}

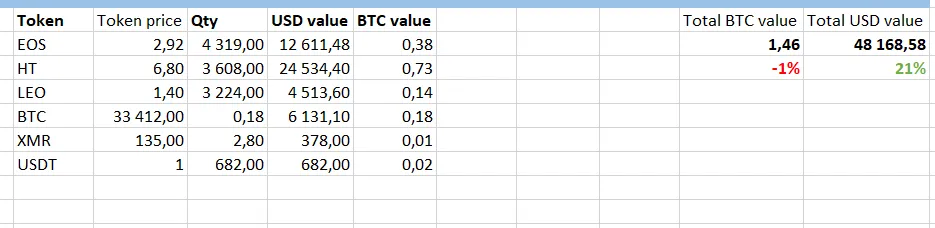

Portfolio snapshot: USD value +21%, BTC value -1% compared to last month.

USDt I have are from selling some of my BTC in ~30k range.

The most important change was converting another big portion of my EOS to HT.

So far, this turned out to be a great decision, as HT price was heavily outperforming EOS.

The price currently sits at +35% since my last big entry. HT just shoot above ATH, and is clearly on price discovery mode :)

Thoughts on LEO

In my initial strategy, I was considering selling at least half on my LEO tokens in order to have more bullish exposure. However, I decided to sell only a small portion and keep the rest, as a stable hedge for a black swan event.

There is another thing that popped up in my head - a bearish scenario for LEO, something that I did not think of before: If a really heavy bull market gets going, LEO holders may sell tokens after seeing its way too stable compared to everything else. This might actually cause really strong selling pressure, which buyback may not be able to compensate. That's why I may reconsider my getting-out strategy, but we still have a lot of time to go.

Black swan for EOS - Dan Larimer leaves Block.one

This was the main factor pushing me into selling some EOS. Althought I do not believe it has any significant longterm impact, the price actually took a beating last month. I still remain #bullishoneos, just a little less.

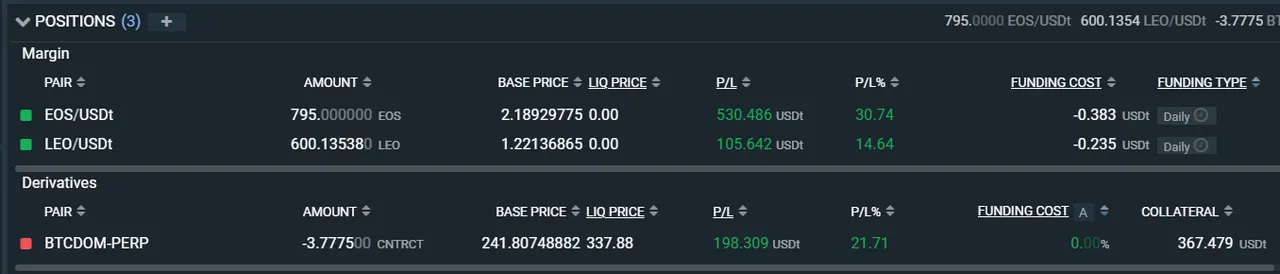

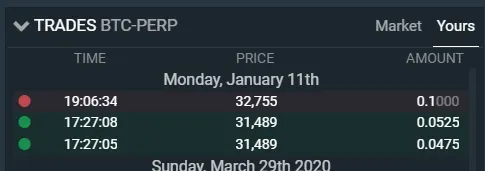

My additional long/short positions look as follows: currently at +830 USD live

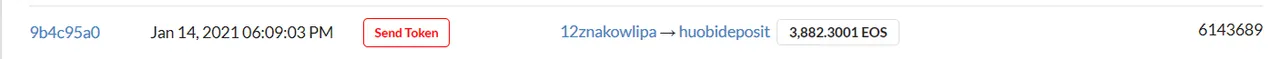

As you can see, I started shorting BTC, luckily at the top of BTC dominance. In the meantime, I also did one quick BTC and LINK long, which made me ~+170 USD. Again, those trades are from 0,03 BTC that I sold.

Quick macro thoughts

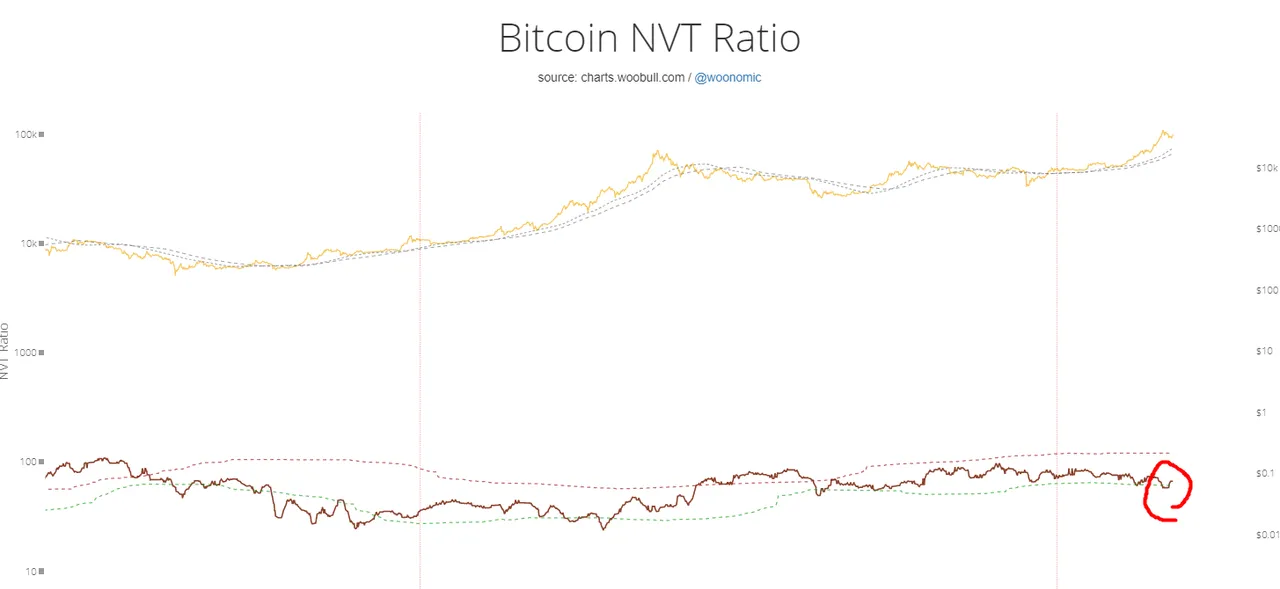

- We are still relatively early in this bull market

- That's it

Consolidation mode is cooling off the indicators, longterm on-chain data is absolutely bullish and Bitcoins are still cheap. Great months ahead!