Hello my fellow bloggers! Today I want to share some great analysis done by a Glassnode co-founder that shows the bullrun is just accelerating and we are still far from the top. Let’s dive in and see some good news.

Source

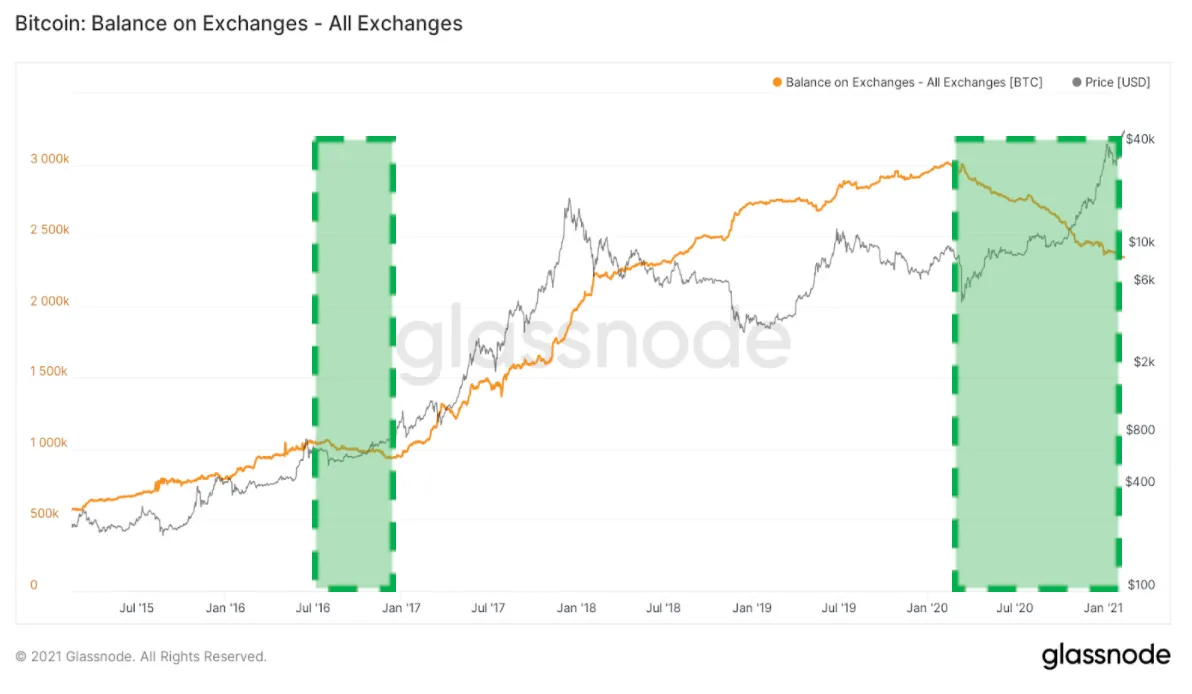

Glassnode co-founders released another crypto market analysis earlier today. The most interesting part of this review is the comparison of current bullrun with 2017-2018 Bitcoin cycle done in order to understand, were we are: still at the bottom or already on the top. As you may know, crypto bull cycle starts with a reduction in on-exchange supply, which leads to a supply squeeze.

Source

As you can see on the chart above, this phase started back in summer 2020 and continues to this date. It looks very similar to the same phase we saw in 2017. The only difference is that this time it goes faster. How does it work? The mechanics is really simple here:

This supply squeeze, created by long term holders accumulating, results in an increase in price. This in turn attracts retail and other types of short term holders that also start to buy in.

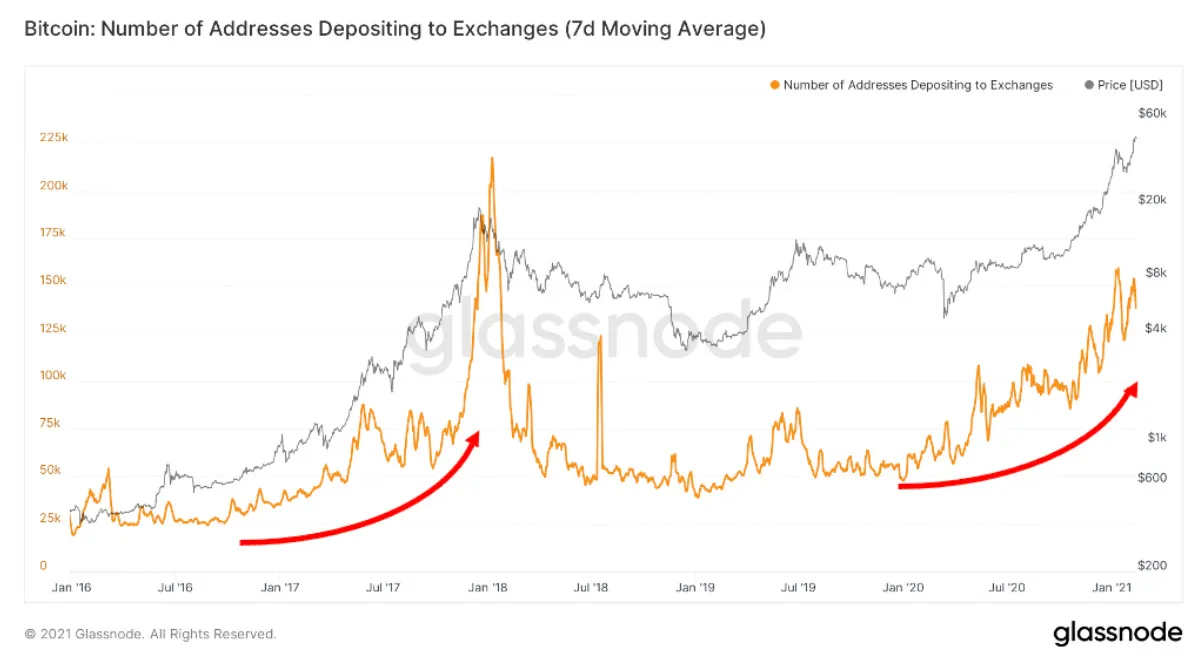

As the result we should see more BTC in hands of short term investors. You can see this on the chart below:

Source

When short term holders accumulate enough BTC, they become important players on the market and start affecting the price. This leads to higher volatility on the market. Long term investors are resistant to price moves. It is easy to watch BTC go down by 10-15% while you already have 4-5x gains. For short term investors the same conditions are stressful and lead to panic actions.

At a certain point, both long term and short term investors start to move BTC to exchanges to take profits. When this process starts to grow exponentially we hit the top of the market. Then the market goes down rapidly. The good thing is that we are not close to this yet as you see on the chart below:

Source

Comparing our current cycle to the last bull run in 2017, it becomes clear that we are still in that early acceleration phase of the curve. Authors of this review conclude:

As things stand in historical terms we are in the middle of this supply transition from long term holders to short term holders. This transition, although faster than in 2017, is a strong sign that we have moved out of the initial accumulation phase.

I totally agree with this review. O strongly believe the party is just warming up. Are you bullish on crypto as well? Let me know in the comments below!

See full article here

Other articles you might enjoy

How many hodlers are there compared to traders?

Bitcoin mining is killing the planet (No)! Let’s take look at this recent FUD.

BTC and ETH supply crisis is behind the corner, will it pump the price?

How Chinese New Year will affect Bitcoin price?

Disclaimer

I’m not a financial of any kind. I encourage you to check all information yourself and make decision only based on your own opinion. All articles are created for solely entertainment purpose.

If you like this post please vote for it and follow my blog. Feel free to share your thoughts in comment section.