So now we seem to be in a sideways market (and I'll take that for another year, no problem!) what kind of returns are available on the Avalanche Network...?

I like Avalanche as it's a sort of half-way house between ETH and BSC - in terms of it's level of decentralisation and fees, so I keep an eye on it.

Note that these are the returns you can expect from now if things remain stable - had you piled in your stables with AVAX a few months back, the figures shown below would be a nonsense because of the intense capital loss you would have suffered, but we can say that about many other DEFI protocols too!

According to DefiLlama Avalanche is the third largest DEFI platform after ETH and BSC (we must discount TRON as it's a scam protocol of course)...

Below, I review the state of play by looking at three of the major platforms on Avalanche, The three largest in terms of TVL which are:

- Benqi

- Trader Joe

- Platypus.

Benqi

Benqi allows you to supply single assets which you can then borrow against...

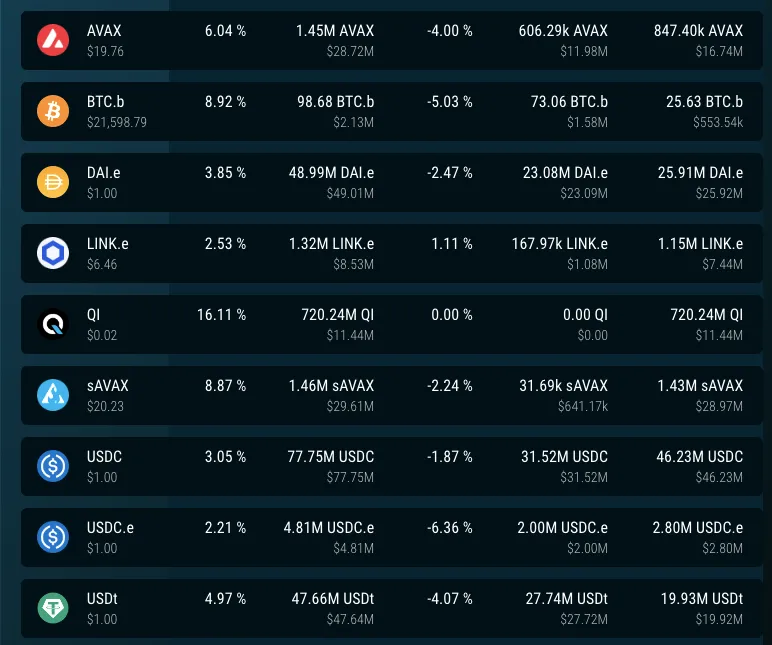

The returns currently offered on Benqi look almost FIAT like, or at the very least CEFI-like:

In other words they look low compared to the dayz of a few months ago with returns of...

- 2-4% on stables

- 8% on the wrapped version on BTC.

- 6-8% on AVAX

These rates seem much more sustainable than the rates of old at least, but it's your call whether you want to risk your assets for such low returns!

Trader Joe

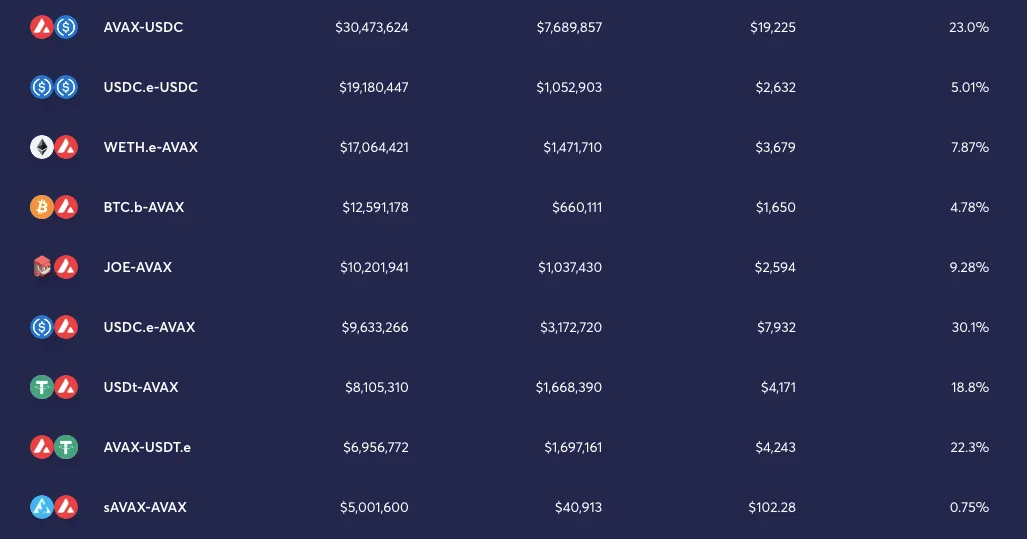

There seem to be some perfectly reasonable Vesting opportunities on Trader Jo ATM...

