( )

)

Warren Buffett and Charlie Munger at the 2017 Berkshire Hathaway Annual Shareholders Meeting. Credit for the video goes to ArtFort.

That's Charlie, I'm Warren. You can tell us apart because he can hear and I can see. That's why we work together so well. We each have our specialty.

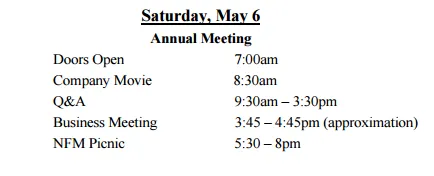

Every year, tens of thousands of Berkshire Hathaway shareholders flood the city of Omaha, Nebraska for the annual shareholders meeting. This was the schedule for this year's meeting:

Source

Notice something? From 9.30am - 3.30pm, Warren and Charlie answer any question that they are asked. The video above is this year's Q&A session. During these Q&A sessions, one of the questions that they get a lot is how do they constantly beat the market. And the answer is that they only invest in companies that lie within their circle of competence.

The Circle of Competence

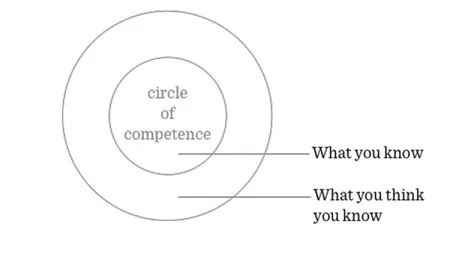

Image Credit: Farnam Street

What an investor needs is the ability to correctly evaluate selected businesses. Note that word “selected”: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.

-- Warren Buffett

Ted Williams, baseball's last .400 hitter, explained his technique in his book The Science of Hitting. He divided the strike zone in 77 cells, where each cell represented a baseball. That was the easy part. He would then practice extreme self-restraint and only swing at the balls which were in the cells with high chance of a successful hit.

This is what Warren and Charlie are talking about when they talk about their circle of competence. They only invest in companies whose business they understand. If they don't understand a company's business, the underlying technology, its operations, then they are perfectly willing to pass, even if it seems like a great deal.

Recently, I have noticed two things: a lot of people want to invest in cryptocurrencies and a lot of people don't understand how cryptocurrencies work. I have also seen articles about how you can become a millionaire in the next 5-10 years by investing in cryptocurrency. I can't tell you if you should invest or not. That's because I don't understand cryptocurrencies enough to know whether it is a good investment or not. What I can tell you is before you make your decision, ask yourself: "Do I understand this enough to put my hard-earned money in it?" And you will know the answer right away.

To learn more about Warren and Charlie's philosophy, I would highly recommend reading the following books:

Seeking Wisdom: From Darwin to Munger

Poor Charlie's Almanack: The Wit and Wisdom of Charles T. Munger

I'd like to close this one with some wisdom from Charlie:

It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be intelligent.

Thank you for reading :)