A future when we need more babies to sustain economic growth. I made a post about the Future Philippine Problem: Underpopulation covering the problem at the surface level. While I was doing some hobby reading at investing in the property sector (real estate) I came across ideas of how demographics affects real estate value. I'm no financial expert and just happen to enjoy studying macroeconomics and financial literacy so it should be understood that nothing in this post should be taken as financial advice.

The short answer:

You need people present to rent your real estate properties or employ them for your business. Now imagine a decreasing workforce with the limited pool of qualified candidates for the job. With a shift to the aging population, more financial burden is pushed to the a working age group to sustain the economy (for taxes) and these taxes will be used to fund existing programs AND pensions. People living longer means incurring long term costs for the government and everyone else able to work. Our taxes fund a retiree's health care benefits and this is a population that isn't expected to contribute less to the economic productivity. Below are just nice trivia I found out while researching on the subject.

A projected decline in population isn't exclusive to the Philippines, it's happening at a global scale. There was a time when overpopulation became a projected threat back in the early 90's so policies were made to reduce the risk but this comes at the cost of decreasing future manpower to fuel economic growth. You've probably seen news about Japan and South Korea implementing desperate measures to grow their population.

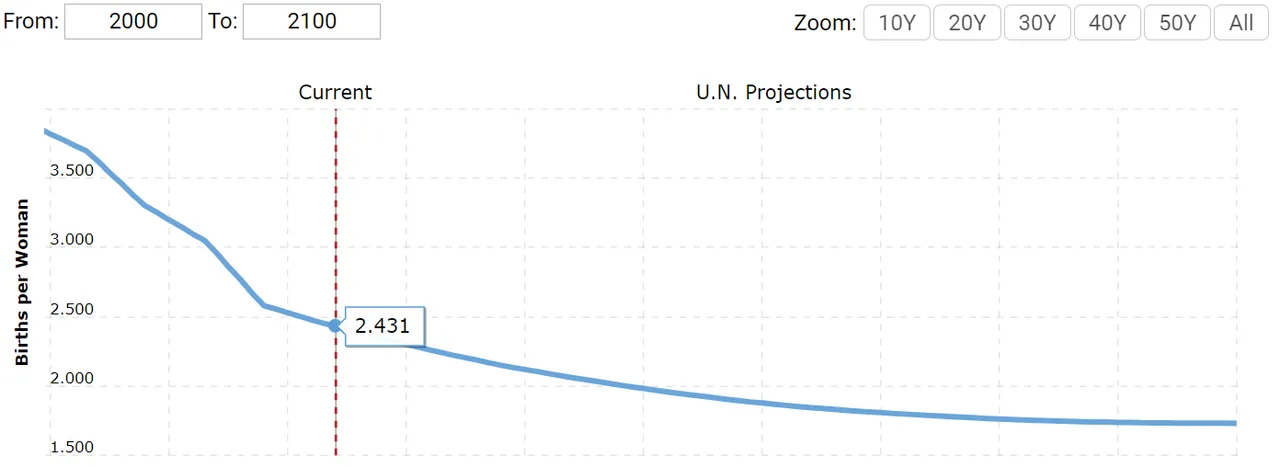

