Hello my fellow bloggers! What will happen with Bitcoin in February? We are seeing a lot of predictions based on various factors. I can’t predict the price, but I can share you some interesting historical data. Let’s dive in!

Source

Source

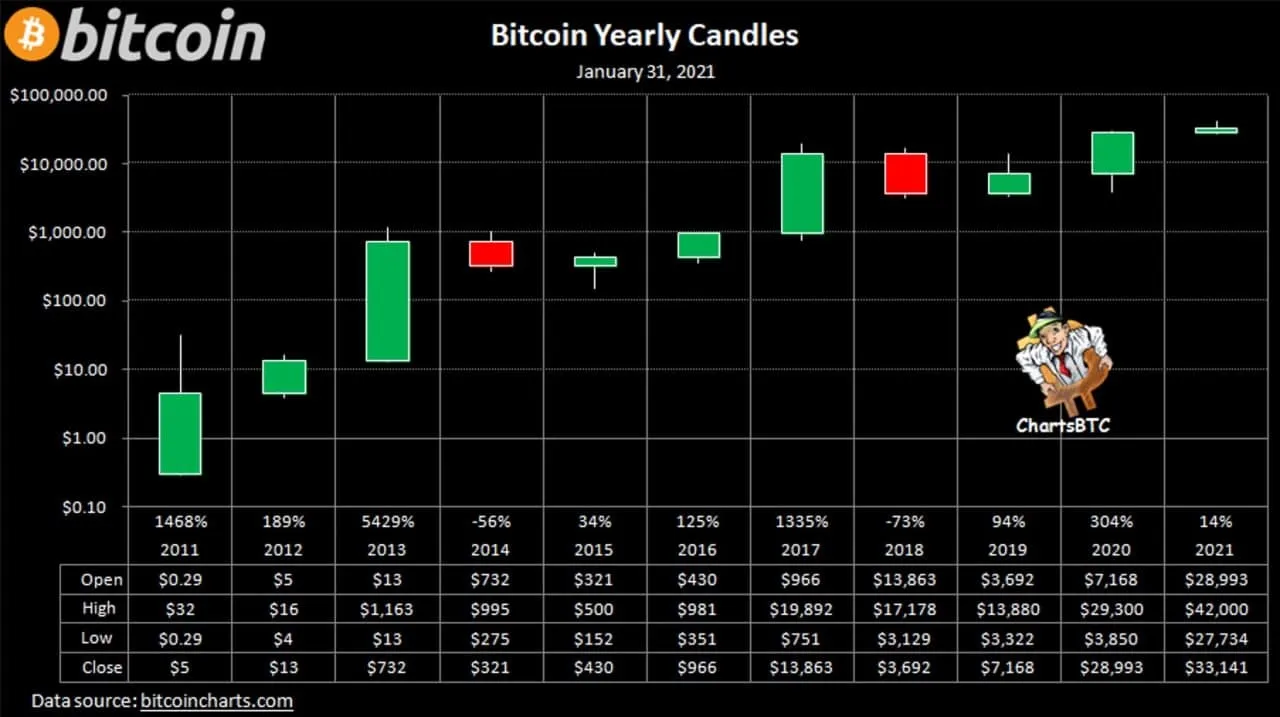

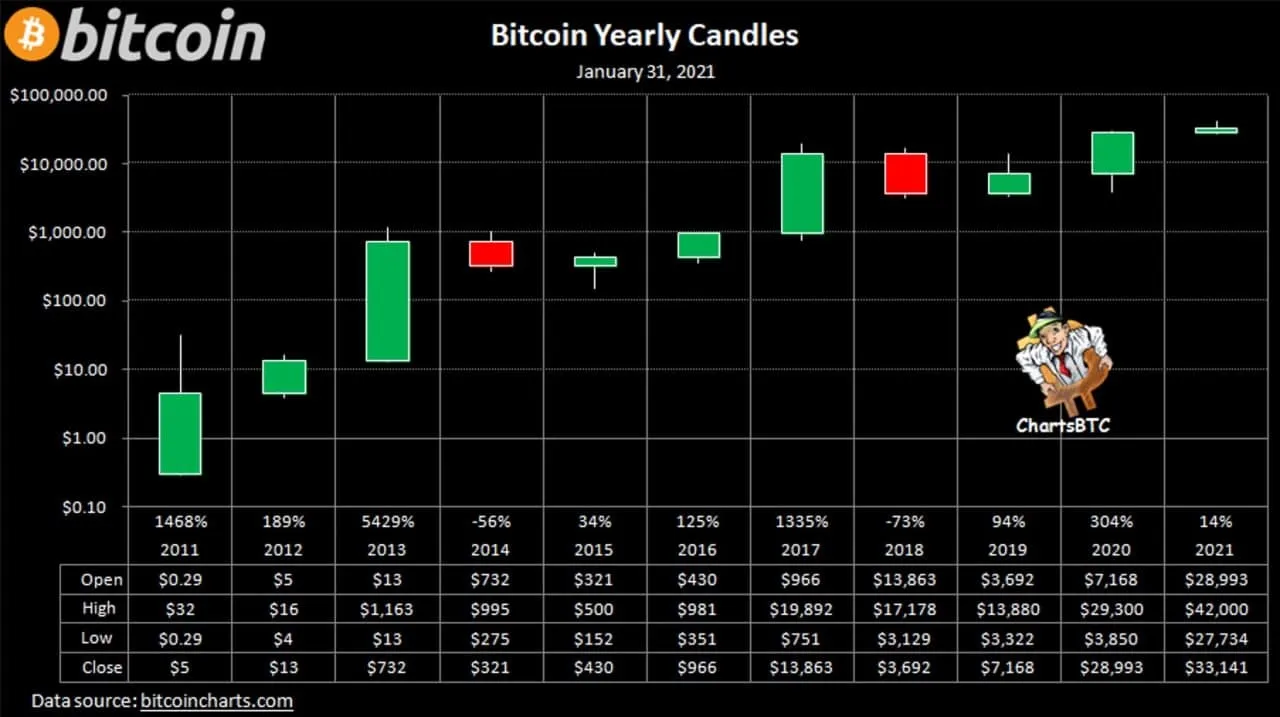

As we all know, Bitcoin is moving in cycles that are based on reward halving. To make this oversimplified, BTC is in bear market for 1 year that is followed by 3 years of a bull market. Bitcoin Yearly candles look like this:

