For the past 10 years, I have studied the art of trading penny stocks, and over the years I have paid for my education through losing, as well as profiting heavily. In order to be successful trader my first and most important piece of advice is any time that you find a ticker that you may like, the first thing that you need to do is read the filings.

Make the following website http://www.otcmarkets.com/home your bible for researching penny stocks.

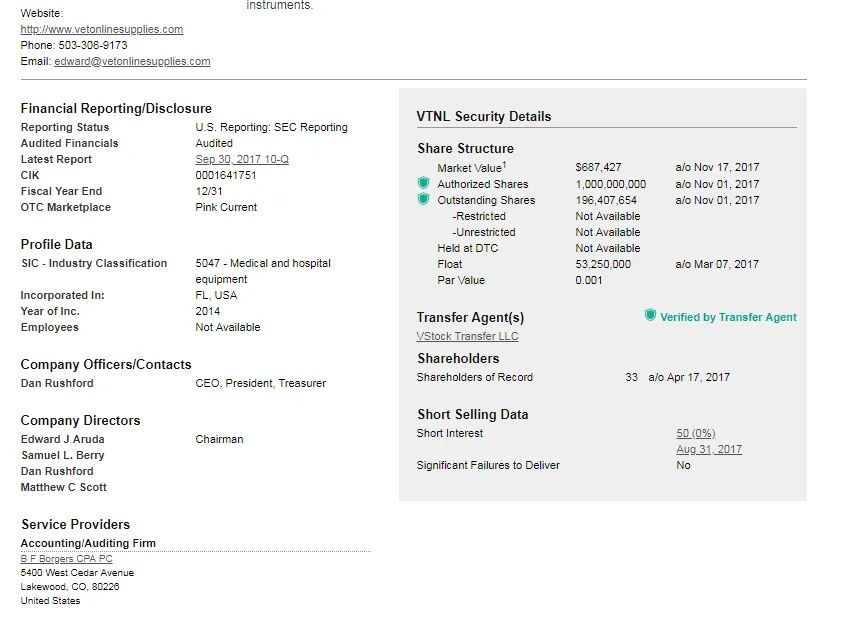

This is going to be the most important resource for information that one can need. All you need to do now is input the ticker into the search box allowing you to view the company that you may be interested ins profile. The first thing that I look for is the current status of the company. For example, Pink, QB, Pink Limited, Stop Signs, these are all tiers of reporting standards that can quickly tell you what kind of shape that the company may be in. I will go into further details on reporting standards in a future post.

The next item I look for is a copy of the most recent 10q filing, This is going to disclose pertinent information about the way that the debt is structured, who has shares to be sold into the market aka dilution. Also you can view any convertible notes, along with the dates that they will come due. The due dates along with the conversion rate and discount is the most important thing that I look for whenever I am looking at a penny stock. When you can calculate the amount of shares coming into the market you can essentially predict when the direction of the stock will go up or down. in my next post I will show more examples of how the calculations work in order to determine the dilution rate as well as how this translates onto a chart.