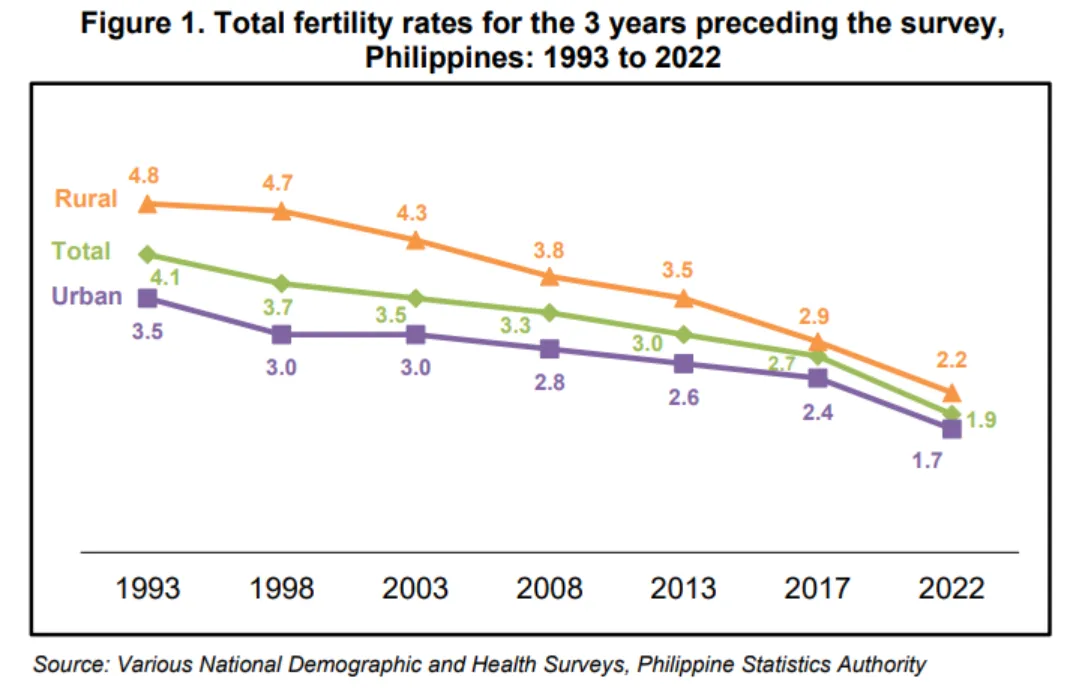

It depends which source you're getting the data from regarding the fertility rate of the Philippines (PH) but all that I've seen so far are in agreement that there is an existing decline in trend and future projections show a continuation of this trend long term.

So why does the drop in fertility rate seem like a non-existent problem from our everyday life? well, it's not like everyone is managing a country through policies for the long term or their job is to monitor population statistics and economy. The vast majority of normal people would just continue to live until these lack of manpower to sustain their lifestyle becomes noticeable to unbearable.

In this article, Fertility responses to individual and contextual unemployment: Differences by socioeconomic background by Wei-hsin Yu and Shengwei Sun show:

The analysis indicates that relatively disadvantaged young adults, such as those with low education or parents with low education, tend to delay childbirth in response to high local unemployment rates but are less likely than the more advantaged to defer childbearing when facing their own unemployment.

Study points to fertility as a leading economic indicator by Kasey Buckles, Daniel Hungerman and Steven Lugauer:

“Once you examine monthly or quarterly data, the pattern becomes obvious,” Hungerman says. “We show the existence and magnitude of this pattern before the Great Recession, and it’s striking since that recession was famously hard to predict. None of the experts saw it coming, and in its first few months, many business leaders were convinced the economy was doing OK — even as the number of conceptions plummeted and had been falling for a while. -source