Source

Source

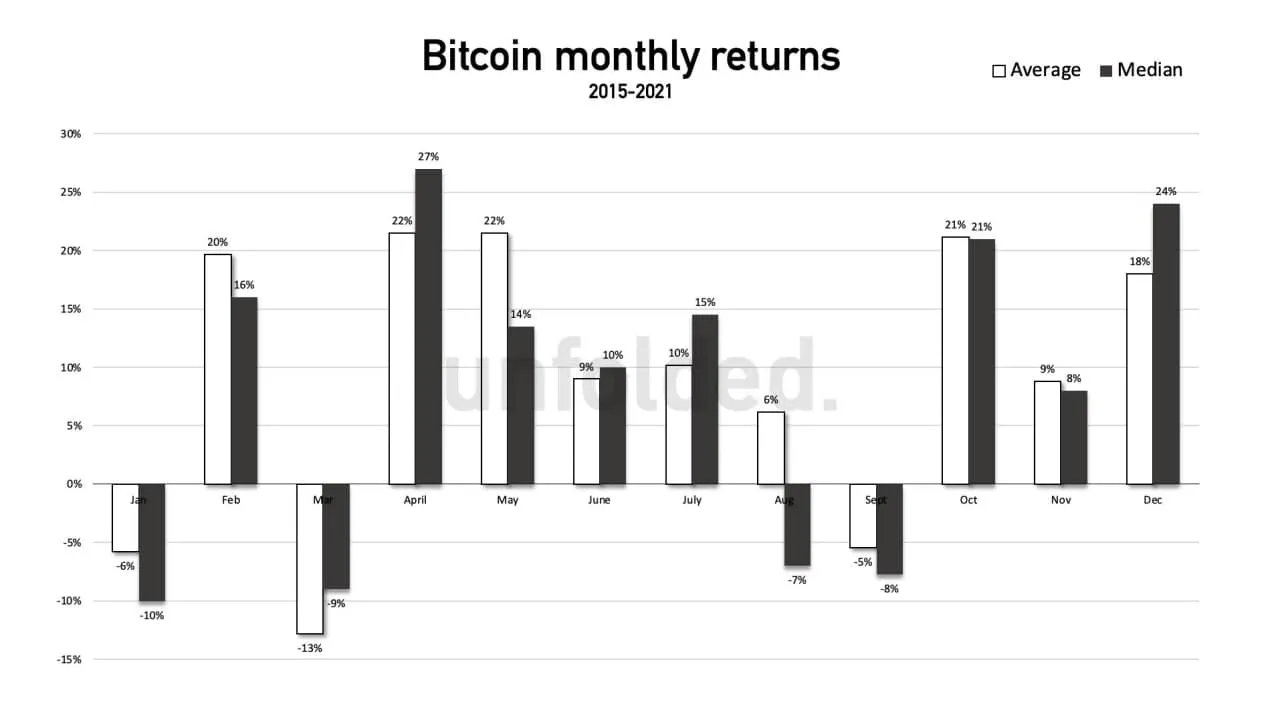

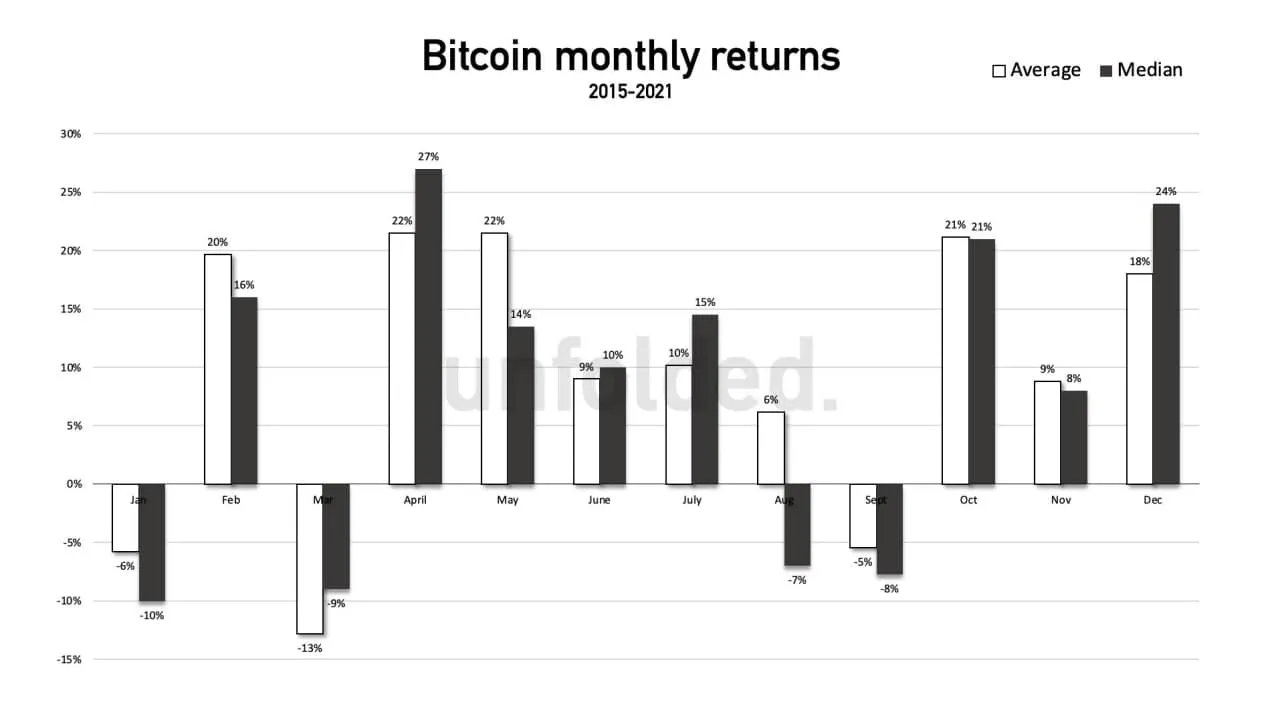

According to the chart, 2021 in overall should be successful year for Bitcoin. However, it doesn’t say anything about particular month. Even if we fully believe in cycles theory, it doesn’t mean we will not have a major correction for BTC or altcoin in February. Ok, then we need some other historical statistics to give us some clues. Bitcoin monthly return chart is exactly what we need. Find it below.

According to historical data, February is among top 5 months for BTC. Average monthly return is 20% (and 16% median return). The question is can we trust this data? On the one hand, it is proven by several years of statistics. If you take a look at BTC monthly candles for the last 6 month of 2020, you will see that the chart aligns with this statistics. On the other hand, Bitcoin is young and these several years of statistics are not that much. January this year had a green candle instead of showing a correction as on the chart.

I think February will be great for BTC. This time historical statistics is backed by good fundamentals. Trusts like Grayscale buy more BTC that mined for the same period of time. See this article for more details on Grayscale. Stable coins a purring to exchanges like never before. Whales are buying more and more BTC on any deep. Social activity is high, even Elon Musk is twitting about crypto. Let’s just relax, make ourselves comfortable and watch Bitcoin price grow.

Other articles you might enjoy

Mass FOMO is around the corner? Or the hype train is getting delayed?

Some people say we are in the beginning of a new altseason, but are we though?

How much Bitcoin does Grayscale actually buy? Can it lead to a supply shortage?

The 7 Habits of Highly effective People: Habit One

Disclaimer

I’m not a financial of any kind. I encourage you to check all information yourself and make decision only based on your own opinion. All articles are created for solely entertainment purpose.

If you like this post please vote for it and follow my blog. Feel free to share your thoughts in comment section.