Robots, automation, deep learning software and other advanced production techniques are replacing a lot of jobs.

It started over century ago with the simpler manufacturing jobs being replaced by machines that did not require computers, just a clever mechanical system to replicate whatever a human worker did.

Then came the computers and robots and then came the software and expert systems and later, deep learning.

Even simple software has replaced whole job classes. For example, when was the last time you saw a secretary pool?

If you think it is just the blue collar jobs that are at risk you would be wrong, deep learning and advanced AI bots are now threatening to replace the lower end of the white collar job spectrum as well. Banks tellers still exist but I personally have not used one in many years, I always go to the ATM instead.

Even entry level lawyer jobs are being replaced by deep learning software that can perform the simpler search and collate tasks that young lawyers would have done in the past.

I do not know this for sure but I imagine that deep learning software could replace grad students in science and engineering laboratories for some of the simpler tasks like data collection and hypothesis generation and testing.

Enter Universal Basic Income

Universal Basic Income (UBI) has been proposed as a means to support that segment of the population which finds itself out of work due to these large scale societal changes.

The idea is to give everybody in a nation the same amount of money each year regardless of their income level. The cost of this entitlement payout would be offset by laying off large numbers of government employees.

Well, that's the theory. Would this work? Well, let's do the math for the USA as an example.

In America, there are about 325,000,000 people. The poverty line is defined as $12,000 for a single person living on their own. Not a lot of money but if you are prepared to live like a monk it will do, I guess.

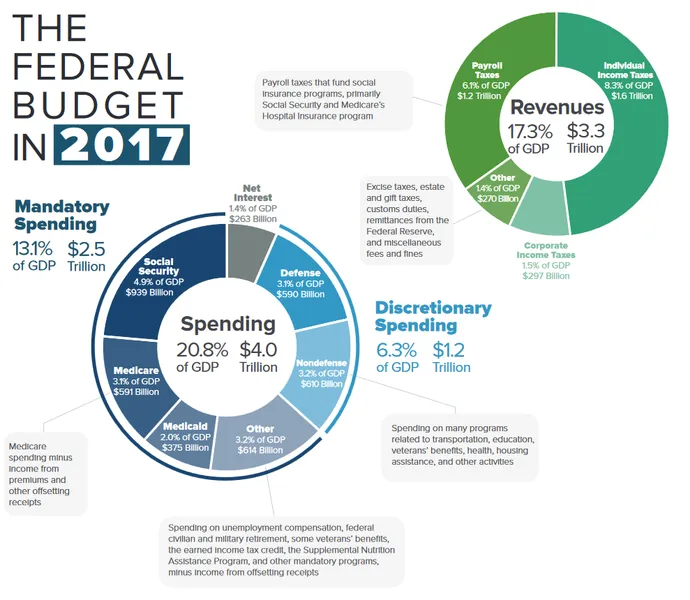

Multiplying these two numbers together means that the American government would need to dispense 3.9 trillion dollars every year. That is equal to the entire US Federal Budget in 2017. Woof!

So UBI would mean that the US government would need to stop spending on everything else just to meet its UBI obligations. Goodbye defense, goodbye environmental protection, goodbye customs and border control, goodbye education and goodbye medicaid.

This is clearly not feasible even if every government employee were laid off.

So what is the alternative?

Negative Income Tax Rates

The idea of negative income tax has been floated as a viable alternative to UBI. With negative income tax rates, if you are earning below a certain level you automatically get money from the government regardless of whether you have a job or not.

For example, if you are a college student earning zero dollars you might be given $20,000 per year (I am just pulling this number out of the air for argument's sake).

For example:

- If you have no job ($0 per year) you would be given $20,000 per year (total income equals $20,000 per year).

- If you have a job at $5,000 per year you would be given $15,000 per year (total income equals $20,000 per year).

- If you have a job at $10,000 per year you would be given $10,000 per year (total income equals $20,000 per year).

- If you have a job at $15,000 per year you might be given $5,000 per year (total income equals $20,000 per year).

- If you have a job at $20,000 per year you would be given nothing (total income equals $20,000 per year).

This first scheme is a little harsh and would definitely generate perverse incentives for people to not work.

So instead try something like:

- If you have no job ($0 per year) you would be given $20,000 per year (total income equals $20,000 per year).