- AVAX-USDC, and most other stable pairs are offering just over 20%

- AVAX-BTC/ ETH - 5-7%

- USDC.e-USDC - the only pure stable option with large liquidity = 5%

This FEELS a lot more sustainable compared to the much higher return rates a few months back (which were double to treble the above).

5% on a pure stable pool and around 20% for exposing that stable to AVAX seems pretty reasonable to me...

Platypus

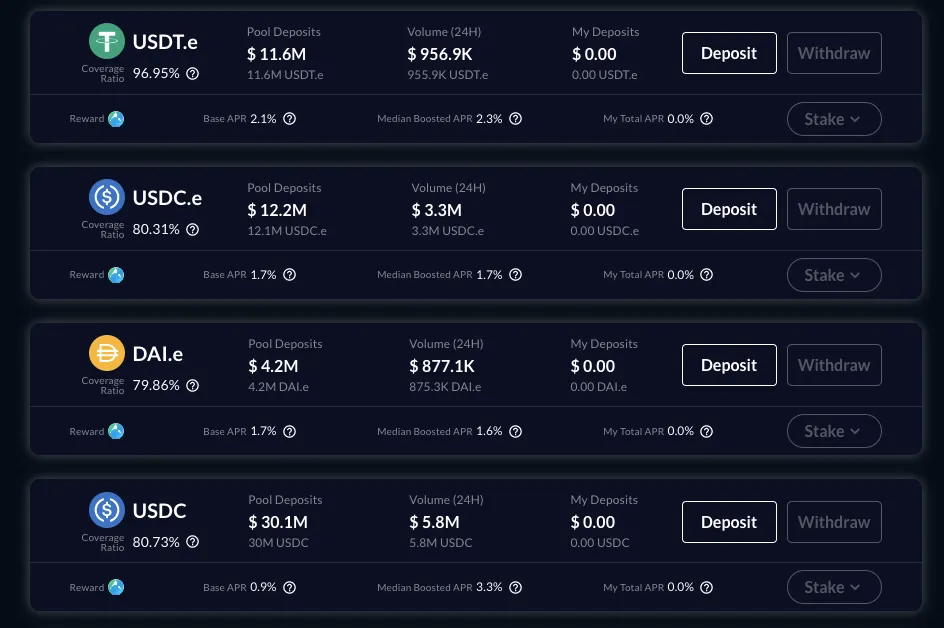

The main remit of Platypus is to incentivise pooling of stables to allow for stable-price swaps of said stables... you earn PTP from pooling any stable coin, and then you can stake that PTP to boost your yield.

The returns on offer are low...just under the 2% mark on average as a base yield...

And the boosted yields aren't much better.

Returns on AVAX - final thoughts...

I can't help but feel we are currently in a kind of mini-plateau period before the crypto markets take another leg down. Personally I don't think things will dip too much further, but I wouldn't rule out another 20-30% and I'd expect all of the DEFI coins such as AVAX to be hit harder, say up to 50%.

On that basis I personally won't be pooling anything more with AVAX even though the 20% returns for doing so on Trader Joe are attractive in current market conditions (and TBH staking SPS for 30% is more appealing).

But I think some of the stable-stable options and the pure BTC option on Benqi are safe enough, as I can't see the whole protocol going into total melt-down even if the markets do dip further.

In terms of Stables, Platypus has nothing on HBD or pHBD-USDC ON Polycub, it doesn't even come close! (But then again given the low returns elsewhere I have to question how sustainable those yields really are!?!).

Moreover, the fact that the yields are so low on the third largest platform by TVL, and that the boost for staking PTP does almost nothing to boost yield, it looks to me like AVALANCHE is already struggling to maintain decent yields.

Personally, I'm steering clear of staking anything on Avalanche for now!