Whenever there is a good company comes up with an IPO as well as the GMP a.k.a Grey Market Premium is good, I try to apply for the IPO or Initial Public Offering. Similarly last week there were three IPOs were opened for applications and I have applied for 2 out of 3. And I got one retail lot of 33 shares of Indegene.

PC: Groww.in

Indegene is a company which offers digital services to the life science business like a clinical trials, complaint handling, sales marketing etc. To be honest it is one of a kind of company and has a huge potential in the future as the life sciences buisness will be huge. So I feel the shares will go for long way.

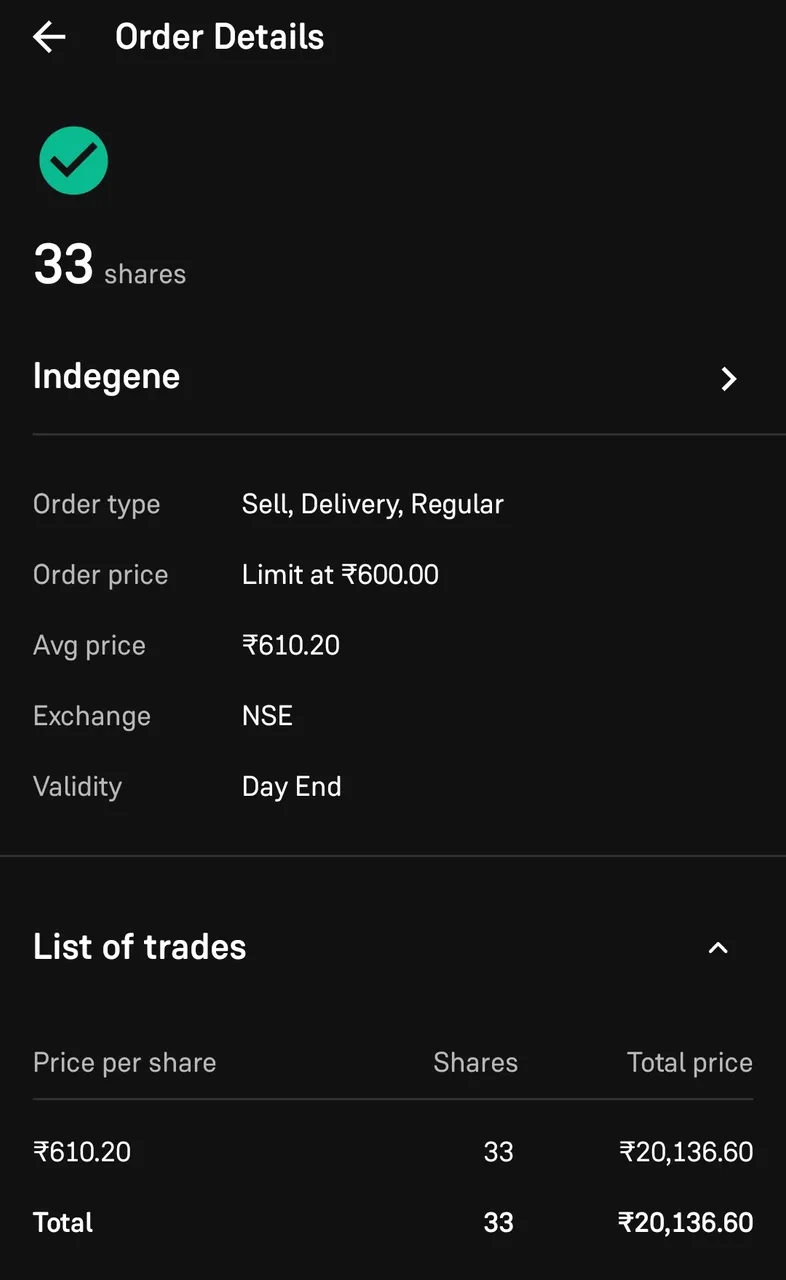

For me I have got one retail lot of 33 shares and I have sold it for profit today. The stock which was around Rs. 452 opened at Rs 655 and I sold it for Rs 610 I.e. around 33% profit. The GMP was showing it as 60% but it had listed for around 44% and I exited for around 34% profit which was ok.

Now the thing is, you might ask if it's so good of a company why I have sold it. Whenever I do an investment I wanted to know what's the purpose for it. Whether I am looking for long term profit or for a quick money. In this case I had some money idle in my bank account for 15 days and I have used it for quick gain. I could not have kept it for long term because I needed that money. And that's why when I applied, I told to myself I will sell it of one the first day itself for whatever profit I will get.

So yeah getting a 33% profit on Rs 15K is quite good in 1 week and I am ok with it. My goal is fulfilled and that's why I sold all the 33 shares and I came out of the company. If in future I will have some money for the investment, I can think of investing it in again by as of today I am all out of the Indegene company.

I have also applied for the TBO Tek, which I might get the allotment status today or tomorrow and just like Indegene, I have applied for TBO Tek for the listing gain.