}

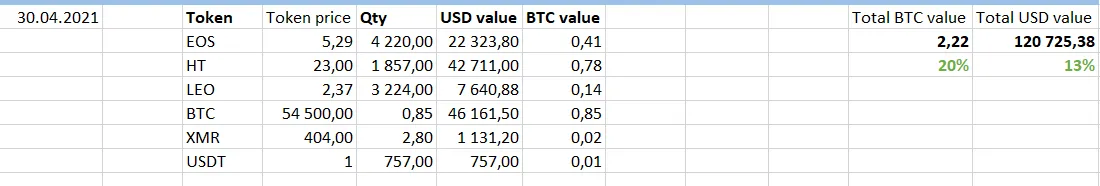

It's 30.04.2021 and the price of BTC is 54k USD.

We've seen a strong correction lately, which led to a major reset of many indicators, creating bigger long-term upside potential. But more on that later.

Portfolio value

My portfolio is +20% in BTC since last month, and +13% in USD. Bitcoin dominance has been falling sharply. Not much has happened during this time. I'm continuing to gradually move my alt bags into BTC. As you can see, my BTC holdings continue to rise and alts are decreasing.

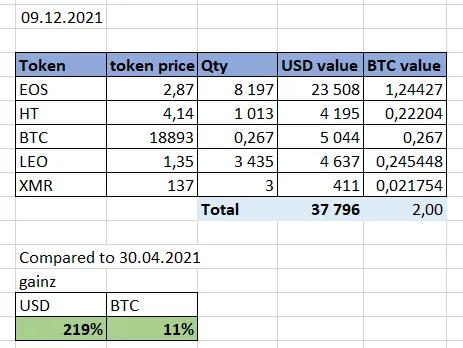

I think it's also a great time to take a step back and compare the returns not only to previous month, but also to the starting point.

As you can see, my portfolio is up 219% in terms of USD and 11% in terms of BTC value. The main point of my strategy is to beat the BTC return. After 4 months, we finally made it. Hopefully we'll keep on track for the rest of the year.

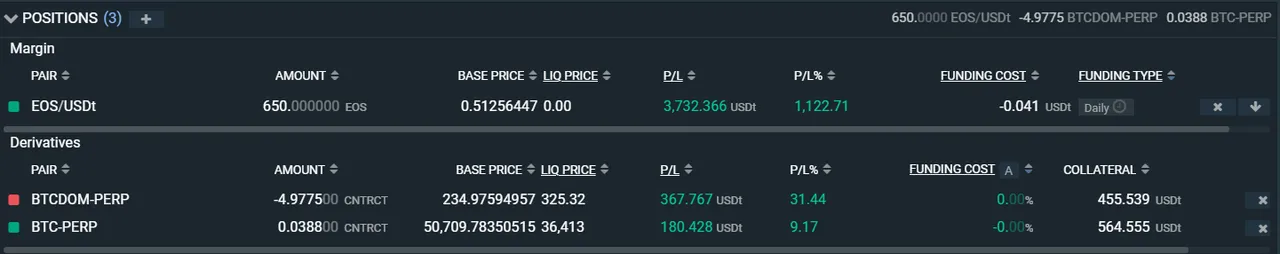

Margin positions update

As you can see, I opened a small long on the last dip. Just couldn't resist it ¯\_(ツ)_/¯

I'm closing it right after I finish writing this update. I'm also closing the BTC Dominance short for the time being. I expect BTC dominance do grind up for a while after such big drop.

During last dip, I also deployed some additional fiat into ETH and BTC to make some quick gainz. However, I'm not including that in this strategy.

Bitcoin is cheap

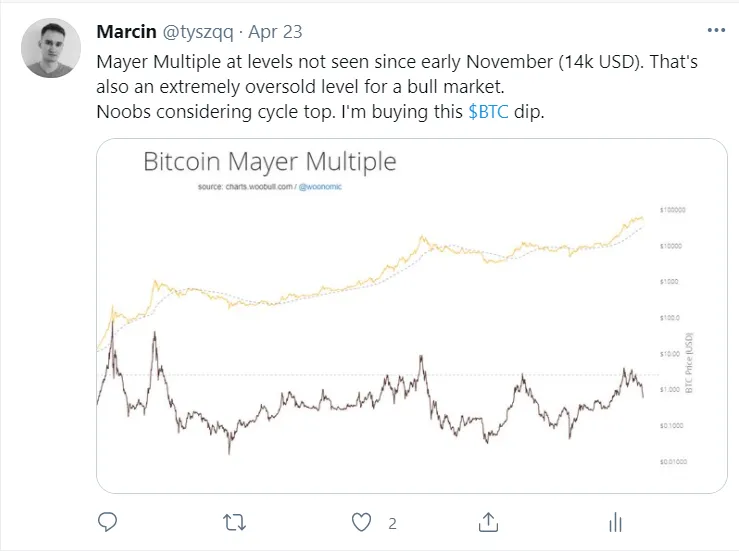

This month, we've seen a major correction which resulted in cooling off action on a lot of indicators.

