Aug 7 Investment Moves as of 11:30 am (EST)

- Portfolio Value $321K (1 Year view)

- Aug 7 Investment moves as of 11:30 am (EST)

- Moving the DELTA up from under .10 to under .20

- Pokemon Products

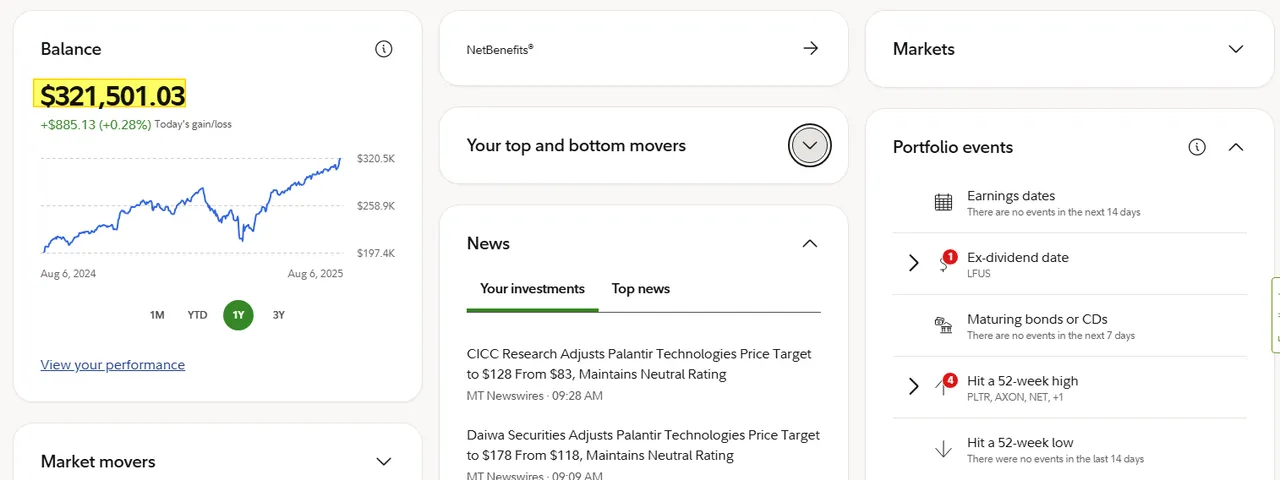

Portfolio Value $321K (1 Year view)

A look at this 1-year view from under $200K a year ago to over $320K now. This is two accounts with this single brokerage (a "brokeragelink account and active 401K plan").

The #401K gets about 7K-8K of new capital per year. I'm not someone who "maxes" out their 401K each year and wonder why everyone is BROKE. My accounts and income align more with my US-based readers.

#PLTR and #AXON are some of the reasons why my account is doing so well. A few good investments that I made 3-4 years ago are things that are impacting the portfolio today.

