A look into MCO, TenX, and Centra

Hello everyone, full disclosure that I own MCO but I wanted to explain some of the differences between Monaco and the competition since a lot of the steemit posts and videos on youtube I've been finding on Monaco are….lackluster. I will refrain from speculating on the price in this post since its more about the actual cards/coins themselves than it is the current price or guessing at future prices.

Monaco has a vision: to put cryptocurrency in every wallet. This goes beyond simply being able to spend your crypto. Spending your crypto is one thing, being able to replace the majority of cards in your wallet - if not all - is another.

All over the world, people carry various types of cards to earn rewards points, cashback, and discounts when they spend. Different cards for different places, some give more cashback for airline purchases, some give more for gas purchases (sometimes even going so far as to have a card for each airline/store/gas station they go to regularly).

Imagine if you could have a card that gave you consistent cashback on every purchase, for life and that the cashback came in the form of a spendable cryptocurrency. It's a reasonably safe assumption to make that you, the reader are invested in crypto and most likely at some point would like to actually spend the crypto you're holding, why not get crypto cashback on that yacht you're gonna buy in the future? Right now, the majority of people have to take their crypto to coinbase and send it to their bank account, paying transaction fees to send to coinbase and then more fees to actually process the payment to your bank account before finally being able to make everyday purchases with crypto.

edit:

lots of new developments in the last few days, anyone reading this should know about the WaveCrest issue and Centra's new hires, I'm working on the update for that now.

Enter the CryptoCards

TenX, Centra and Monaco, giving you the ability to spend your crypto directly. But not all cards are created equal.

Card A: TenX (around 430M market cap as of my writing) is the biggest at this point and has cards shipping in Europe.

Their fees include:

- A 15$ physical card issuing fee which includes shipping and tracking and costs 10$ per year if you spend less than $1,000 per year or is free otherwise.

- A 1.5$ virtual card issuing fee with the same annual fee as the physical card (10$/less than 1k spent or free).

- Aside from that they have a Foreign Exchange fee of 0% and an ATM Fee of 2.75 EUR per transaction - not including the fees the ATM itself has (TenX has no control over that).

Following that is their limits according to the support base:

Important note: The WaveCrest MyChoice Corporate KYC limits are set to change on 17 January 2018. The new limits will be as follows.

- Level 1

- After you activate your card on the app, you automatically gain KYC level 1 access.

- US$250 limit per transaction

- US$250 maximum lifetime spending

- US$100 maximum ATM withdrawal amount per transaction; 2 withdrawal limit per day

- US$100 maximum ATM withdrawal lifetime

- Card can become disabled if irregularities are detected by the card issuer.

- Level 2

- Obtained after KYC documents are submitted through the app and subsequently approved by the card issuer.

- US$10,000 limit per transaction

- US$20,000 maximum spending daily

- Unlimited lifetime spending

- US$1,000 maximum ATM withdrawal amount per transaction

- US$1,000 total maximum ATM withdrawal amount per day,

- 2 withdrawal limit per day

- Note: If you are registered as a French resident, your ATM withdrawal limit is US$1,000 per 30 days

- Unlimited ATM withdrawal lifetime

It looks like the main changes from previous limits are the MASSIVE reduction in spending ability with level 1 access and the daily atm withdrawal limit on level 2 going down from being able to pull $2,000 per day from an atm to $1,000. The ATM daily withdrawal limit (2 times) remains unchanged.

