At the moment I’m in a position where I need to decide if I’m going to take a break for a few months from applying for credit cards, or if I shouldn’t. I feel like I haven’t put enough thought into this in the past, which is why I’m currently in this position.

At the beginning of the year I shared the 21 credit cards that I’m starting 2018 with, and in this post wanted to share the two paths I’m trying to decide between.

Should I get below 5/24?

Nowadays Chase generally has among the most compelling credit cards, and many of their cards have a “5/24 restriction,” where you can’t be approved if you’ve opened five or more new card accounts in the past 24 months. This doesn’t apply to all Chase cards, though.

Chase cards not subject to 5/24

<div>

<div>

<a href="http://oc.brcclx.com/t/?lid=26603468&tid=ipl">The Hyatt Credit Card</a>

</div>

<div>

40,000 Bonus Points </div>

</div>

</div>

</div><div> <div>

<div>

<a href="https://oc.brcclx.com/t/?lid=26649006&tid=ipl" title="IHG® Rewards Club Premier Credit Card">

<img src="https://jlk.news/wp-content/uploads/2018/05/fOlJfl.png" alt><br></a>

</div>

<div>

<div>

<a href="https://oc.brcclx.com/t/?lid=26649006&tid=ipl">IHG® Rewards Club Premier Credit Card</a>

</div>

<div>

10 points per $1 spent when you stay at an IHG hotel. </div>

</div>

</div>

</div><div> <div>

<div>

<a href="https://oc.brcclx.com/t/?lid=21894762&tid=ipl" title="British Airways Visa Signature® Card">

<img src="https://jlk.news/wp-content/uploads/2018/05/c3bVPz.png" alt><br></a>

</div>

<div>

<div>

<a href="https://oc.brcclx.com/t/?lid=21894762&tid=ipl">British Airways Visa Signature® Card</a>

</div>

<div>

Up to 100,000 Bonus Avios </div>

</div>

</div>

</div> </div>

</div>

</div>

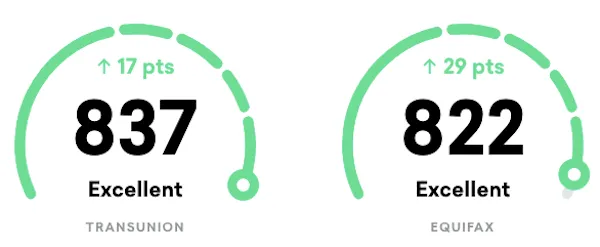

I just checked my CreditKarma account, and first of all I’m quite proud of my credit score.

Take that, people who say having lots of credit cards is bad for your credit score.

More importantly, I’m actually getting close to being under the 5/24 limit. Here’s the credit history for my most recent new card accounts (see this post for how to check your 5/24 score):

As you can see, in about 4-5 months I should be at the point where I’m only showing four new card accounts on my personal credit report within the past 24 months.

The thing is, there are some cards I really want to apply for right now, and I can’t decide if I should first get under the 5/24 limit, or if it’s not worth the opportunity cost to wait.

Let’s look at both sides of this.

The reason I want to get under 5/24

Why do I want to get under the 5/24 limit? Specifically because there are three cards that I really want, not just for the great welcome bonuses, but because I’d get a lot of value out of them long term:

The $95 annual fee Ink Business Preferred℠ Credit Card:

- Offers a welcome bonus of 80,000 points after spending $5,000 within three months

- Offers 3x points on the first $150,000 of combined purchases per cardmember year on travel, shipping purchases, internet, cable, and phone services, and advertising purchases made with social media sites and search engines

- Has an incredible cell phone protection plan that I’d get a lot of value out of

The no annual fee Ink Business UnlimitedSM Credit Card:

- Offers a welcome bonus of 50,000 points after spending $3,000 within three months

- Offers 1.5x points on all purchases

The $95 annual fee Marriott Rewards® Premier Plus Credit Card:

- Offers a welcome bonus of 100,000 Marriott Rewards points after spending $5,000 within three months

- Offers an anniversary free night award valid at a property retailing for up to 35,000 points per night

Just by getting to “4/24” I could pick up all three of these cards. That’s because while the two business cards are subjected to the 5/24 restriction, applying for them doesn’t actually qualify as a further inquiry towards that limit. So I could pick up the two Ink Cards and then the Marriott Card.

