Selections for further reading and discussion.

What can you learn from these links?

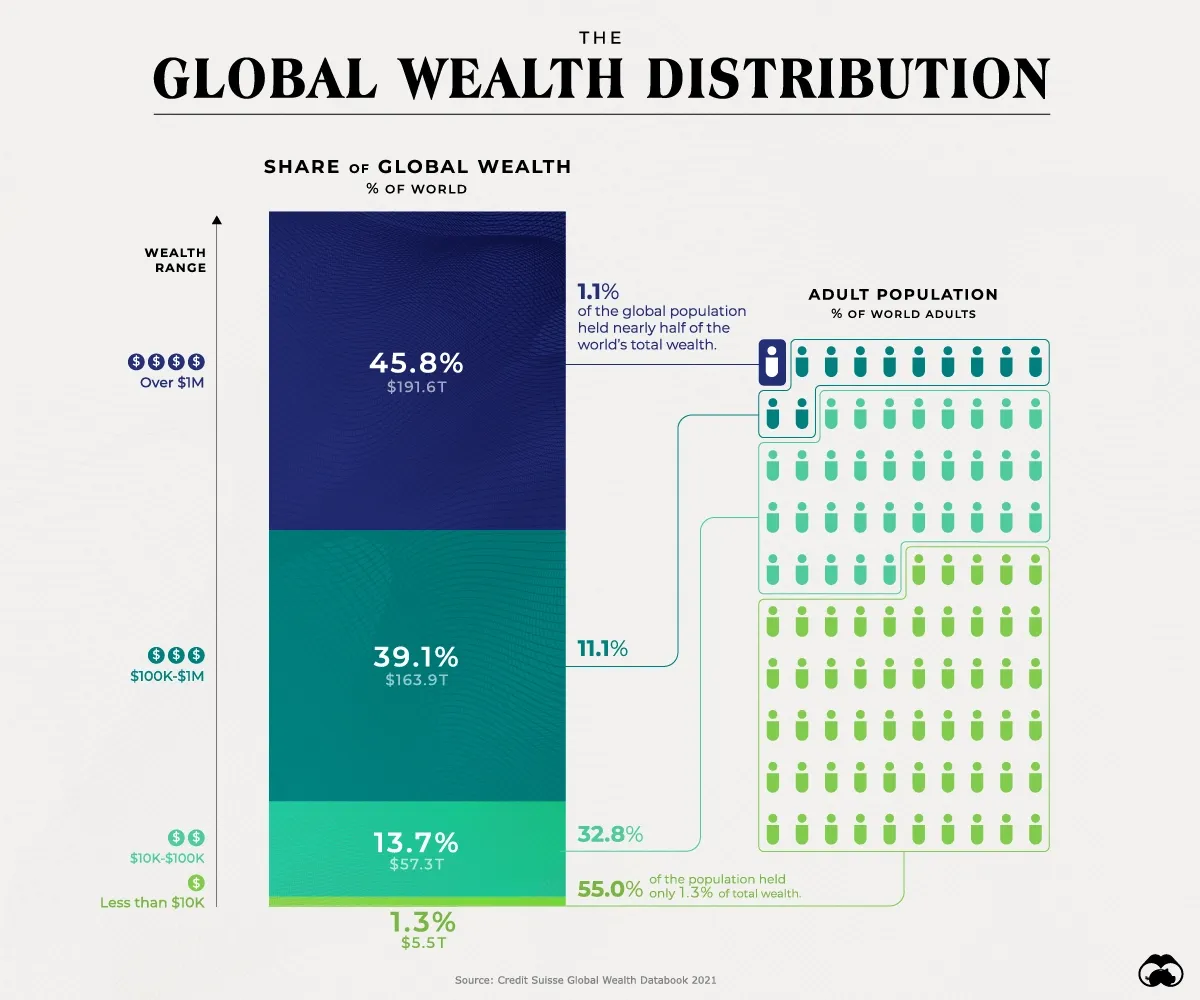

https://www.visualcapitalist.com/distribution-of-global-wealth-chart/

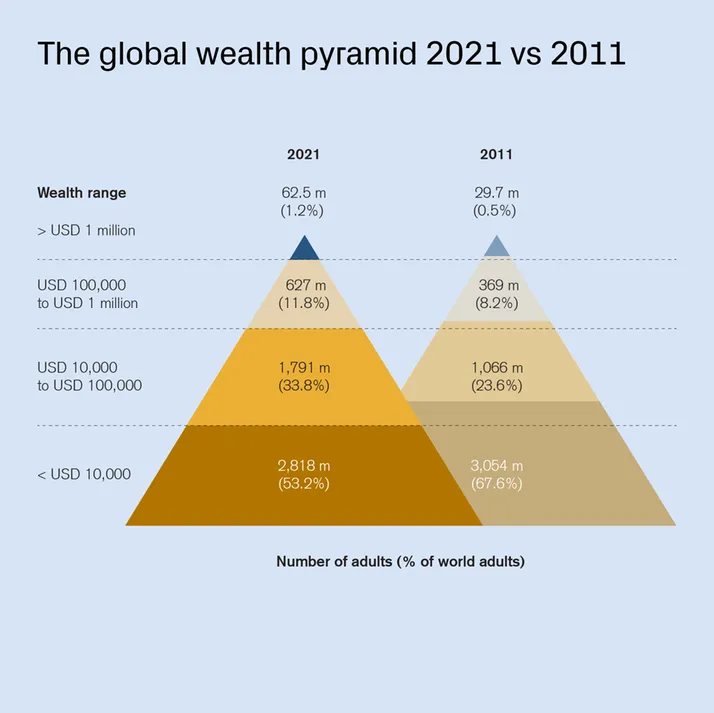

"By the end of 2021, global wealth totaled an estimated USD 463.6 trillion**, which represents an increase of 9.8% versus 2020 and is far above the average annual +6.6% recorded since the beginning of the century. Setting aside exchange rate movements, aggregate global wealth grew by 12.7%, making it the fastest annual rate ever recorded."

"Barclays Capital Inc. says 2023 will go down as one of the worst for the world economy in four decades. Ned Davis Research Inc. puts the odds of a severe global downturn at 65%. Fidelity International reckons a hard landing looks unavoidable."

https://www.bloomberg.com/graphics/2023-investment-outlooks/

"Wealth management industry consolidations were ablaze throughout 2022 despite volatile market conditions. Through mergers and acquisitions (M&A), firms can cater to new markets and client segments with a broad range of products and services to suit diverse HNWI investment appetites."

"With excessive post-COVID consumer demand, bloated retail inventories and the battle against inflation continuing to weigh on growth in 2023, Morgan Stanley believes global GDP growth will top out at just 2.2%, narrowly defying recession, but lower than the 3% growth expected for 2022."

https://www.morganstanley.com/ideas/global-macro-economy-outlook-2023

"In the fourth quarter of 2022, the Bank of Japan and the Bank of England were forced to intervene in their nations’ currency markets to prevent instability. In Japan, a precipitous decline in the yen eventually required action. In England, the central bank had to step in to protect the country’s bond market and pension system. The financial market’s implied volatility – a gauge of overall financial stability – is currently elevated, with most of the concern lying outside the U.S. It's worth noting that financial systems around the world are globally linked and as a result are vulnerable to instability occurring beyond their borders. Our strategists believe that the prospect of increased financial instability is remote in 2023, but it's something that investors should prepare their portfolios for regardless." https://www.jpmorgan.com/wealth-management/wealth-partners/insights/2023-outlook-key-takeaway

"As we look ahead to 2023, we believe the valuation gaps that exist across asset classes may become a greater focus for investors. While valuation is a poor predictor of short-term performance, it does suggest the potential for international equities (including emerging markets and Canada) to outperform U.S. equities over the medium term"

https://www.ig.ca/en/insights/2023-outlook-navigating-the-peaks-and-troughs

[ ** 463.6/21m= 220,761,904.7619048 ]