Next up: holding PAY

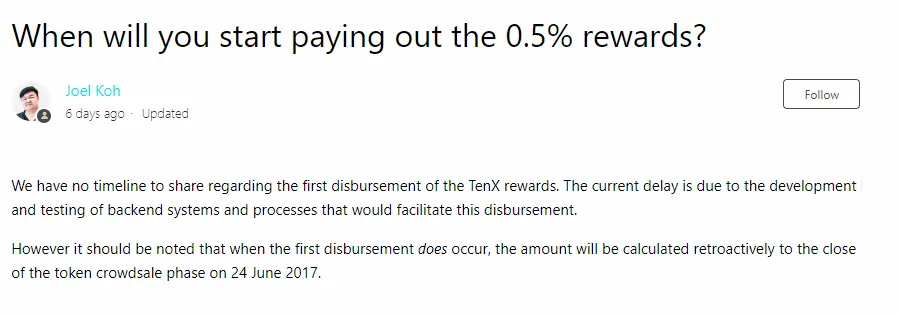

Since I can't put it any better than the TenX support base here is their answer

Pretty much the exact same as the last answer to this question on the same base posted 2 months ago. At some point they'll get around to it, but it looks like they messed up or were delayed a bit with the development of the entire disbursement process. Either way, at least now they've posted an update on it and we know they are still working on something.

Lastly, the cards themselves:

TenX cards are issued by Wave Crest Holdings limited, who is licensed to issue Visa Prepaid cards. On October 16th TenX cards outside the European territories supported by Wave Crest (read: the rest of the world) were rendered useless, as Wave Crest simply stopped supporting countries outside of the European Territory.

To clarify, that doesn't mean TenX can't be used globally, just that TenX cards issued to anyone not in the European territories supported by wave crest are unusable, a cardholder outside of those territories but with an unactivated card can no longer activate it and cards are no longer being issued outside of those territories.

Card B: Centra (223m market cap, cards ?shipping?? to places?)

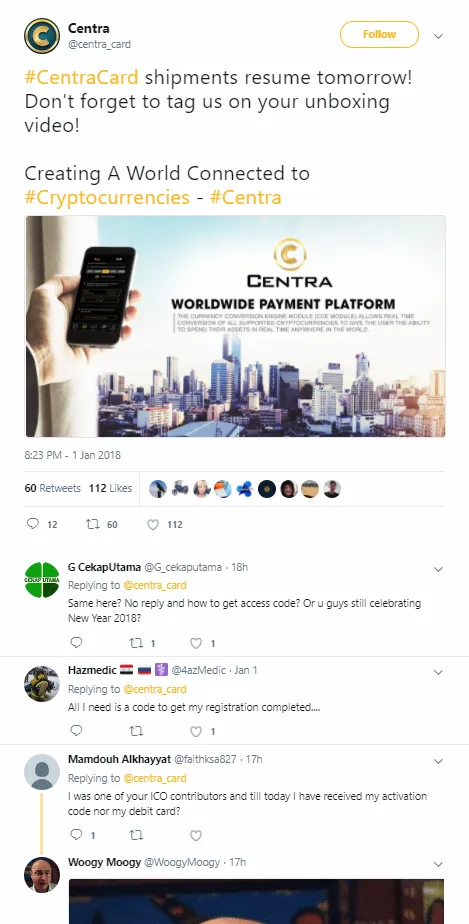

This card isn't really looking too good at the moment and I don't want to bother giving it the TenX treatment...with ICO contributors and many more still waiting for even their ACCESS codes to finish registration let alone having their cards you begin to wonder, is putting money on Centra really worth the risk over TenX or MCO when do things like not even attempting to help ICO contributors complete registration.

Aside from that, something interesting I noticed: the people posting videos on youtube about using their centra cards all have accounts that seem like they were either made to shill centra or repurposed to do so.

See:

I'm not gonna spend too much more time on Centra.....they're honestly not worth it imho.

Card C: Monaco (207m market cap, cards releasing soon - Approved VISA Program Manager)

I'll start off with fees like I did with TenX, but the fees are a little different here.

None of the cards actually require payment or have monthly/annual fees, though the ones that offer cashback and other extra features do require you to hold some MCO. Aside from that, each card has a monthly interbank exchange rate limit and an free ATM withdrawal limit, with .5% and 2% fees respectively added after passing a limit.