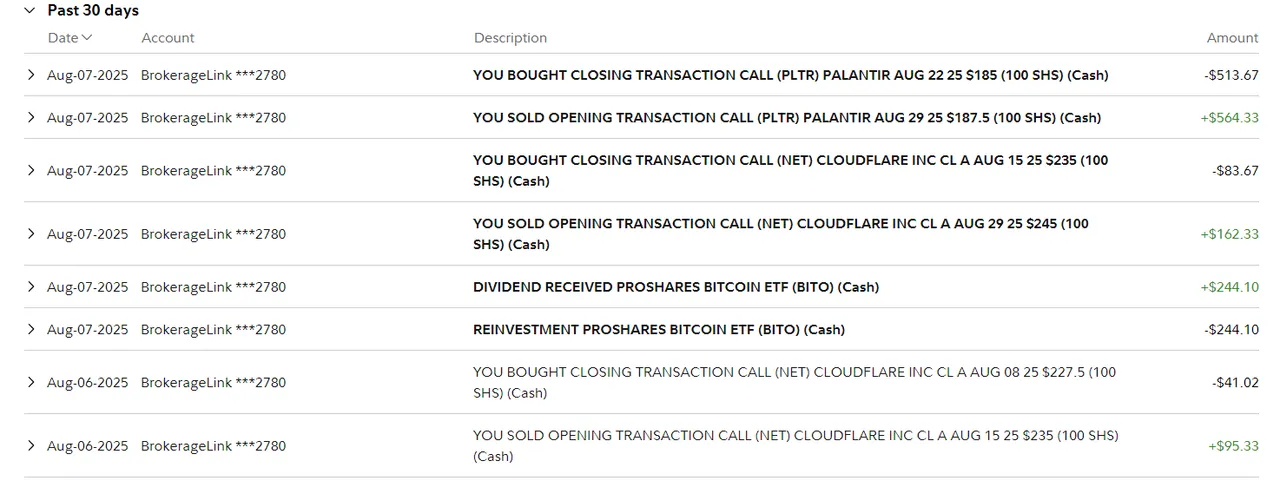

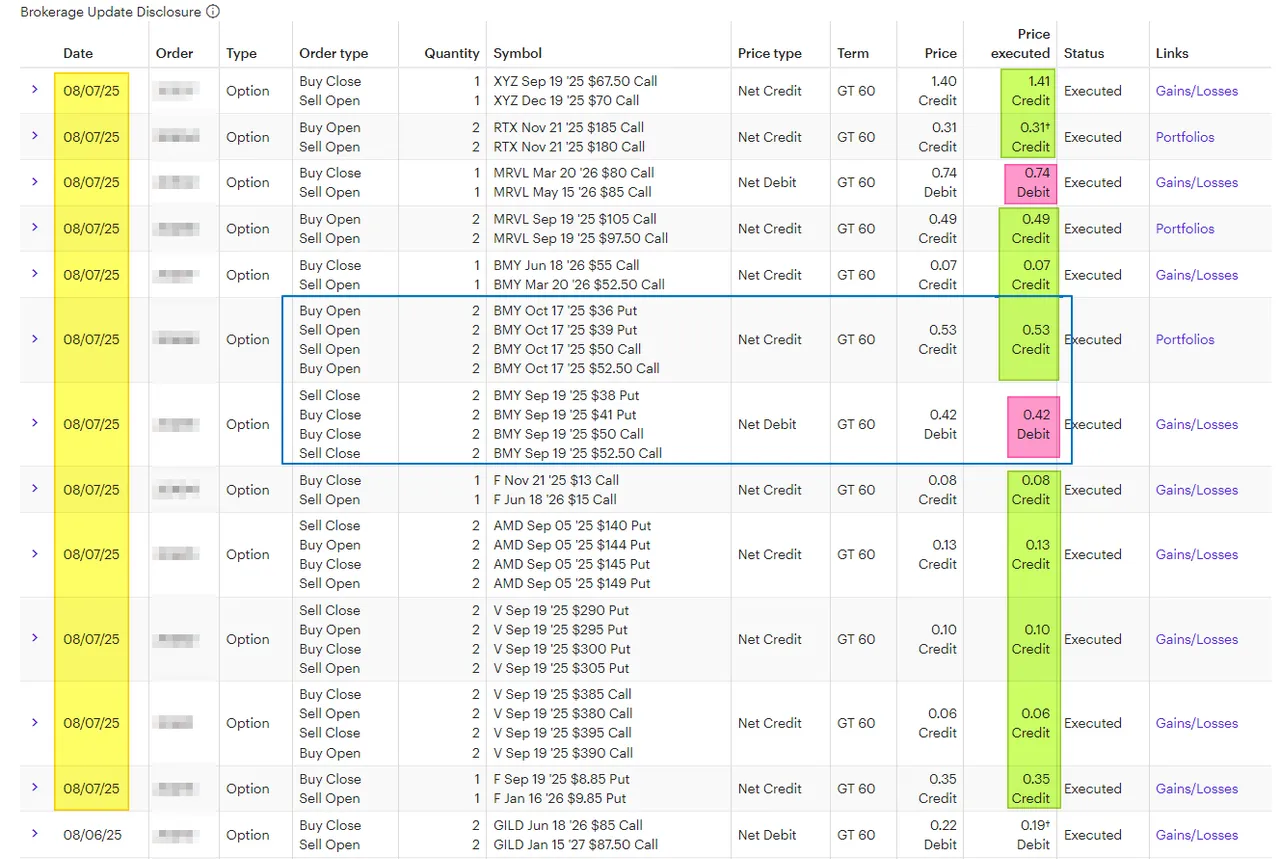

Aug 7 Investment moves as of 11:30 am (EST)

These are my option trades (most of them are "rolling of options" so you can see the #closing and #opening of the new position.