- If you have a job $5,000 per year you would be given $20,000 per year (total income equals $25,000 per year).

- If you have a job $10,000 per year you would be given $17,500 per year (total income equals $27,500 per year).

- If you have a job $15,000 per year you would be given $15,000 per year (total income equals $30,000 per year).

- If you have a job $20,000 per year you would be given $12,500 per year (total income equals $32,500 per year).

- If you have a job $25,000 per year you would be given $10,000 per year (total income equals $35,000 per year).

- If you have a job $30,000 per year you would be given $7,500 per year (total income equals $37,500 per year).

- If you have a job $35,000 per year you would be given $5,000 per year (total income equals $40,000 per year).

- If you have a job $40,000 per year you would be given $2,500 per year (total income equals $42,500 per year).

- If you have a job $45,000 per year you would be given $0 per year (total income equals $45,000 per year).

The second scheme would provide people with incentives to get jobs and to chase after promotions since every bump in pay will also get you a bump in total earnings.

How To Pay For All Of This?

About 5 months ago I wrote a post called Tax The Robots! in which I argued that automation is inevitable and it is coming for all of our jobs. It is just a matter of time.

We may then just treat every robot and every automated process as an "employee" working for a wage. That robot or automated process would then have to pay a poll tax or some other kind of fee. The extra revenue coming into the government from these sources could then be used to mitigate the cost of a negative income tax program.

We could also lay off all of the government employees who handle welfare payments, pensions and other benefits and just keep the tax revenue employees.

What About Children?

With a negative income tax scheme even children could get an income (say $5,000 per kid per year) to be spent by their parents for the necessities of life (if they are good parents).

Wouldn't This Lead To A Lot Of Welfare Queens?

Yes, this would lead to a strategy of having lots of kids to make bank. The government would therefore need to cap the benefits at something like three kids, or $15,000. Every kid thereafter does not generate a boost in the payments.

An alternative would be to reduce the payments of each additional kid. First kid: $5,000 per year, second kid: $3,000 per year, third kid $1,500 per year, fourth kid: $0 per year.

This might have the beneficial effect of boosting local population growth and reduce the need for massive amounts of immigration (eliminating harmful brain drain from developing countries).

Closing Words

The positive side of negative income tax rates is that people could quit their shitty dead end jobs and go back to school. They could get an education or get a trade and then look for a good job. Starving artists could stop starving and start making art.

I think only a small fraction of people would become layabouts, stoners or drunkards (honestly, most people are not like that). They would be there but they would be fewer than you expect.

Ideas like this are large and the chances of unintended consequences are large. Who really knows how a society would respond to an incentive like this?

One would also have to run a large and sophisticated financial computer model to determine the optimal negative income tax rate structure that would provide incentives to people to work and also not bankrupt the economy.

Having said all that, it seems the impacts of automation are relentless and are nowhere near slowing down. When the majority of white collar workers are getting laid off then schemes like this will suddenly become very popular.

Who knows one day a country may even try it out on a large scale?

Thank you for reading my post.

My Daily Steemit Work Cycle

- Write my daily post, depending on my familiarity with a topic this can be as fast a 2 hours and as long a 7 to 8 hours if much research or programming is needed.

- Go read the steemstem posts of my favourite steemstem authors. Give them all upvotes.

- Ask stupid questions in any post that seems interesting to me.

- Go to the New section of steemstem, look for people with low reputation scores and:

- Politely tell people who incorrectly used the steemstem tag to not do so using this reply: "I don't think that this post actually belongs in Steemstem. STEM is Science Technology Engineering and Math. Looking forward to any topics you may want to write about on that in the future."

- Let people who wrote a steemstem related post but need help with style, image credits, source credits etc that I have created a style guide with a reply that looks something like this: "I wrote a style guide for STEM posts that you might find interesting (or not, up to you): Procrastilearner's Style Guide For Science and Technology Posts."

- Upvote people with low reputation scores who wrote a good steemstem post.

- Upvote and Resteem people with low reputation scores who wrote steemstem posts and wrote a very good post.

- Downvote anyone who blatantly plagiarizes (not often but it happens).

Post Sources

What Deep Learning Is Doing For The Legal Sector

USA - Wikipedia page

Poverty Line - Paying For Senior Care.com

US Federal Budget

Universal Basic Income

Negative Income Tax Rate