Should Countries Try And Lower The Wealth Gap Among Citizens

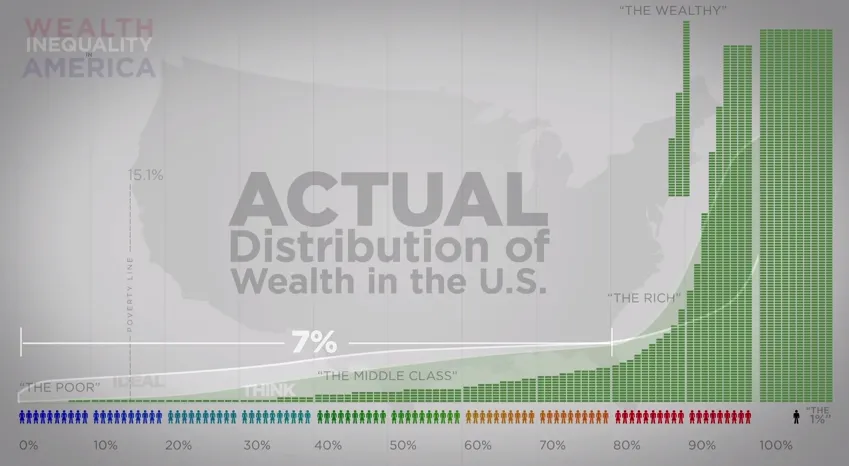

It is no surprise to anyone that in many countries around the world and specifically in the United States,massive wealth gaps exist amongst the population. For example in the US, the New York Times reportedthat the richest 1% own more wealth than the bottom 90% combined.(1) The financial crisis only helped make the wealth gap worse and now the gap is the second largest since the great depression. We live in a capitalist society, so we encourage making as much as possible, but should governments actively try and keep the wealth gap at an average rate or should they take a complete hands off approach? How could the government even go about lowering the wealth gap effectively? This post rides along a fine line of what you believe politically and what you believe economically, which only further makes things more difficult.

Ideologically financial freedom should be available to those in the US, especially the wealthiest, but is it the best option for the country as a whole? The US has a benefit that most of the country is extremely optimistic with almost 1/3 believing they will one day have enough money they don’t have to work (excluding retirement) and another 1/3 believing they will have enough money to not have to worry about money as a problem.(2) These statistics however don’t match up with the actual wealth distribution in America at all. If people knew the real statistics, they would realize that their chances of transitioning into the upper class are slim to none. While it is possible to make a sufficient savings for yourself during retirement, the chances of actually transitioning into the upper class or retiring and a younger age are slim. So say the government wanted to fix this problem, how would they even go about

it?

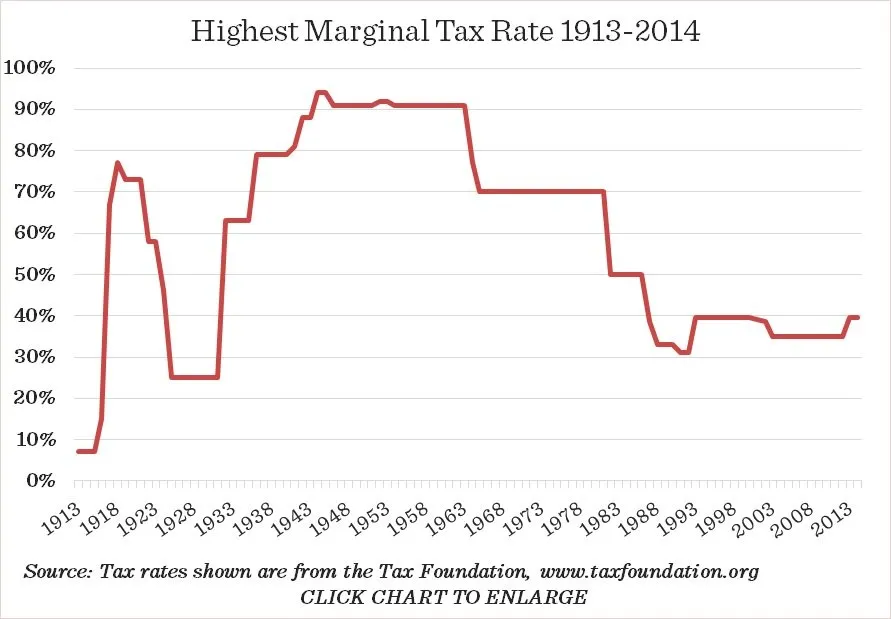

If we take the US as the example to use, which take in mind is not nearly as bad as some developing countries, there are constantly debates about taxing the wealthier more, or giving them tax breaks because they create the businesses that benefit us all. However there are problems with both theories.On the side of taxing the rich more, economic minds have basically come to a conclusion that the tax rate can only be so high until the rich seek other options such as hiding income in off shore accounts.

When you are rich enough, you unavoidably become a bit like an international citizen, as there are countries that are willing to act as a tax haven and you can afford the necessary lawyers to abide by the legal rules. The tax rate in the US now is actually pretty low compared to past rates, but a more international and technological world comes with the advantage of making hiding money easier. Making hiding money easier means that the tax rate which would cause the rich to look for tax havens becomes lower and lower. While we were able to have a marginal tax rate at 70% on the richest in the 60s, now a 40% rate is even too much to keep money inside the country to be taxed by the US government.

On the flip side the Trickle Down Economic Theory which has been cited by many politicians in the past has almost entirely been discounted. The truth is that there is only so much people can purchase with their money and many of the rich avoid investing directly into new businesses and infrastructure that would create jobs. Too many people with a hundred million or even a billion dollars are choosing to sit back and retire rather than invest in the future. There are some exceptions but for the most part these people are hording money and buying up everything in the US. If you wonder why a studio apartment in NYC is 2 million dollars, its because the entire market is owned and horded by a small group of people.So is there really a way to even lower the wealth gap in the US without pushing those who pay the majority of the taxes out? Im not so sure.

I think that taxing the wealthier a higher percentage is justified, just because of how many opportunities they have to make more income than the regular person. The returns on investment with people who have large amounts of money usually exceeds the average person, the S&P 500 and the DJIA. For example if I had five million dollars, I could buy a block of apartments and with rental income make my money back completely in 10-20 years. However, im not completely sure that we should raise taxes more than they already are because it might push the wealthy towards capital flight. I think there is probably room to tax them, but how much I don’t think anyone knows. We would need extensive data and some testing available to make an informed decision. Im curious what people here think, I read all the comments, and even if I don’t respond right away I do get around to it before I post my article the next day. I posted some sources below for any who are interested.

-Calaber24p

1- http://www.nytimes.com/2014/07/24/opinion/nicholas-kristof-idiots-guide-to-inequality-pikettycapital.html?_r=0

2- http://www.bankrate.com/finance/financial-literacy/do-you-think-you-will-be-rich-one-day-1.aspx

3- https://www.washingtonpost.com/news/wonk/wp/2015/05/21/the-top-10-of-americans-own-76-ofthe-stuff-and-its-dragging-our-economy-down/