There are a ton of ways to get Rich, some of which I've covered here on The Road to Riches.

Today though I want to talk about Asymmetrical Investing... as I personally have a decent chunk of my net worth allocated to this strategy at the moment.

Now it's not the safest thing ever so let's get that out of the way, but there are ways to mitigate your risk so read on!

"Let's Get Physical!"

I mean Asymmetrical. The former was an Olivia Newton John reference.

(realize no one probably knows who that is, realize I am now older than I thought, unsuccessfully google a gif of Olivia newton john, fail, move on)

An asymmetrical trade, or opportunity (I should be in sales) is one in which the potential reward FAR exceeds the potential risk. For instance, risking $1000 for a potential return of $10,000. Also known as a ten bagger, is a classic example of an asymmetrical trade.

Now I'm not saying put all of your eggs in one basket. Let's say you split your portfolio into 10 different potential 10 baggers. Even if only a third of them worked out and the remaining seven investments went to zero, you'd still have tripled your initial investment! This is pretty much the strategy followed by venture capitalist. Your winners more than make up for your losers.

Most people are blindly throwing money wittingly or not at the stock market. Basically risking a 100% to return (hopefully) 8-10% a year. Perfect for a life of mediocrity and (maybe?) retiring in 40 years.

To me it makes much more sense to risk 10% for a potential return of a 1000% or more in many cases.

All Asymmetrical trades are not created equal.

So now that we're on the same page, what should you invest in?

Just because the gains far outpace the risk, doesn't mean it's a good idea. After all playing the lottery is an asymmetrical proposition, you risk a buck with the chance of making a million times that. However you can play the lottery all you want, and you're likely to still end up out of your dollar.

So what are we looking for?

We're looking for investments with intrinsically limited downside. We want to tilt the odds in our favor. We want something of real value (not an ICO), that just so happens to be on sale. Now if you've read some of my prior articles, you are already know where I'm going with this.

Cycles.

In life there are many naturally occurring cycles. Animals move in patterns throughout their habitats, the planets move in cycles around the Sun and every Thanksgiving like clock work Uncle Larry will say something to make everyone extremely uncomfortable.

The seasons change pretty predictably every year as well. Winter melts into Spring, Summer, then cools into Fall, EVERY year without fail. Not ONE year since I've been alive has Winter failed to turn into Spring.

Wouldn't it be great if you could make an Asymmetrical bet that Spring would come this year?

Well you can, stay with me, because this is where it gets good...

Markets are also highly cyclical.

The stock market, real estate, and even the price of wheat.

Some more than others.

When these markets are bombed out and no one is interested in them, that is their winter.

This is a great opportunity, because it is at this time that almost no one thinks that Spring will come!

This sets up large dis allocations in the market and creates a ton of- you guessed it, asymmetrical trades.

COMMODITIES

The most volatile of these cycles, and the one I've devoted a large portion of my own funds to are commodities.

This is a market that routinely gets bombed out for years and left for dead, followed by meteoric rises wherein the commodity will double or triple in a short time frame. Making it a perfect asymmetrical trade.