First, Mayer Multiple, which showed a great buying opportunity:

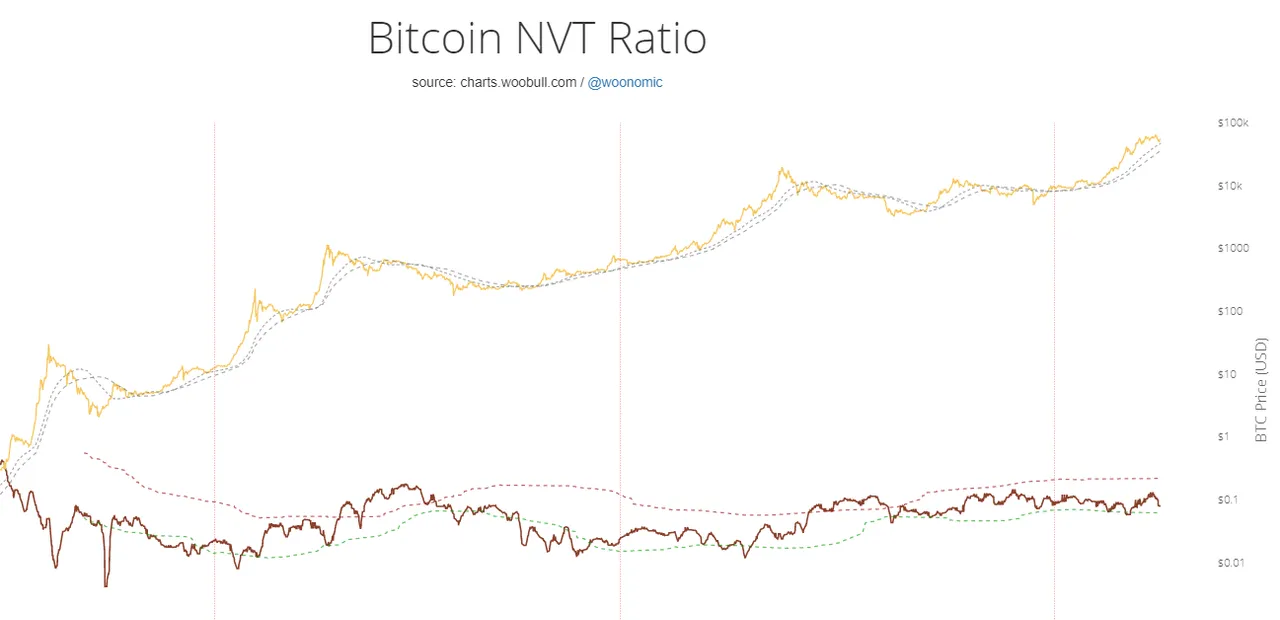

Then, NVT ratio, which dropped very sharply.

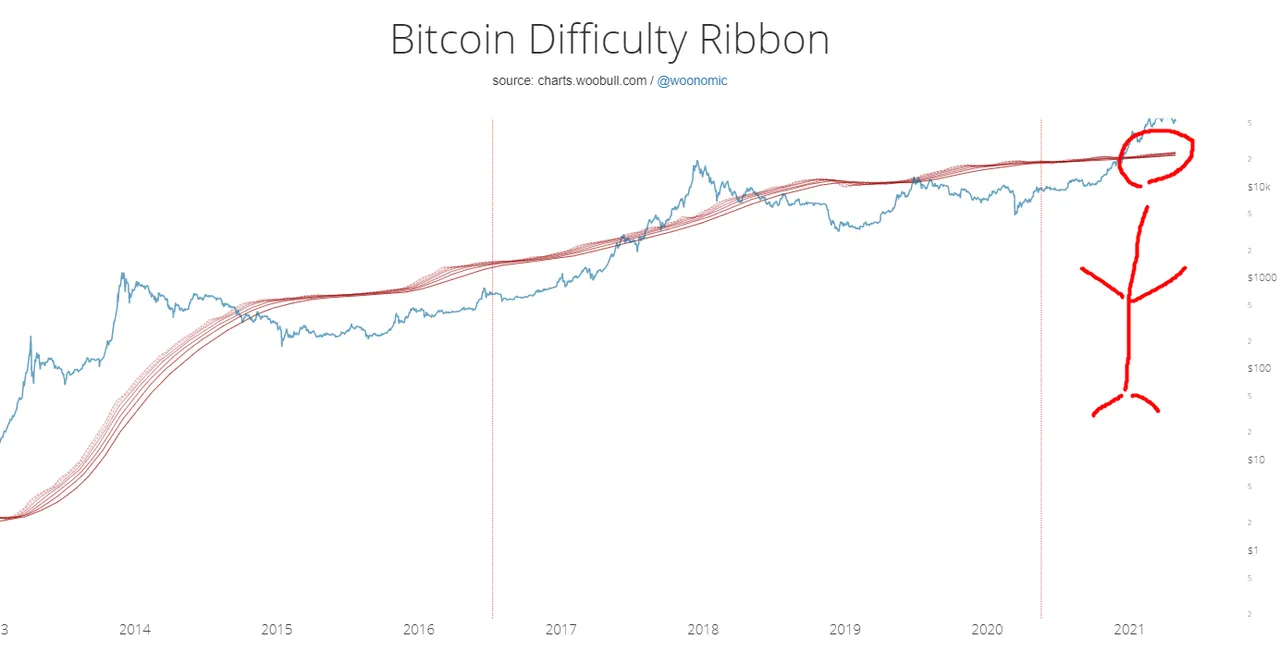

Difficulty Ribbon expanding

I've been watching is indicator for quite a while now. Expanding difficulty ribbon is a clear sign of bull market going into 2nd, strong wave of price growth.

Can't wait for another update! Market growth potential in May is unprecedented.