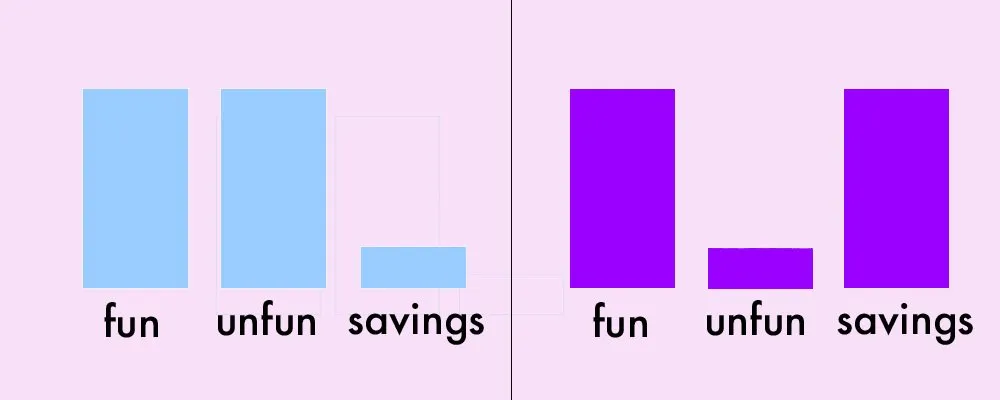

Personal finance is often framed as a trade-off. You have to balance three elements: Fun Spending, Unfun Spending (i.e. bills and boring shit), and Saving.

I just realized I'm at full unibrow status right now lol

Fun Spending, or “Guilt-Free Money” as I think of it (hat tip to Ramit), is exactly what it sounds like: Spending for fun. A new video game, that $25/pound fancy cheese, concert tickets, whatever.

Unfun Spending is spending money on necessary or helpful things that aren’t exciting to buy. The most obvious is paying rent / bills. I count basic groceries and home goods (like paper towels) all in this category too.

Saving is pretty obvious. I include investing and debt payments in this category - anything where you put money in a place that improves your long-term financial prospects.

Usually this is a “Pick two out of three” scenario. Or for me in a lot of 2017 a “Pick one out of three, motherfucker” kind of scenario lol. Here are two examples:

This is ok as long as you have two out of three covered, and you basically oscillate between paying for fun things OR putting away money into savings. The “Unfun” category in theory should never be sacrificed.

But then this happened:

and with Steem prices so high, now I feel like this:

It’s crazy. I can go to the coffeeshop and get some breakfast without even thinking twice. Today it was a corned beef + spinach + swiss cheese omelette with an Americano, it was fuckin delicious.

Meanwhile I am stashing 50% of my income into my tax account and my debt payments. Which feels pretty responsible to me.

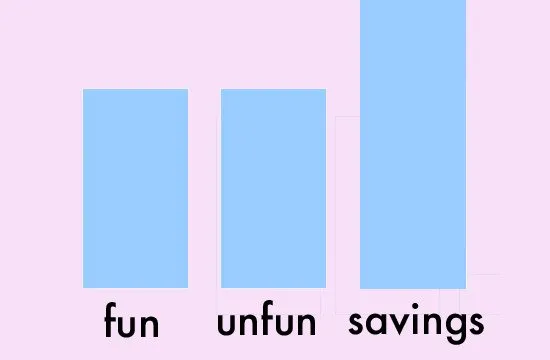

Somehow many people make huge mistakes when they start earning more money… they spend all of it. Their pattern looks like this:

As crazy as this seems, I can understand it. When you experience a drastic increase in income, it’s easy to let it fall through your fingers. Your bank account feels fat and without a financial system in place, the money is real easy to spend in stupid ways.

It’s like having a fridge full of chocolate cake when you want to lose weight… and you’ve never heard of a diet.

Luckily I’ve heard the “lottery winner goes broke” story too many times, so I’m being proactive to stash my money in the right places. And with the current Steem boom, it just isn’t that hard.

I guess the lesson for this post is twofold:

(1) If you are holding Steem/SBD right now, it’s smart to think about guaranteeing some long-term value. What can you do this week to ensure you are better off for the future, even if Steem freakishly crashes back down to $1? Mitigate that risk IMO.

(2) Remember that lottery winners go broke all the time. And in the case of something less extreme than the lottery - like a pay raise, or a modest cash windfall - it’s really really easy to go through that money without capturing any longer-term benefits. When the day comes where you experience some financial abundance… SAVE!!!

OK, here’s the numbers for today:

Personal Finance Update

ASSETS:

Checking Account #1 (Bills/Rent): $500

Checking Account #2 (Day-to-day spending): $368

Checking Account #3 (BTC Debit Card Wallet): $10

Savings/Tax Account #1: $600

Steem Liquid Wallet: 10 steem + 11 SBD = USD $150

Steem Power: 1,724 SP // $11,206

Total Assets: $12,834

DEBTS:

Money Owed to my Dad: $10,208

PayPal Credit: $5,798

Chase Credit: $0 <— PAID OFF

Short Term Steem Loan: $225

Total Debts: -$16,231

NET WORTH AS OF TODAY: -$3,397

LAST WEEK: -$5,480

NET CHANGE: +$2,083

🚨🚨🚨 We’re getting awfully close to net worth $0 now 🚨🚨🚨

Final Thoughts

2018 is off to a great start. At this point there is absolutely no telling what comes next. Buckle your seatbelts and get ready for some volatility - I feel us heading straight towards $50 steems, or maybe towards $0.50 steems… can’t tell… lol

Whatever happens, let’s all continue to focus on gratitude as we earn increased rewards at the moment. Steem on, pals.