Throughout history we have seen empires rise and fall. The Greeks, Romans, and British all managed to conquer and reign over the planet for some time, before their ultimate demise.

Of course, the fall of an empire doesn't happen overnight. It occurs over years or decades, before it finally becomes apparent in a watershed moment that they are no longer the world superpower.

Lately we've seen a lot of news about "de-dollarization". Or in other words, the process of a nation weening its banks and economy off of the US dollar, the current world reserve currency.

Here is a list of some de-dollarization events that have occurred in recent weeks:

- In February, Iraq announced that they are going to allow trade with China to be settled in Yuan instead of US dollars.

- Around mid-March, Iran announced that it no longer intends to settle trade with Africa using the US dollar.

- Later that month, Saudi Arabia, which has had an agreement with the U.S. since the 1970s to sell its oil only in dollars, stated that it is willing to sell oil to China directly for Yuan.

- Then Russia announced that they will start settling trade in Yuan with Latin America, Africa and Asia.

- Following that, the president of Kenya advised his citizens to get rid of US dollars, as they will start allowing their oil importers to purchase the commodity with Shillings.

- Most recently, Brazil and China announced they will start exchanging goods and services using their own currencies, eliminating the need for US dollars and an intermediary.

What could be the reason for so many countries announcing de-dollarization at the same time?

As the Federal Reserve continues to raise interest rates to fight inflation (which it created), it sucks fiat out of the financial system and creates a dollar shortage worldwide.

In effect, they are tightening the noose on nations who, unlike the U.S., are unable to create dollars to pay their debts.

This is a driving force behind countries seeking to trade in alternative currencies, in addition to simply recognizing the unsustainable path of U.S. fiscal and monetary policy.

Will this international trend towards de-dollarization continue over the coming weeks and months, and if so, what will be the ramifications?

Dollar Collapse?

If all countries were to stop using the dollar, it would obviously plummet in value. But the truth is that people have been unsuccessfully calling a US dollar collapse for over 50 years now...

Some thought it was the end when Nixon took the dollar off of the gold standard in 1971. Then, in 1981, when the US national debt topped 1 trillion dollars, even more predicted that the end of the dollar was nigh.

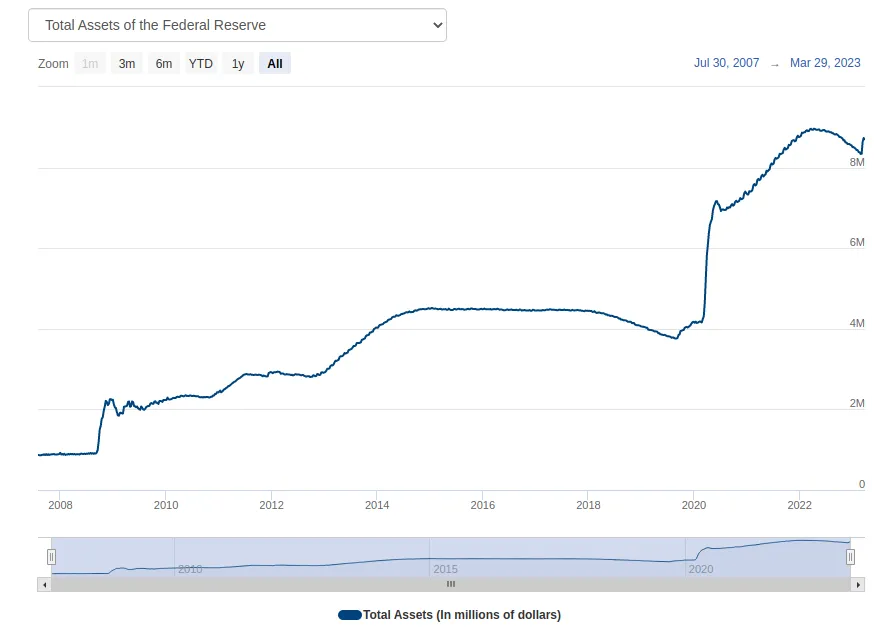

I only started following the situation in 2011, after getting curious about the 2008 financial crisis. At that point, several economists were convinced that a dollar collapse was imminent given the bailouts, quantitative easing, and artificially low interest rates.

Yet despite insanely loose monetary policy, the dollar continued to remain dominant throughout the decade. For how much longer could this go on? Many monetary experts on Twitter were anticipating a financial reset in 2019 after the repo market went haywire.

Then, seemingly out of the blue, the Covid-19 plandemic happened and the loose monetary policies went into hyper-drive. Not only were corporations being bailed out this time, but individuals (in the form of helicopter money) were too. The Fed's balance sheet doubled:

Surely the dollar couldn't survive such a rapid expansion of the money supply!? Despite record inflation rates, it did.

QE1, QE2, QE3, NIRP, ZIRP, Bailouts, and Covid-19 Helicopter Money have all hacked away at the dollar's strength over the past two decades, and yet it is still considered the world reserve currency.

