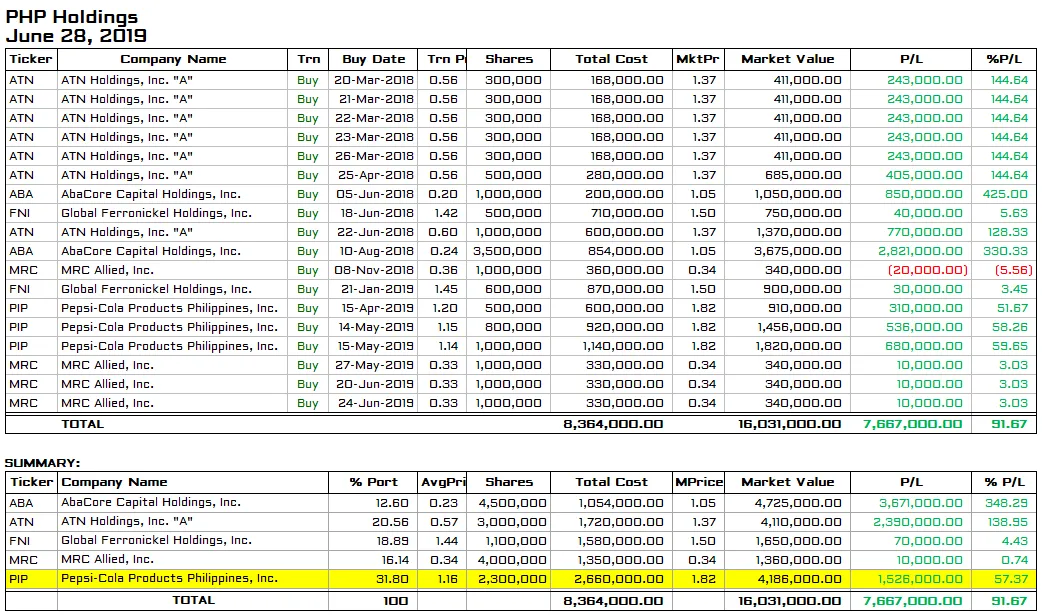

As I said earlier, I sold my previous stocks asset class (portfolio) in exchange for real properties. Since then, I’m in the process of reallocating and rebalancing my portfolio once again. As of today, Pepsi-Cola Products Philippines, Inc. (PIP) is 31.80% of my most recent stocks portfolio.

Why PIP?

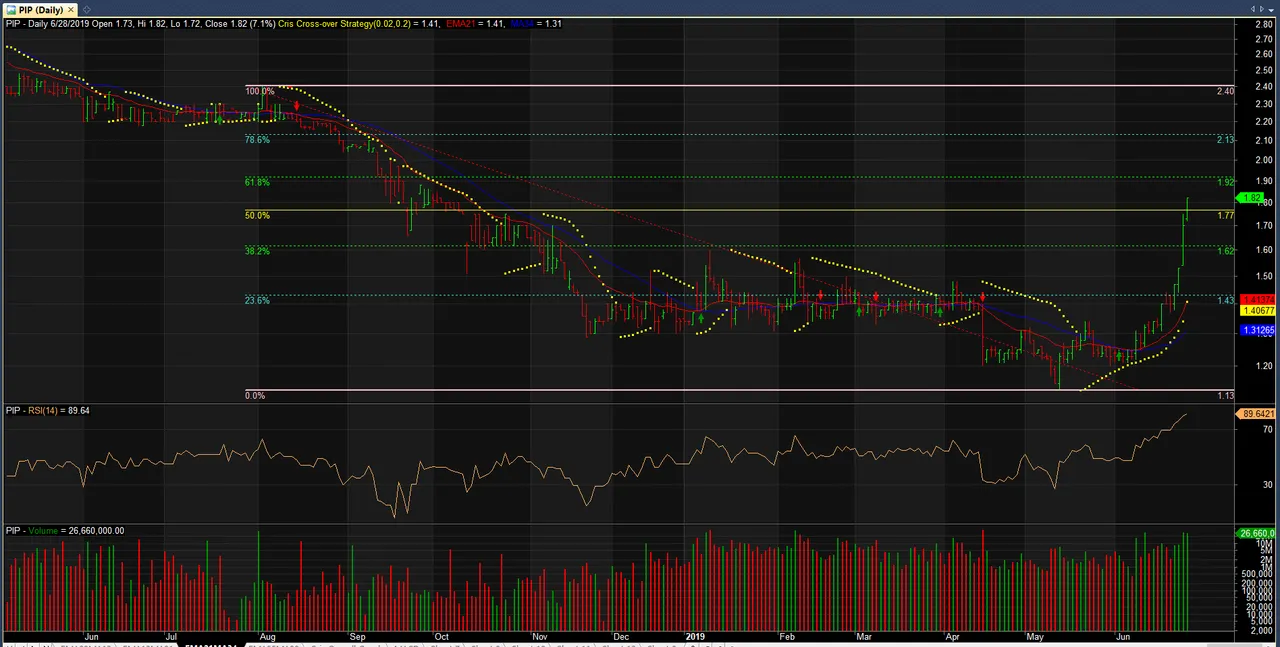

I believed consumer stocks are sustainable for long-term investment. Technically, on June 4, 2019 my buy signal indicator confirmed that 1.13 price on May 15, 2019 is the most current support for PIP, which re-affirmed by EMA 21 crossed MA 34 on June 10, 2019.

Today, we just surpassed the 50% Fibonacci which for me signaled a bullish territory. If 61.8% Fibonacci will be broken up in the next two weeks then the resistance of 2.40 can easily be achieved. Otherwise, a sideways pattern is to be expected in the near mid-term as PIP fundamentally edged up a bit only in 1Q19 compared the same period last year.

Please upvote and follow me on https://steemit.com/@php-ph.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of this security.