Digital? Yes. Blockchain? Not quite. Innovation? Let’s talk.

This week, Luxembourg made headlines for issuing €50M in digital treasury certificates on “blockchain.”

The Finance Minister called it a “textbook case of sovereign digital finance.” The media called it “historic.”

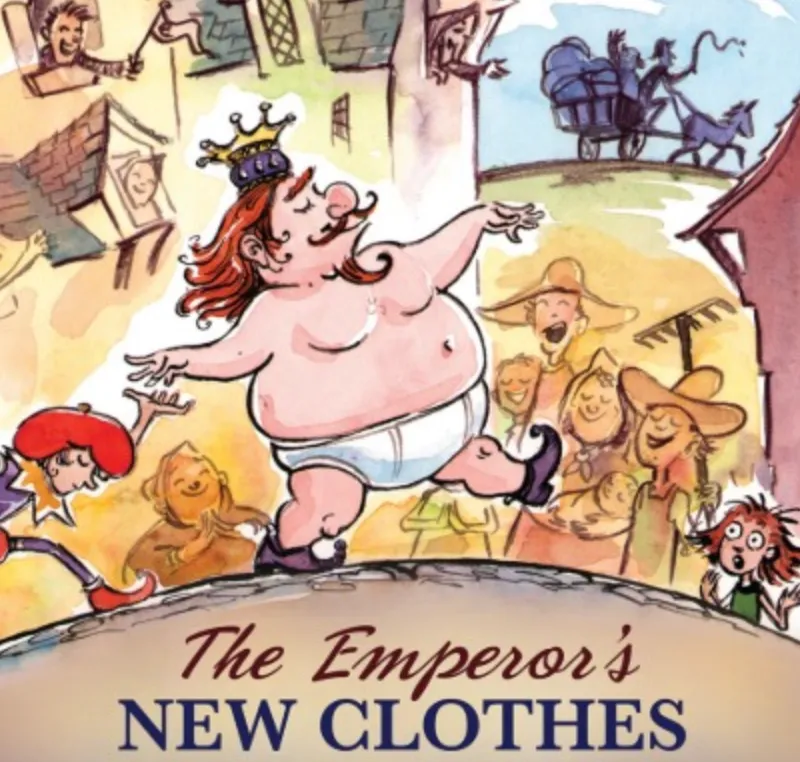

But let’s be honest. The Emperor is naked.

What actually happened?

- €50M in short-term debt was issued (just 0.2% of national debt)

- Not listed, not public, not on a public blockchain

- Issued on HSBC’s private ‘Orion’ blockchain, with HSBC as gatekeeper

In short? A digital mirror of TradFi, impressive legally and technically, but no decentralization, no openness, no real innovation.

Why does this matter? Because it’s a classic playbook: Embrace. Extend. Extinguish.

Embrace the language (blockchain! transparency! tokens!)

Extend inside walled gardens with private infrastructure

Extinguish real innovation by blocking open alternatives while looking “modern”

To give some context, is a phrase that the U.S. Department of Justice found was used internally by Microsoft to describe its strategy for entering product categories involving widely used open standards, extending those standards with proprietary capabilities, and using the differences to strongly disadvantage its competitors.

A good PR move, reinforced by regulation.

Meanwhile:

- EUR stablecoins are suppressed

- MiCA limits programmable finance

- Open systems are sidelined in favor of “safe,” state-approved sandboxes

The goal? Prevent real euro-denominated, on-chain infrastructure from emerging, because who wants something that is, public, DeFi-composable, startup-friendly, interoperable and most of all... out of centralized control?

Here’s the real issue:

Instead of leading, Luxembourg is spending time and capital on symbolic pilots that don’t scale and don’t integrate with the future of finance.

But it doesn’t have to be this way.

Luxembourg has the legal framework. It has the tech capability. It could lead Europe in issuing open, programmable euro assets on public blockchains.

We’re not here to throw stones. We’re here to inform, challenge, and push for what’s possible.

Because if we keep confusing insulation “innovation”, we risk missing the very opportunity Europe says it wants.

Let’s build systems that are open, transparent, interoperable and citizen-first.

The future of finance is already on-chain.

Will Europe join? Or keep watching from behind closed doors, as it often does?

Let’s be honest. Letz OffChain. 🧡