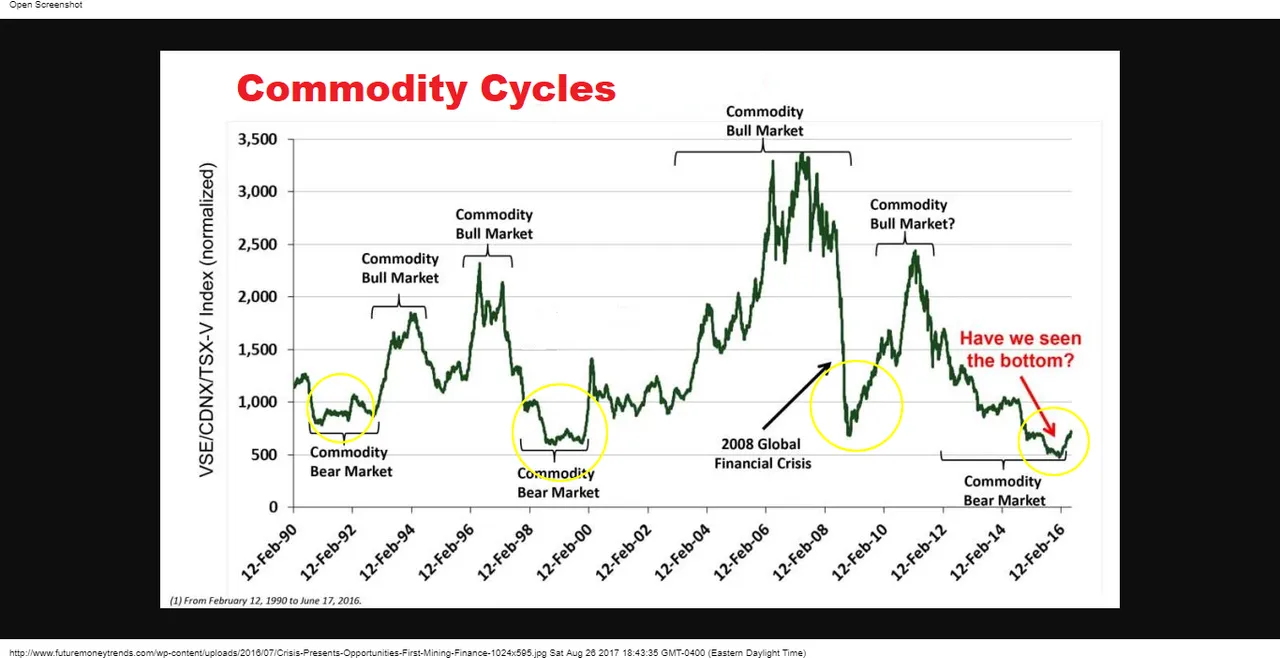

Take a look.

Something of value that's down 90% in real terms has limited down side risk, but HUGE upside potential!

The stocks that produce these commodities offer even MORE leverage.

It is not uncommon for these stocks to rise 3- 5 times as much as the commodity itself!

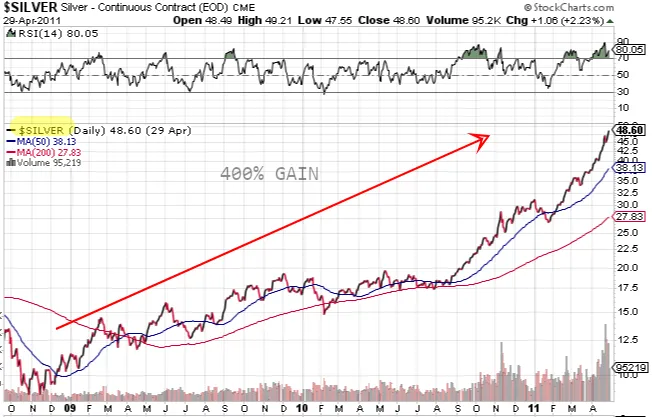

For example, off the 2008 lows Silver rose a stunning +400% in just over 2 years.

First Majestic, a primary Silver producer during that same time frame rose over +2000%!

As you can see, the equities offer massive leverage.

Looking back at the first chart, commodities are bombed out across the board, are destitute, have hit rock bottom and have been in the 'Winter' season if you will.

This is precisely the time you want to enter into this market, because I believe 2018 is going to see a big rebound across the board for commodities.

My personal top commodity picks that I'm invested in are: gold/ silver, uranium, copper, zinc, and vanadium.

Commodity Cycles are some of the most predictable gains you'll come across. If you're looking for an asymmetrical trade with limited down side risk, and enormous upside potential to the tune of 500%, 1000% or more this is the space you want to be in.

Happy Investing!

Until next time.

It's your move.

JESS

*This rant was brought to you by Olivia Newton John

Thanks for reading! If you enjoyed this rant, you might also enjoy some of my

Recent Articles:

5 Things You Need to Give Up If You Want to Be Successful

Death of the Petrodollar Imminent as China Moves to Undercut U.S. Hegemony

Top 10 Things that Change Once You Become Rich

Does Legendary Investor Jim Rogers Hold the Most Powerful Secret to Investment Success?

This Indicator has Predicted the last 7 U.S. Recessions. What's it saying now?