Delta neutral trading is a strategy in which a trader aims to offset the price risk of an underlying asset by taking an equal and opposite position in a derivative security, such as options. This can be a useful strategy for traders who want to speculate on the direction of an underlying asset without being exposed to the full price risk of the asset.

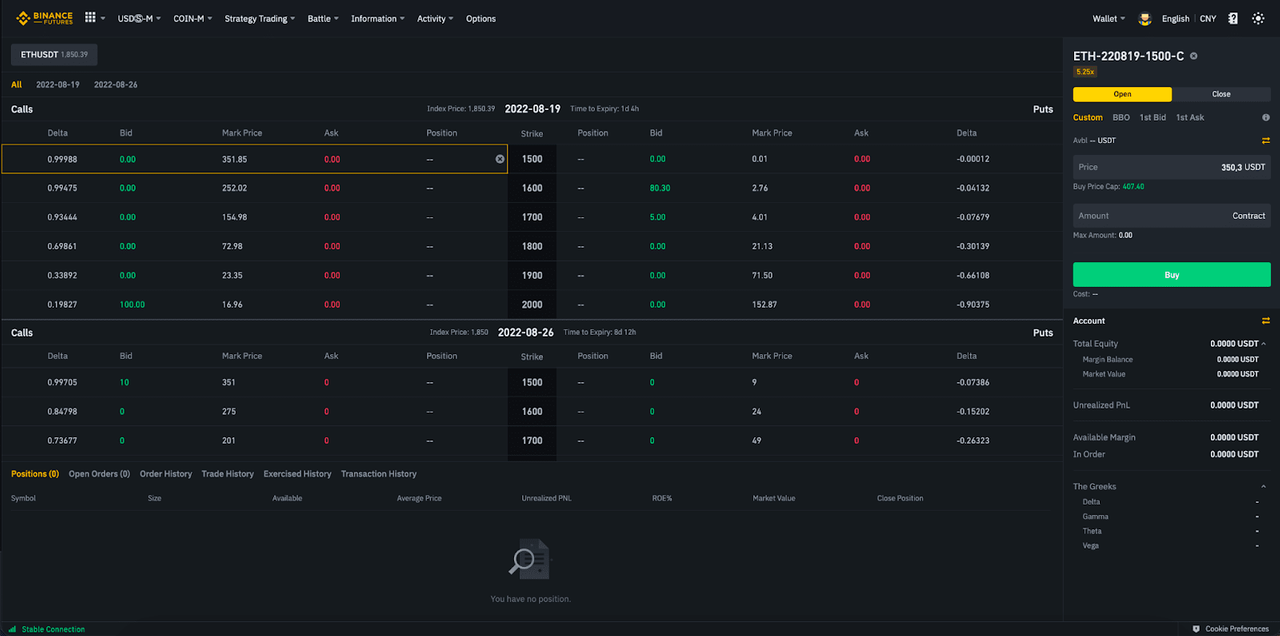

One way to implement a delta neutral trading strategy on Binance is by using options. Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a certain date. By buying and selling options in such a way that the net delta of the positions is zero, a trader can achieve a delta neutral position.

Here's an example of how a trader could use options to implement a delta neutral strategy on Binance if the price of Bitcoin (BTC) is currently $16,500:

Identify the underlying asset: The trader has chosen BTC as the underlying asset for their delta neutral position.

Determine the target delta: The trader has decided to target a delta of zero for their position.

Select the options: The trader could achieve a delta of zero by buying one call option with a delta of +0.5 and selling one call option with a delta of -0.5. Let's assume the trader has chosen the following options:

- Buy 1 BTC $17,500 call option with a delta of +0.5 and a premium of $500

- Sell 1 BTC $16,500 call option with a delta of -0.5 and a premium of $400

- Execute the trade: The trader can then execute the trade on a cryptocurrency exchange or through a broker.

After executing the trade, the trader will have a delta neutral position in BTC. This means that their overall position will be less sensitive to changes in the price of BTC, as the price risk has been offset by the opposing positions in the options. However, it's important to keep in mind that the trader will still be exposed to other risks, such as the risk of losing the premium paid for the options if the options expire out of the money.

It's also important to note that delta neutral positions need to be monitored and adjusted as the delta of the options changes over time. This is because the delta of an option can change as the price of the underlying asset moves and as the option approaches expiration. To maintain a delta neutral position, a trader may need to buy or sell additional options to offset any changes in the delta of their existing positions.

Overall, delta neutral trading can be a useful strategy for traders who want to speculate on the direction of an underlying asset while limiting price risk. By carefully selecting options and monitoring their positions, traders can potentially profit from changes in the price of the underlying asset without being fully exposed to its price risk. However, it's important to keep in mind that options trading carries its own risks, and traders should carefully consider these risks before making a trade.

This is just a basic strategy however you would need to research more before trying it out and would need to understand your risk.