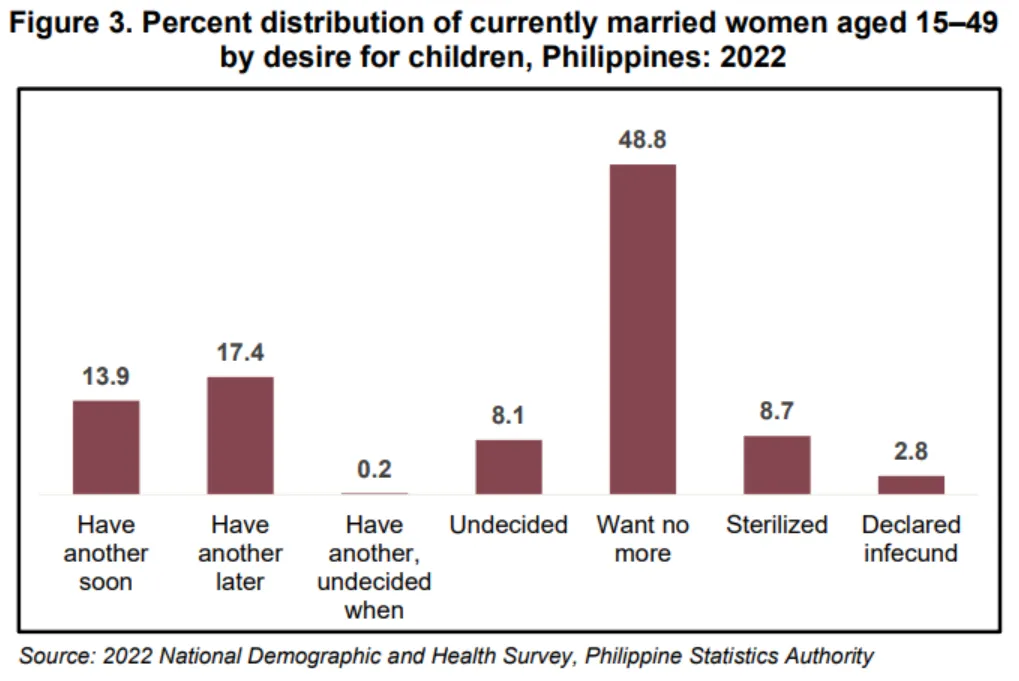

I've summed up all the studies above with a thought that a decline in interest at making babies is an early sign that the economy isn't doing well because people are unwilling to shoulder the economic burden to support a family financially.

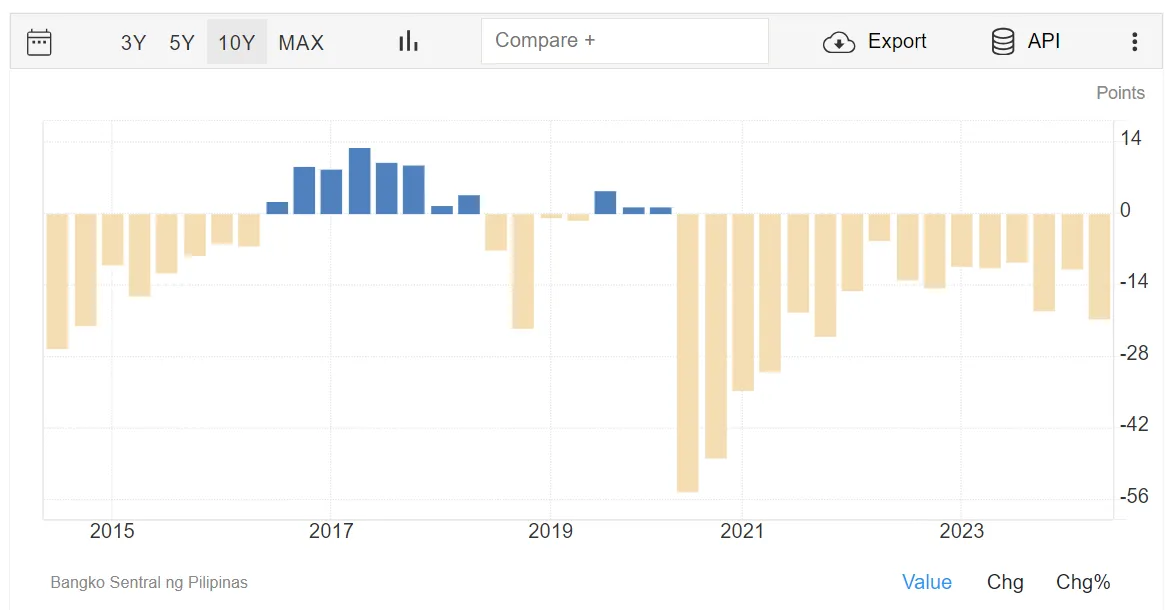

This is a 10 year view of the Philippine consumer confidence.

primarily driven by concerns over a faster rise in the cost of goods, higher household expenses, reduced income, fewer available jobs, and doubts about the effectiveness of government policies and programs related to inflation management, traffic and public transportation, financial assistance, and labor and employment.

This has been in the negative in the 10 year period and it trends parallel to the decline in fertility rate

Projected by the UN and Philippine Statistics Authority, respectively.

Real estate is still an area where great value can be generated whether there is a rising or declining economy but this largely depends on what properties one is putting their money on and location, location, location. There would still be people that would opt to rent because they can't afford their own place and small business start ups looking for spaces during recessions. I've been looking into Real Estate Investment Trust Funds as an alternative.

Given that population decline is a global problem, well developed countries have increased their efforts to remedy the problem by introducing policies to ease migration. Even if the Philippines can somehow sustain a healthy replacement level of fertility rate, if the economic conditions are not favorable, people will just seek opportunities abroad and supply the labor there.

Thanks for your time.