Now let's take all those trillions of dollars of debt that have been accumulated over the past decade at zero percent interest rates, and jack the rate up to 5% in the span of 9 months:

I think everyone can agree that at some point this craziness has to come to and end. And would you really be surprised if the time is now, after all that has happened over the past three years?

How ridiculous can the monetary policy get before there is a watershed moment, and the dollar is abandoned by all parties? Could we have finally reached that point, after more than 50 years of wrong calls?

What more is it going to take?

Loss of Geopolitical Power

In addition to de-dollarization, there has been news about the United States losing geopolitical power as well.

Mexico, one of the United States' closest manufacturing allies, has expressed interest in joining the BRICS, an alliance which isn't exactly friendly to the United States and their worldwide dollar hegemony.

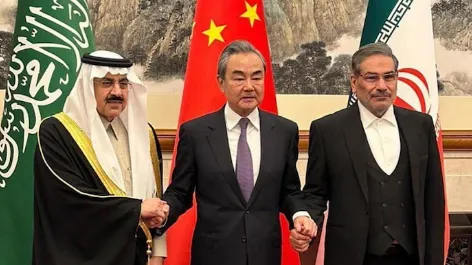

Also, China recently brokered a peace deal between rivals Saudi Arabia and Iran. The US now seems to be taking a backseat in Middle East peace talks.

How will the United States react to nations dropping the dollar and undermining them politically?

WWIII?

In the past, the United States have used their military, or the CIA, to overthrow regimes which attempted to trade in alternative currencies.

However, this time around, they don't seem to be kicking up a huge fuss about it.

Perhaps they know there's nothing much they can do about it, seeing that so many countries are deviating from the dollar in unison.

Also, these days the might of the US military is being called into question. The soldiers who refused to take the mRNA shot have either quit or been discharged, and many who remain are crying over being misgendered:

If the U.S. doesn't respond with military action after Russia, Iran, Saudi Arabia, Kenya, and Brazil drop its currency, will other nations interpret it as weakness, and garner the courage to also side-step the dollar?

International Dollar Denominated Debt To The Rescue?

Given all that's happening here, is it still possible that the dollar could survive as the world reserve currency for several more decades?

One argument of the dollar proponents is that outside of the U.S., countries have massive debts denominated in US dollars, and since they all need US dollars to service those debts, there is always demand for the dollar.

But what if those countries were to negotiate with each other, and re-denominate their debts in a currency other than the US dollar? This could lead to a sell-off of U.S. treasuries.

If countries were to start selling their US treasuries en mass, long-term interest rates would rise rapidly along with inflation. The buyer of last resort, the Fed, would flood the market with dollars, and cause hyperinflation.

Planned Financial Reset

We also must consider that everything that is happening right now was planned in advance. In such case, the bankers always knew that U.S. monetary policy was on an unsustainable path, so they needed an event in order to set off a controlled demolition of the dollar.

I find it interesting that both CNN and Fox news covered stories about de-dollarization on the same weekend. It's almost as if the powers that be are ready to let the people know that the US dollar is nearing the end of its lifespan, and that CBDCs are on the way.

We know that most developed nations have been working on CBDCs over the past few years and have been gradually announcing their intentions to "pilot" them.

Unplanned Interference

Despite their ingenuity, I don't believe the bankers were able to predict the emergence of cryptocurrencies and their exponential growth. That is why they are attacking crypto from multiple angles right now, as they realize it could interfere with their plans.

Luckily for us, cryptocurrencies are decentralized, international, and therefore unstoppable. In terms of individual sovereignty, it is the best form of money created so far in human history.

Many people of the older generation are hoping for a return to the gold standard, because it was money for thousands of years before the debt-based fiat financial system took over. But I don't buy that argument. Just consider how humans used the horse as their main mode of transportation for thousands of years before the automobile was invented.

I do believe we are going to see many currency wars take place over the next decade or two. We could quite possibly see a commodity-backed Yuan facing off against a crumbling fiat dollar/euro system, while CBDCs wage war against cryptocurrencies. Within the decentralized realm itself we will see cryptocurrencies fighting amongst themselves for dominance.

That is why, at the end of the day, it is important to constantly stay up do date with financial news, blockchain ecosystems, and the launch of new tokens. We need to filter out those that offer no innovation or value from those with strong communities and new functionality.

Conclusion

Could this fiat financial insanity last for several more years? All signs point to major paradigm shifts in the financial order coming soon. To survive and thrive during these tumultuous times we need to maintain a diversified and carefully researched portfolio of digital assets, preferably in a jurisdiction that is crypto-friendly.

Do you think the dollar will lose its reserve status soon, or does it still have decades of dominance ahead of it?

Source: Barrel photo

Source: Saudi, Iran, China Peace Deal Image

Source: Cryptos image

Source: Fed Balance Sheet