The most important takeaway for many traders and investors is that staking can earn rewards for holding specific cryptocurrencies. In any case, even if you're only interested in earning stake rewards, knowing how and why the system works is helpful.

Crypto staking generates passive income by staking particular cryptocurrencies to validate transactions on a blockchain network. Even though staking and crypto mining are not the same, both can give returns far above a standard savings account.

Crypto staking may be intimidating, but the fundamentals are easy to understand. Furthermore, many online exchanges make crypto staking easier for ordinary citizens.

Understanding how the system operates, which currencies you can stake, and some of the risks associated with cryptocurrency staking can help you make an informed decision.

Crypto Staking

Cryptocurrency staking is a method for verifying transactions. There are two aspects of this process: committing holdings and verifying transactions. Participants can also profit from their holdings in this way.

As long as the crypto you hold enables staking, you can put part of your cryptos to work and reap the benefits. You can think of it as a savings account that pays interest on the amount of money you put into it. Depending on how much you stake in cryptocurrencies, you can make anywhere from 5 percent to 20 percent annually.

Hive currently offers an APR of 2.87% on your staked HP.

Here you can find a staking calculator for Hive: stakingrewards.com

You may ask, why do I get rewards? It's because the blockchain uses your holdings. Thanks to a consensus technique called proof-of-stake, all transactions would be confirmed and protected. If you've staked your crypto, it's also a part of the process. Presently, staking is supported in cryptocurrencies such as Solana, Polkadot, Ether and Cardano.

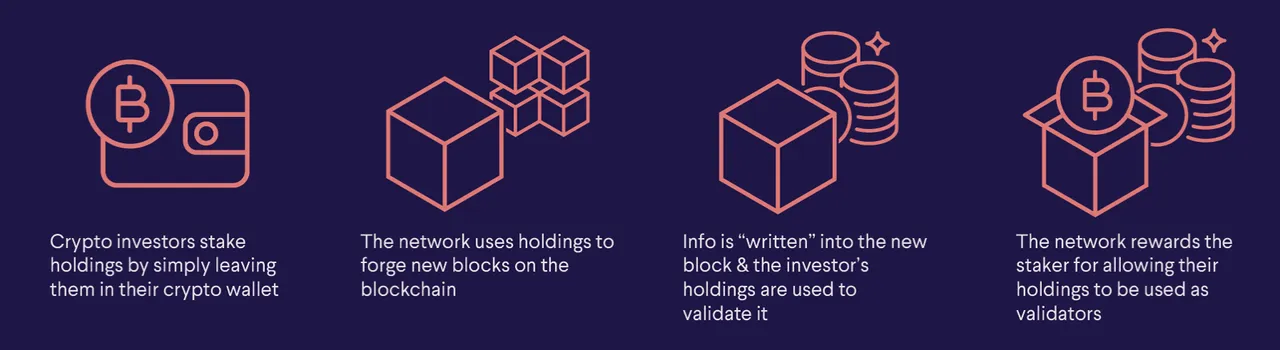

How Staking Works?

Staking refers to adding new transactions to the blockchain in cryptocurrencies. Staking operates on the proof-of-stake concept.

Initially, participants agreed to use the cryptocurrency system to exchange their currencies. Blocks of transactions are confirmed by validators chosen by the protocol from among these parties. The more coins you pledge, the more likely you will be chosen as a validator.

Cryptocurrencies are created and distributed to block validators as staking rewards for every block added to the network. Most of the time, participants are rewarded with the same cryptocurrency they are staking with their time. On the other hand, some blockchains use a different type of cryptocurrency to reward their participants.

Those who wish to stake crypto must do so by holding a cryptocurrency that operates on the proof-of-stake mechanism. Then you can decide how many holdings you wish to put on the line. This can be accomplished through several major crypto exchanges.

When you stake your crypto, you are still in the ownership of that crypto. When you stake crypto, you're effectively putting them to work, and you have the option to unstake them later if you decide to swap them. The unstaking procedure may take some time; with some cryptocurrencies, you'll be obliged to stake for a specified period.

Staking is not possible with all types of cryptocurrency, such as bitcoin. It is only available with cryptocurrencies that operate on the proof-of-stake methodology of validation.

To add blocks to their blockchains, many cryptocurrencies employ the proof-of-work concept. The problem with proof-of-work is that it necessitates using a significant amount of computational power. As a result, cryptocurrencies that use proof-of-work have resulted in considerable energy consumption. Because of environmental issues, Bitcoin has received a lot of backlash in recent years.

On the other hand, proof-of-stake does not need as much energy. The increased scalability means that it can also manage significantly higher volumes of transactions.

Benefits of Staking

If you stake your holdings, you can reap a variety of rewards. Here are a few of them:

Earn more tokens

The most important one is building your collection of tokens or coins. Stakers aren't guaranteed anything because the process of forging new blocks and awarding rewards is entirely random, but they do "earn interest" in the sense that they are putting their money holdings at risk.

Staking requires fewer resources.

As opposed to crypto mining, sticking requires significantly fewer resources, which may allow you to sleep better at night. Staking also has the additional benefit of servicing the ecosystem by making tokens more scarce, which can boost the value of your holdings.

Right to vote

As previously said, stakers are more deeply rooted in a single ecosystem or blockchain network, which may offer them more significant influence over the direction in which a particular cryptocurrency is headed. It's comparable to hold stock in a corporation. If you stake your claim, you will be granted voting privileges.

Expanding assets

Setting up staking for investors utilizing an exchange can be as simple as flipping a few switches to get things started. They may keep track of the progress of their investments from there. Maintaining your investment while putting in minimal effort is a hands-off, straightforward approach to do so.

Risks of Staking

There are a few concerns associated with cryptocurrency staking that you should be aware of:

Cryptocurrency markets are highly volatile and can collapse significantly in a short period. If the value of your staked assets plummets dramatically, the loss might easily outweigh any money you earn on them. Staking can need the temporary storage of your coins for a specified period. This period prevents you from doing anything with your staked assets, such as selling them during that period.

Depending on the cryptocurrency, you may be required to wait seven days or longer to unstake your cryptocurrency.

The most significant danger associated with cryptocurrency staking is that the price will fall. It's important to remember this whenever you come across cryptocurrencies that offer excessively high staking reward rates.

For example, many smaller cryptocurrency ventures advertise high-interest rates to entice investors, but their prices later plummet as a result. If you're interested in incorporating bitcoin into your portfolio but prefer a lower level of risk, you have the option to invest in cryptocurrency stocks instead.

Even though the cryptocurrency you staked is still yours, you must unstake it to trade it again. It's critical to understand whether or not there is a minimum lockup period and how long the unstaking process takes to avoid any unpleasant surprises.

Final Thoughts

If you're expecting to stay on to your assets for an extended period, staking your crypto on a proof-of-stake blockchain network is an intriguing alternative for generating interest revenue. Even though these investments are not without danger, staking strategically and being patient can reap substantial rewards.

Best,

keblex