"So how do I make money with it?" is a frequently asked question I get from people when the conversation steers towards crypto. They've heard the amazing stories of kids who "made millions" or 100x'ed their portfolio by investing at the right time, and they want to recreate the same scenario for themselves.

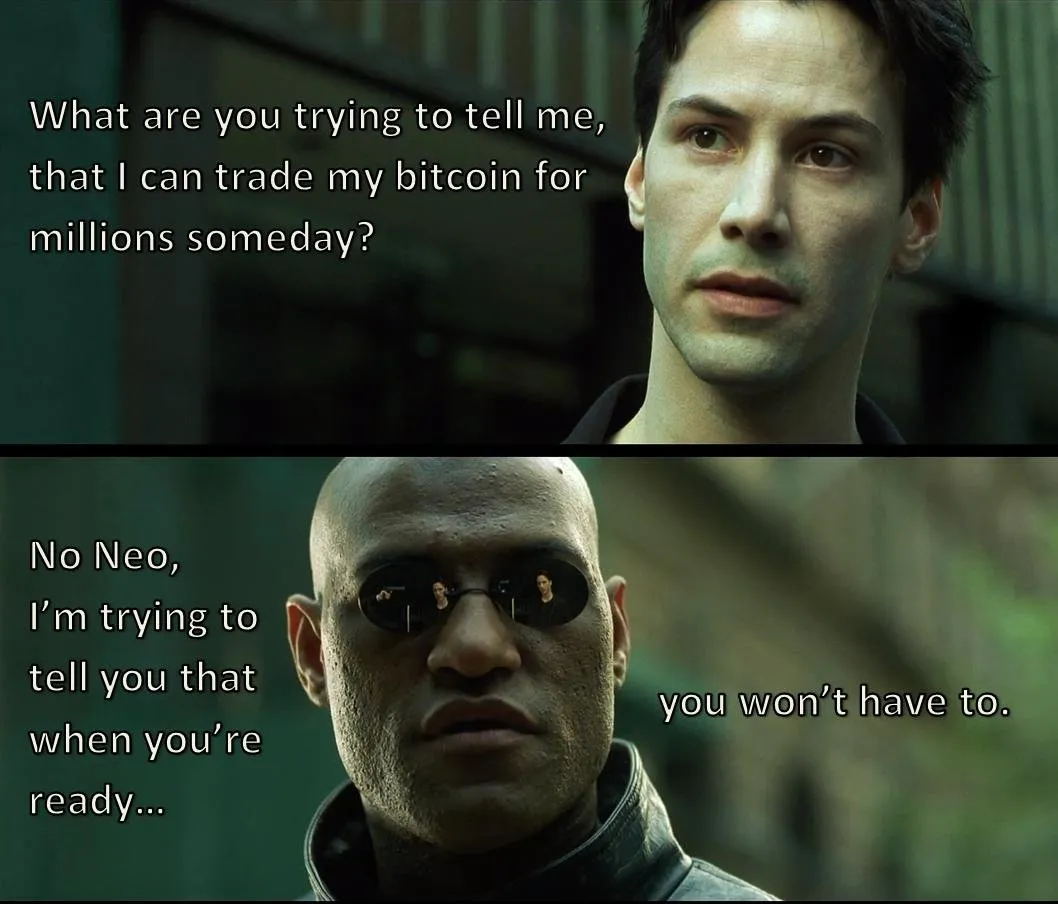

Getting wrapped up in the emotion of it all, they fail to understand that crypto isn't about "making money". Rather, it's about replacing money. And so long as they stay trapped in the old paradigm of fiat, they won't manage to have long-term success with crypto investing.

Bitcoin was created in the depths of the financial crisis of 2008 as an alternative form of money to fiat. Based on his message inscribed in the first block, Satoshi Nakamoto took issue with the unjust banker bailouts happening at the time, and I believe recognized that the fiat system was unsustainable and needed a viable replacement:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

Now, 13 years later, we have much more advanced crypto ecosystems such as Ethereum, Cosmos, and Polkadot (among many others). All are based off the original Bitcoin technology, but with enhancements that facilitate permissionless trading, lending, perpetual futures, NFTs, and so forth. If you really take the time to investigate what's going on, you'll come to the conlusion that a brand new financial system is being built from the ground up, and it's way better than the old system.

Thanks to artificially low interest rates and QE infinity, the traditional banking system has been on its last legs for the past decade, and is now hanging by a thread since the covid lockdowns. It was only meant to work alongside an economy that grows in perpetuity every year. But we've come to the realization that unlimited growth isn't feasible. After all, we live on a spherical planet, with finite resources. Therefore, the economy cannot grow into infinity, and the old financial system needs replacing.

Of course, the powers that be already have a comprehensive alternative system ready to go, namely "The Great Reset" and CBDCs, a plan to make the world greener, more sustainable, and controlled. If their plan were to succeed it would mean draconian rules placed on what we can and cannot buy, and a digital currency that has an expiry date. Those of us who champion individual liberty would rather see a world operating on decentralized cryptocurrencies and free markets.

And while the trend towards crypto acceptance is on the rise globally, most realtors, car dealerships, and department stores still only accept fiat currencies. Therefore, I imagine there will be quite a few people who sell their crypto for fiat in the next bull run. A decision like that comes with some risk, however, because at some point the traditional financial system is going to buckle, and the dollars you receive for crypto for will end up essentially worthless, or only exchangeable for CBDCs, which will have limited use.

Crypto is going to cause a generational shift in how we think about wealth and riches. Eventually there will be businesses that only accept crypto as payment, and refuse both fiat and CBDCs. As this trend progresses, the value of fiat and CBDCs will continue to decline, and those who sold-out for the old system will see their wealth slowly (or rapidly) vanish.

The concept of ownership is going to change as well. Physical plots of land, cars, and other big-ticket items will be represented by NFTs on various blockchains. Governance is going to be uprooted too. Businesses and governments will transform into DAOs and voting will take place on the blockchain, rather than at voting stations or shareholder meetings.

Despite temporary bear markets like the one we are in now, the value of cryptocurrencies relative to fiat will continue to increase over time. But "getting rich" won't be as simple as selling your crypto for fiat when it's worth millions, and then kicking back into early retirement. One will have to adapt to a new world where the concept of payments, ownership, and governance changes completely.

Those who cannot accept the failure of traditional institutions will struggle to "get rich" with crypto. Retaining wealth in the new financial system will mean accepting the obsolescence of old-school banking and adapting to the new world of decentralized finance.

In what other ways will people need to adapt as public blockchains continue to expand?

Image source: https://energycue.it/wp-content/uploads/2017/10/

Image source: https://cointelegraph.com.br/news/the-9-funniest-memes-about-bitcoin-on-the-internet