What Is Bitconnect?

Bitconnect, WAS a lending platform. Where users would deposit Bitcoin into their account. Then using the internal exchange on the Bitconnect webiste, would purchase BCC or Bitconnect Coins with their Bitcoin. Then users would lend these newly purchased BCC coins to a supposed Bot that would trade the coins for them based on volatility and would give lenders returns based on daily volatility. (volatility is how much the price rises or falls). Below is a picture from the Bitconnect website, to help you better understand the system and rates.

Ship Sinking: Bitconnect Stops Lending

On January 16, 2018, Bitconnect announced in an article on their official website that the lending program would halt. All active loan were released at the set price of $363.62 per coin. This announcement was seemingly out of nowhere, with no legit justification to the halt. But Bitconnect claims the three reasons are:

1. Bad Press

Youtube videos, news article, and huge cryptocurrency figures all making content that put Bitconnect in bad light. Causing a lack of trust and confidence in the platform.

2. Cease and Desist

Two USA states have handed Bitconnect a Cease and Desist order, North Carolina, and Texas. Bitconnect claims that this, "hindrance for the legal continuation of the platform". Both Cease and Desist orders claim Bitconnect was giving unregistered securities.

3. DDoS Attacks

The Bitconnect website has been facing extensive DDoS attacks. Especially the days leading up to the halting of the lending program. Making the website hard to use, and causing safety concerns.

Major Losses

The price of Bitconnect coins plummeted after the halt in the lending program. For good reason and just simple economics, the coins became useless, once the lending platform was halted. Their became no viable reason to have Bitconnect coins, in response a massive dump of the coin took place, everyone and their mom sold their coins. This progressively made the price of BCC plummet over 90% within the time frame of a few days. leaving many Bitconnect lenders stuck with worthless coins. A quick glance at CoinMarketCap.com, shows Bitconnect went from a price of $431 on January 7, 2018, all the way down to just $10 (at the time of writing) January 26, 2018. In addition, many lenders on Bitconnect had holding in BCC over $100,00. And many had active loans over $100,000, Bitconnect release all active loans at the set price of $363.62 per coin, but since the price quick plummeted to $10. A LOT of money was lost by lenders, there was hardly any time to react to the situation. Furthermore, attempting to sell BCC coins became near impossible. Since everyone was selling, almost no one was buying selling.

Law Suit

Source: Cointelegraph.com

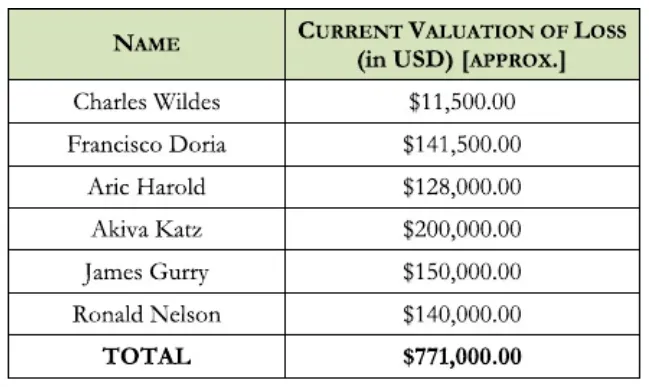

In the wake of these major losses, lawsuits have come forward targeting Bitconnect across the board. Bitconnect its self along with its representatives and promoters have had lawsuits filed against them in the past week. Above is a picture of the 6 investors who are carrying out a lawsuit against Bitconnect directly. Beside each investors name is the USD value that was lost due to Bitconnect halting lending and the price plummet that followed. These six investors alone lost more the $700,000, and this is just the tip of the iceberg. Some lenders lost more than this, and some lost more situationally. One induvial put his entire life savings into Bitconnect loans, right before the halt took place. This is just one story of many. Lawsuits have also have been filed against big Youtubers who promoted Bitconnect. Bitconnect utilized a referral program that made it profitable to get new lenders to sign up under your referral link. Four Youtubers have been accused of aggressively recruiting new investors into the Ponzi scheme using social media. And have had lawsuits filed against them.

LESSON - Stay Away From Lending Platforms!!!

Please for your own financial safety stay away from lending platforms. Bitconnect is considered the pioneer in cryptocurrency lending platforms and was the largest. Bitconnect has given way to other lending platforms such a Davor and many others. If the biggest and original lending platform falls, think how soon the other platforms will follow. When investing, when it seems too good to be true, it often is. Follow your heart and brain, not money.