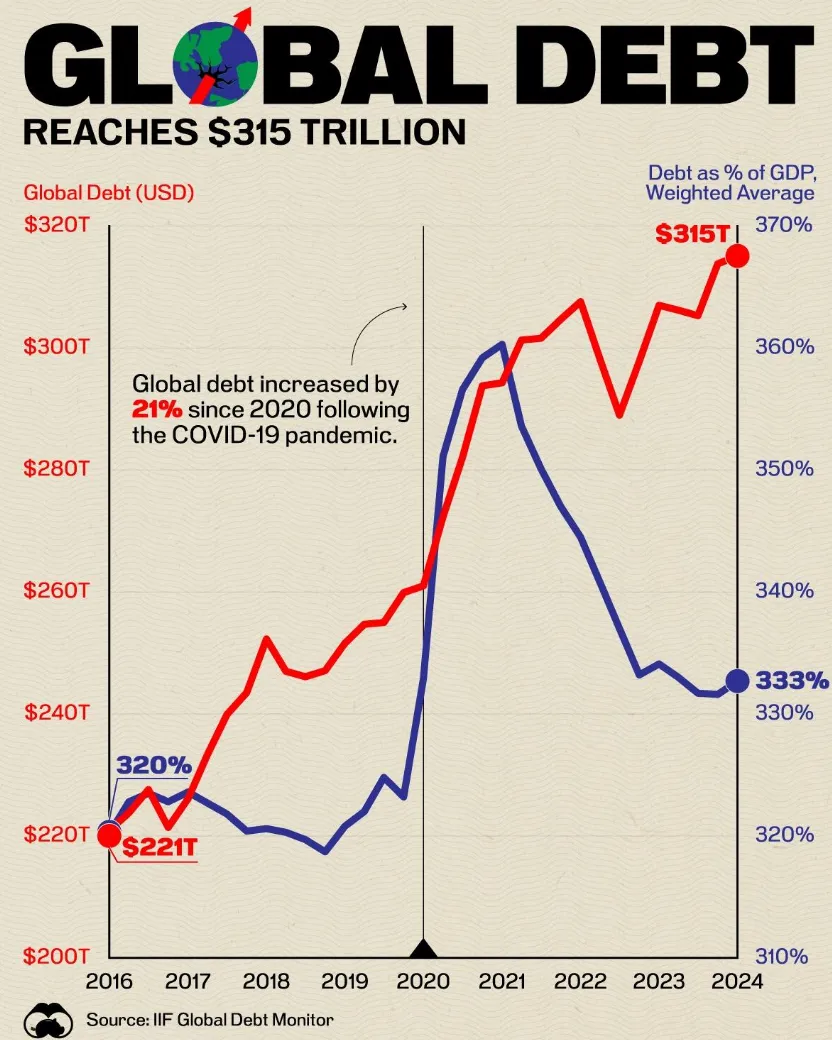

Total worldwide debt (a combination of sovereign, corporate and individual) recently surpassed a whopping $315 trillion dollars.

This is a 43% increase from the $215 trillion dollars it was just eight years ago. To put that in perspective, global debt was just slightly over $1 trillion back in 1970.

In other words, the amount of debt being added to the global financial system is expanding exponentially with each year that passes.

The question you may be asking yourself is, how did we get ourselves into this debt trap, and who exactly do we owe it to?

Who Owns The Debt?

The global debt is owned by a combination of foreign governments, commercial banks, (your?) pension funds, insurance companies, family offices, private investors (your T-bills?), and more.

It's fairly difficult to verify exactly who owns what because unlike cryptocurrency, the traditional banking system is not transparent. We simply have to trust the numbers that are published by governments and banks.

It's By Design

It's important to realize that in traditional finance currency is lent into existence, and the corresponding amount of debt must be paid back at interest.

For example, let's say you take out a mortgage from the bank for $500,000 dollars. If the bank satisfies its reserve requirements, it will credit your account with $500,000 cash and create a corresponding $500,000 mortgage on its books that you must pay off over time, at interest.

The obvious question is, where does the currency come from to pay the interest on your mortgage?

Even if we wanted to pay of all $315 trillion dollars of worldwide debt, there isn't enough currency in existence to do so, and that is a by design.

Currency is removed from the system whenever we pay off debt, and that causes the economy to contract. In order to revive it, we need to add additional debt/currency (via lower interest rates, quantitative easing, etc).

Watch this video by Mike Maloney for a good visualization.

It's Unsustainable

Usually, new currency is created (out of thin air) by the commercial banking system whenever they issue new loans to businesses and individuals. When interest rates are low (like in 2020/2021) there is more demand for loans, and the money supply expands.

However, since the Federal Reserve raised interest rates to 5% last year (lowering borrowing demand), and continued with its quantitative tightening program (pulling currency/liquidity out of the system) someone had to pick up the slack.

As of late, the government has been compensating for the lack of liquidity in the system with unprecedented deficit spending (about $1 trillion dollars every 3 months).

So you see, if congress were to "balance the budget" (cut spending), we would enter into a deflationary spiral and set off a chain-reaction of bankruptcies.

The powers that be know that the current system is unsustainable, and that is why a "Great Reset" is upon us. You can either follow their lead, or take part in building out a new decentralized, crypto-based economy.

Opt Out

Bitcoin was the first decentralized digital asset completely outside of the traditional banking system, and the technology behind it has the potential to revolutionize our economies.

Unlike unsustainable debt-backed fiat currencies, Bitcoin is backed by compute power, a solid community, and sound math. And unlike central banks, Bitcoin is decentralized, which makes it unstoppable.

As the traditional debt-based financial system continues to spiral out of control, the crypto industry will continue to innovate and expand.

You can take control of your financial future now by investing in Bitcoin, or by participating in the new economy with something like HIVE, crypto gaming, or a DePIN project. The tokens behind these networks could very well end up being the money of the future.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Until next time...

Resources

Global Debt Chart [1]

Image Generation Courtesy of Venice AI [2]