Cards I’m missing out on if I wait

In order to get below the 5/24 limit, I wouldn’t be able to apply for any personal credit cards in the next 4-5 months, so I’d be missing out on quite a few new cards that I’m interested in. Most notably:

The $89 annual fee IHG® Rewards Club Premier Credit Card:

- Offers a welcome bonus of 80,000 IHG Rewards Club points after spending $2,000 within three months

- Offers an anniversary free night award valid at a property retailing for up to 40,000 points per night, so this is a card I’d hold onto long term

- Offers a fourth night free on award redemptions, which would get me significant value

The $95 annual fee (waived the first year) Citi ThankYou® Premier Card:

- Offers a welcome bonus of 50,000 Citi ThankYou points after spending $4,000 within the first three months

- Offers 3x points on travel and gas, and 2x points on dining and entertainment

The card I can get either way

The one credit card that I plan to apply for either way in the coming days is the CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®, which is offering a welcome bonus of 70,000 AAdvantage miles after spending $4,000 within the first four months, with the $95 annual fee waived for the first year.

Why can I get this either way? Because applying for a Citi business card doesn’t count towards the 5/24 limit, so getting this has no bearing on when I’d actually fall under 5/24.

Amex cards that are somewhre in the middle

Somewhat related to this is my general American Express credit card situation. Amex limits you to having five credit cards (regardless of whether they’re personal or business), and that excludes charge cards. I’m maxed out on American Express cards, as I have the following:

- Hilton Honors Ascend Card

- The Blue Business℠ Plus Credit Card from American Express

- The Amex EveryDay® Preferred Credit Card from American Express

- Starwood Preferred Guest® Credit Card from American Express

- Starwood Preferred Guest® Business Credit Card from American Express

I get value from each of those cards, and am generally tempted to keep them. However, there are some other Amex cards I’d eventually like to get:

- The $95 annual fee Hilton Honors American Express Business Card is offering a welcome bonus of 125,000 Honors bonus points after spending $5,000 within four months; applying for this card wouldn’t count towards 5/24, so in theory I could apply soon, but I am maxed out on Amex Cards, so…

- The $450 annual fee Hilton Aspire Card offers Hilton Honors Diamond status, a $250 annual airline fee credit, a $250 Hilton resort credit, and more

- The $450 annual fee SPG Amex Luxury Card is being introduced in August, and will offer a $300 statement credit for Marriott/Starwood purchases every year, an anniversary free night certificate valid at a property costing up to 50,000 points per night, and much more

I think eventually I’ll probably cancel the two old SPG Amex Cards, and instead get the new premium Hilton and Starwood Cards.

Bottom line

People ask me all the time whether they should hold off on getting new cards so they can get under 5/24, or if they should go ahead and apply now, and forget about it. The truth is that I’m as indecisive as the rest of you.

There’s always a tradeoff here, and that’s something I’m experiencing personally right now, given that credit cards keep getting more compelling. Personally I’m leaning towards holding off five months so that I can hopefully get the Ink Business Preferred℠ Credit Card, Ink Business UnlimitedSM Credit Card, and Marriott Rewards® Premier Plus Credit Card. Those are all cards I’d get a lot of long term value out of.

However, that means I may miss out on several good offers in the meantime, which is never fun.

One thing is for sure — I need to make up my mind, because I feel like the past couple of years I’ve been going back and forth, and then I end up applying for a card here and there. That’s why I’m almost always just above the 5/24 limit.

What would you do?

Posted from my blog with SteemPress : https://jlk.news/uncategorized/deciding-on-a-5-24-credit-card-strategy