetual market, and they remain active. You can see these orders in the first chart provided.

If my bot had been liquidated at $72,600, I would have acquired the same position in the perpetual market to replace its exposure.

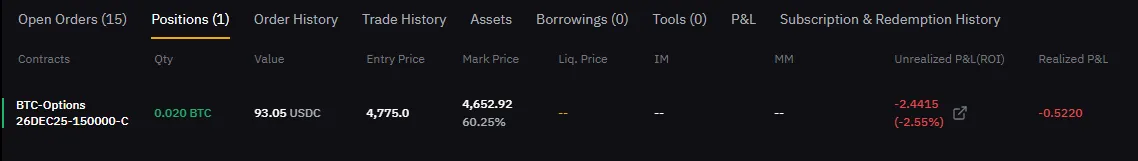

My 150k Call option regained a bit of value, but still is in the red.

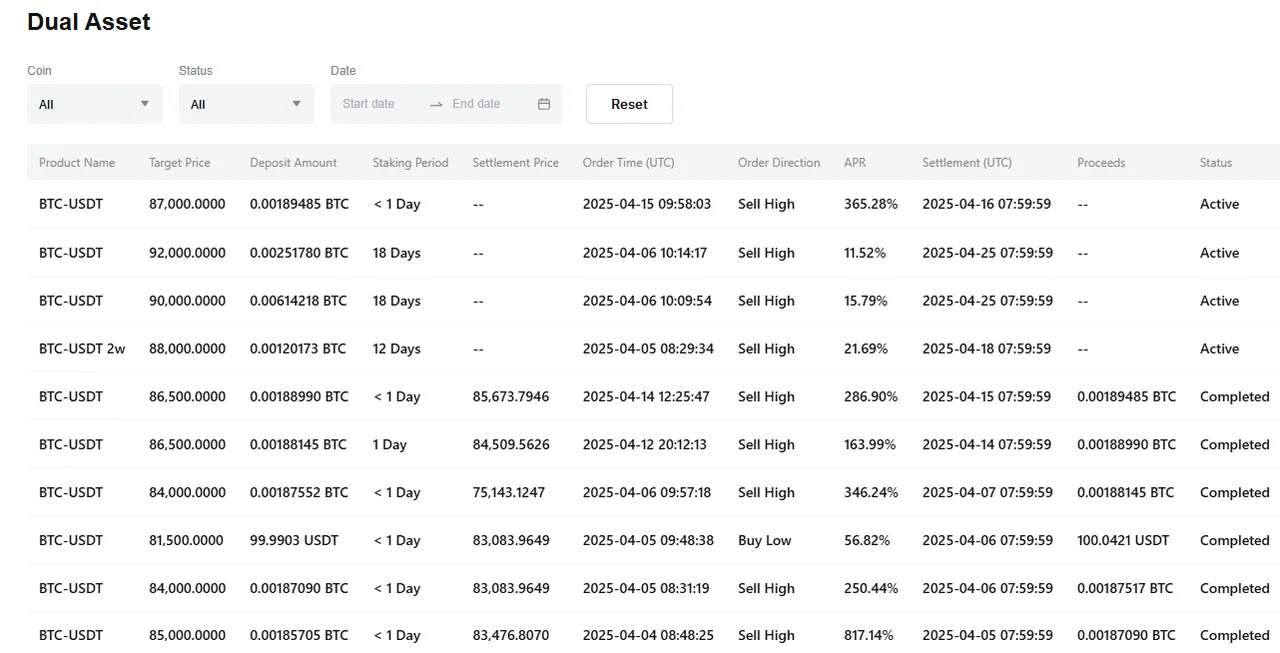

Structured products made a bit of profit too.

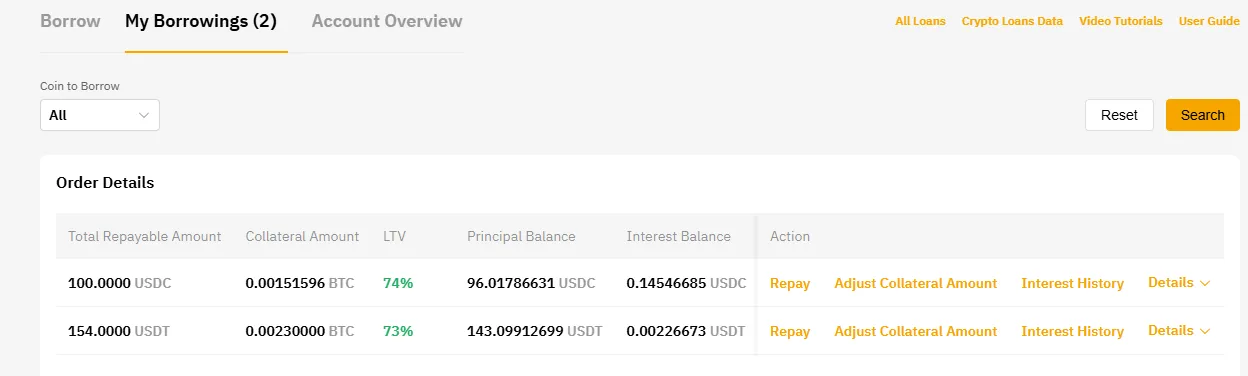

So far, I’ve used the profits generated to repay my loans.

I will calculate APR in BTC and USD terms at the end of the month. Today just wanted to share this little update :)