Here is the first set:

Here is the next set from a different account:

I closed the BMY #ironcondor for Sept 2025 and opened a new one for Oct 2025. I added risk to my Visa Iron Condor based on the delta. Adjusted where I needed to.

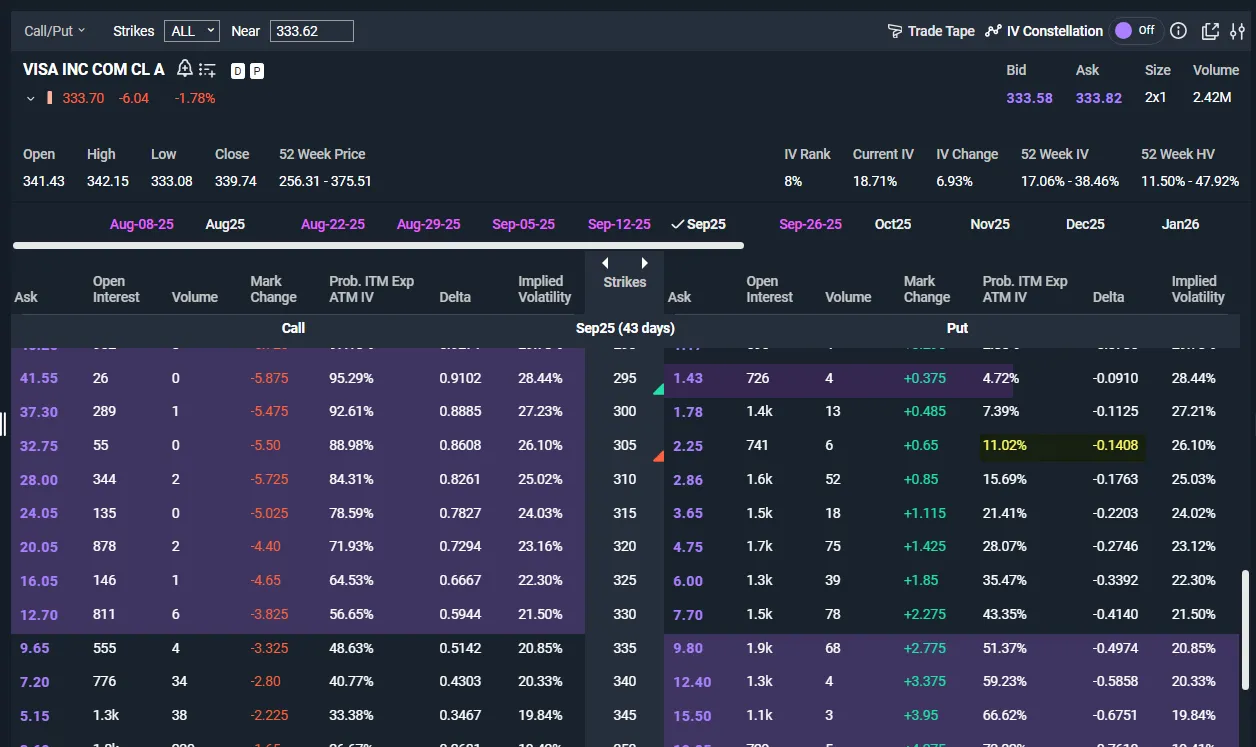

Moving the DELTA up from under .10 to under .20

A few days ago, I shared some changes I’m planning to implement in 2026. One major shift involves increasing the level of risk I take by moving from trades with a delta of 10 or lower to those with a delta between 0.11 and 0.20. Today, I started testing that strategy to get comfortable with the new approach.

Playing it safe has helped me win more consistently, but the trade-off is lower profit per trade, which directly affects my ROI. That’s one reason my returns may appear smaller compared to other traders.

Looking ahead, I expect my profits to grow by 50% to 100% compared to what I’ve earned over the past three years. The logic is simple: safer trades typically yield smaller premiums — often in the $0.05 to $0.15 range per contract. When I hold these positions until time decay kicks in, I can usually close them with $0.02 to $0.07 remaining.

Of course, these are averages. Some tickers like Visa tend to offer higher premiums, while others like Ford offer less. With the new strategy, I anticipate seeing premiums in the $0.09 to $0.30 range per contract.

I’ll be sharing more insights in the coming weeks as I gather data and can walk through a real-life example to illustrate how this shift plays out.

Visa:

Pokemon Products

Adding more products to my collection

Have a profitable day!