Week 8 - Feb 17 President's Day (Markets Closed)

- What do I do when markets are closed?

- Gaming (NFT) earnings for Feb 2025

- Dividends for week 8 forecast $97.

- Investments into non-traditional assets

What do I do when markets are closed?

Today several things are closed in the USA, with the STOCK markets being the one I'm talking about. Normally I would be trading and creating a POST telling you what moves I did on Feb 17, 2025.

Since the Stock Market is closed, I will look for something else I can talk about for today.

The markets ended Friday with a split RED and GREEN depending on which index you prefer. Weekly gain is nice when looking at 5-day trends.

No Dividend.

No Option Trading today.

No Selling of Assets today.

We just have to wait until tomorrow.

Gaming (NFT) earnings for Feb 2025

I play several NFT games and don't talk much about "earnings" because it is not as good as I would think it could be.

@Splinterlands is a game I have been playing for over 3 years with hundreds of dollars invested. However, up to this point, my assets have dropped in value. This is the same experience I had with other projects before it.

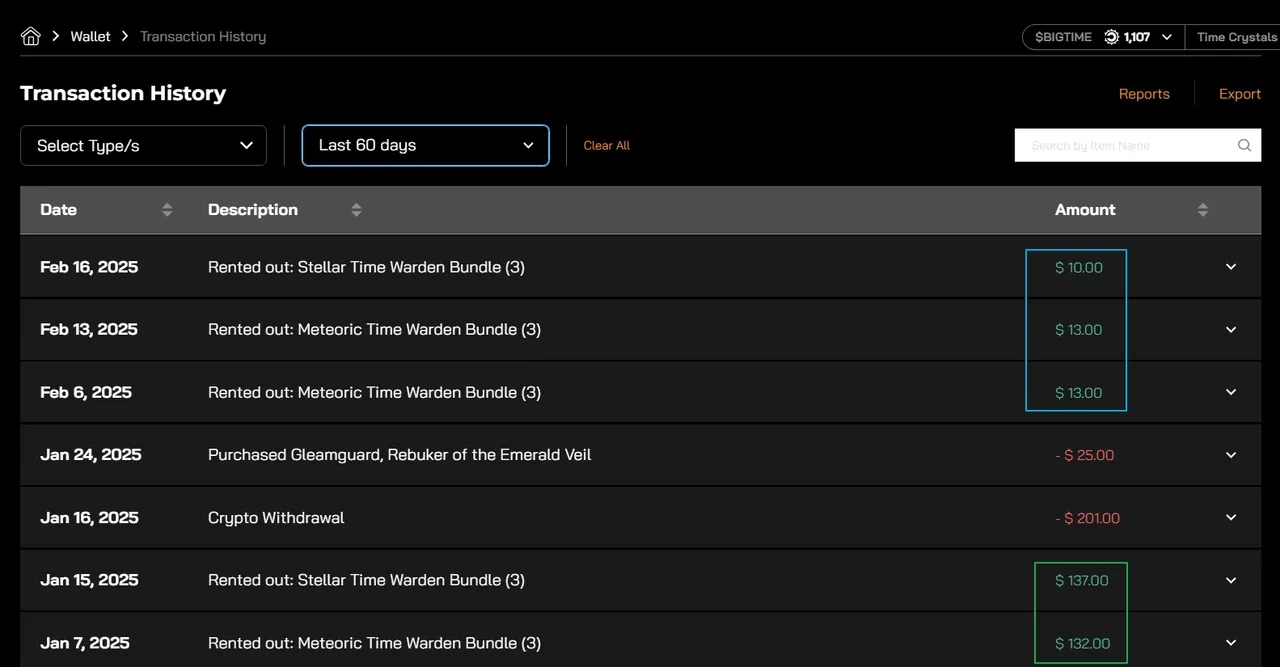

@bigtime is a game I have played for the last year and so far, my #play2earn experience is slightly better. The rental system here appears to be OK, with the ability for some "returns" to be made.

The last couple of weeks have turned downward and my rental in FEB might only make me $50-$80, much lower than the $200+ I got 4 weeks ago. I also know that prices will move up and down and that is normal for this type of investment. The risks are much higher and it should not SURPRISE you when making these types of investment moves.

This will impact how much BITCOIN I will purchase in Feb 2025. I might only purchase $50 based on what I expected to make from my RENTALS from NFT gaming. However, I only collected $36 in rentals so far, so I might need to wait for next week before I make the purchase.