Basically: no monthly or annual fees, interbank exchange and ATM withdrawals have fees after passing the limits and VISA platinum cards require MCO to be held for 6 months

The "MCO holding period" for cards that require you to do so is 6 months after which your MCO would be released and you can do whatever you want with it - sell it for btc, spend it, keep holding, etc. You don't need to deposit any MCO until your card ships. Dynamic pricing will come into effect once cards start shipping to keep the cost of cards reasonable as value of MCO increases.

Unlike TenX there are a couple different card options so in the interest of space I'll consolidate a bit with 2 quotes from the FAQ about the overall card situation followed by [limits and cards] since each card has a different limit.

Monaco is an approved VISA Program Manager. Being a Program Manager enables us to manage the marketing for Monaco cards, distribution, KYC/AML, customer support and all other operational aspects of the card program, including working with a processor on transaction authorization and processing. Being a Program Manager is different from being a Card Issuer as the latter is responsible for meeting local regulatory requirements and settlements to VISA.

Monaco's strategy to roll out it's product globally is to go market by market and secure card issuing capability and assure local compliance. We now have our own BIN numbers (both Classic and Platinum), we set the rules of our program ourselves, we are not limited by any "shared BIN" arrangements which other companies are subject to. The difference to customers is two-fold: * We are going to be able to offer much more competitive pricing to Monaco customers (read: better exchange rates) as we are eliminating a middle man from our setup * We are going to be able to innovate faster on our product and the features we offer to our customers, as we are not limited by 3rd party shared BIN program rules

This in my opinion puts TenX and Monaco in completely different leagues, TenX will always have to deal with WaveCrestHoldings issuing their cards as evidenced by the fact that they're currently scrambling trying to figure out how to get cards outside Europe.

The Cards

Midnight Blue - plastic - VISA - free:

- No MCO required - completely free including shipping.

- All basic features

- $2,000 interbank exchange rates limit

- $200 free ATM withdrawal limit

Ruby Steel - metal - VISA Platinum - 50 MCO/6 Months

- 1% cashback on ALL purchases

- All basic features

- $4,000 interbank exchange rates limit

- $400 free ATM withdrawal limit

Space Gray, Rose Gold - metal - VISA Platinum - 500 MCO/6 Months

- 1.5% cashback on ALL purchases

- All basic features

- LoungeKey airport lounge access - unlimited access to 900 lounges in 450 cities, for the rest of your life

- $10,000 interbank exchange rates limit

- $800 free ATM withdrawal limit

Obsidian Black - metal - supply limited to 999 - VISA Platinum - 50,000 MCO/6 Months or special ICO conditions

- 2% cashback on ALL purchases

- All basic features

- LoungeKey airport lounge access - unlimited access to 900 lounges in 450 cities, for the rest of your life

- Unlimited interbank exchange rates limit

- $1,000 free ATM withdrawal limit

From the MCO Q/A's we also know that merchant cashback is being worked on among other new features, but there's no point speculating on the specifics currently since not much more is known. There are also 2 new products being developed and we should be clued in on them soon, possibly in the Q/A session on January 9th.

Currently holding MCO outside of card reservation you can also spend MCO (including your cashback) once you have your card, but I would assume the 2 new products create more usability for MCO.

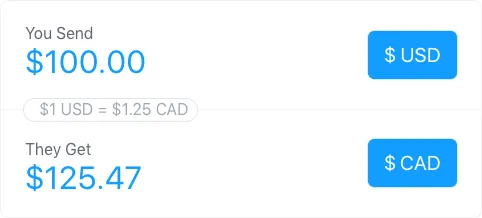

Lastly, one of the biggest benefits to all cards is the ability to get the REAL exchange rate, not the exchange rate after a bank takes its 5-8% cut. This means that no matter where you are in the world, your card will be treated as local currency using perfect interbank exchange rates.

I know I haven't compared their teams yet, but I'm pretty tired so I'll get to that and anything I missed tomorrow. Let me know what I missed, if you want me to actually post about Centra (I'd rather not), and if you have any suggestions.

Thanks for reading,

HP

edit:

removed small bit of speculation

and in the sense of fairness I will properly go over Centra in a separate post so as to not make a major change to this one.