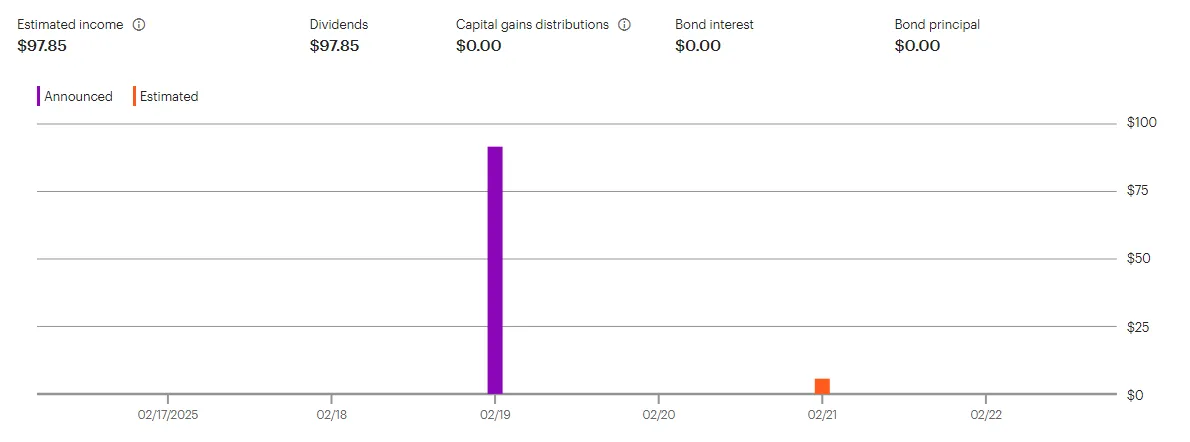

Dividends for week 8 forecast $97.

This week's dividend is expected to be at $97! I will have to wait until MARCH before the BIG dividends start to roll in.

Investments into non-traditional assets

I have your standard asset type (stock, bonds (including Series EE), CD, real estate, etc). Part of investing is to diversify into other non-correlated assets to reduce some risk.

Here are some of those assets:

- Gold/silver

- Stamps / Coins / etc.

- Watches / Art / etc.

- Baseball cards and TCG (Pokemon/Magic)

- Bitcoin/ ETH

- NFT.

Currently, I have NFT in at least 3 different GAMES right now. I have Bitcoin and Ether and I'm looking to add more to those holdings since I think I have too little allocated to those asset types.

The next step is to look into Pokemon cards again. When my college-age son was a little kid, we went to the local library to play the trading card game with other kids. After a year or so, we stopped doing it. I never tossed away any of the cards and I think some of those cards may have some value.

The one thing I like is the "collecting" and finding things in the wild. Pokemon cards have always been random luck with getting the "CHASE" cards.

As a beginner, I most likely will start by buying a "SEAL" Elite Training Box for their promo and holding for 2-3 years before selling. I'm looking for mostly a passive way to grow my collection of Pokemon Assets and my first SEAL box will come today.

What next?

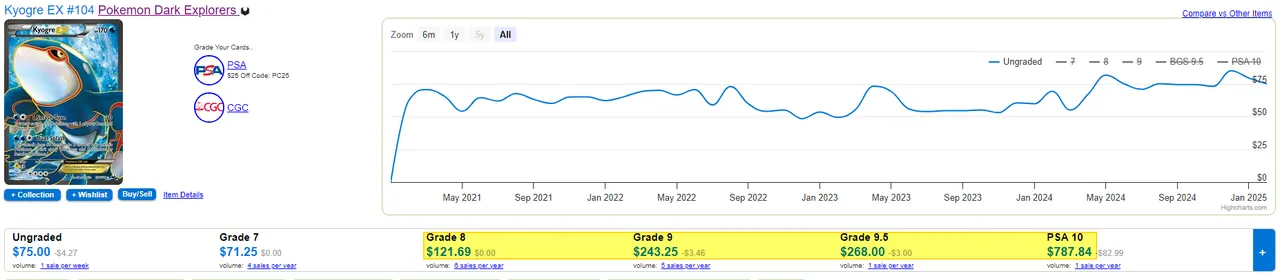

The next step is to learn how to SORT and group all my cards by YEAR/SET. I need to learn how to pre-grade and understand the condition of my cards (Mint , LP, MP, HP, damaged). I believe the last step is to pick only the top 5 or 10 cards in my collection and SEND that out for PSA grading. Grading can cost $20 each, so I need to only grade cards that are worth more than $50 raw and with the chance of the card being worth 3x more after grading.

For example, I happen to have a full art card from a decade ago:

This card is about $75 today but can be worth between $120-$250. If the card is a PSA 10, it can be worth over $750 for that card.

An example of how this Hobby can be expensive is when I grade a card like this (I don't have it):

A $9 card might only come back as a $8.50 card (PSA-8) or a $23 card (PSA-9). Don't forget that it costs about $20 to grade and it costs money to buy the PACKS or CARDS to begin with. This can be unprofitable as you can spend more than the cost is worth only to get a slab card that is worth less than the money for the grading service.

Part of what I have to learn is to stick to the passive nature of SEAL products. Making 2x and 3x is all I need to keep the "flow of money" working. I need to sell the items so I can lock in the profits and then REPEAT the process over again. I will get my first box that I purchased for $40 today. I might have to hold it for 2 or 3 years before I can sell it for $80-90.

Have a profitable day!

Solving Chaos!