The CUB Protocol is hitting new all-time highs in so many different ways. Prior to the launch of bHIVE and bHBD, things weren't looking so good for CUB. We were awaiting for the team to build something that could drive revenue in a sustainable and growing way.

Well, now with bHIVE and bHBD being live for the past 3 months, it's obvious that sustainability has arrived. We've seen ~1M CUB get burned since the bridge launched in August 2022. That's f*cking incredible.

Alongside that, the bridge liquidity continues to deepen. We just crossed 729k in TVL for bHIVE and bHBD pools! That's AMAZING!

We need to keep seeing this growth if we want to see CUB succeed long-term. I believe that this growth is met with a lot of positive ears around the community.

We all experienced the bad mindset that comes with the price dropping 99%. That's happened across the entire DeFi industry and CUB is no stranger to it.

But now, CUB is doing something different. CUB is building something different.

CUB has hit upon a sustainable model of growth and revenue generation.

Cash flow is king in this world and CUB is starting to generate a lot of it. If this trend continues, we'll see the CUB burns continue to soak up the supply.

What happens in the long-run as this continues? Only one answer: CUB's market cap must grow to accommodate growing revenues.

Follow along as I report daily on @cubdaily 🙏🏽

Focus of the Day

Focus in on the revenues. We're seeing revenue continue to climb each month. As this revenue grows, burns will grow with it.

as a community if we want to do our part in making this happen, we need to wrap HBD and HIVE across the Multi-Token Bridge to bHBD and bHIVE and provide liquidity to one of the 4 LPs:

- bHBD-bHIVE

- bHBD-BUSD

- bHIVE-CUB

- bHBD-CUB

This is ESSENTIAL. We need the TVL to grow.

Last report, TVL was inching close to $700k. This report, we're now at $729k. We are CLEARLY GROWING. The faster this number grows, the faster the amount of burned CUB grows toward our target of 800k CUB burned per month!

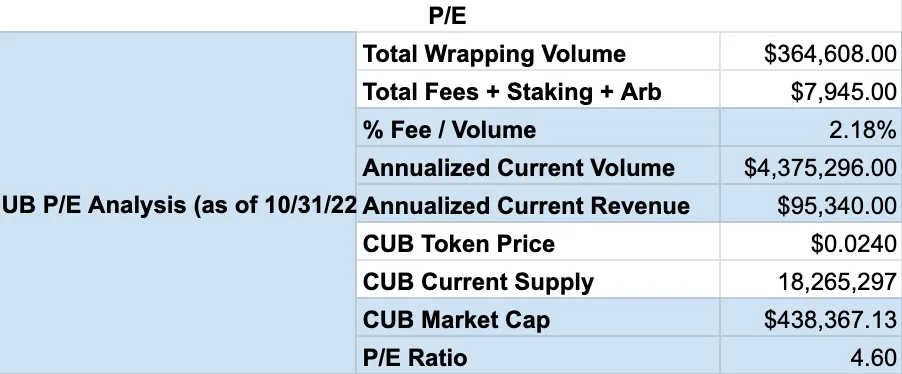

P/E Analysis of CUB

Here's a new section I'm trying out. I decided to run a P/E analysis of CUB using data from each Monthly Burn Report posted by @leofinance. Check out the second analysis I ran and leave a comment below with your thoughts.

Keep in mind that a low P/E ratio is good. It means that the revenue that CUB is generating each month is increasing faster than the CUB price is increasing (more revenues earned per share of CUB).

CUB Token

- Price: $0.02887

- Total CUB Supply: 18,319,920

- Total CUB Burned: 1,390,374

- Total Market Cap: $525,215

- Total Value Locked: $1,694,560.86

Multi-Token Bridge Stats

- bHBD-bHIVE: $164k

- bHBD-BUSD: $244k

- bHBD-CUB: $159k

- bHIVE-CUB: $162k

- Total: $729k

A NEW ALL-TIME HIGH for THE MULTI-TOKEN BRIDGE POOLS!!!!!

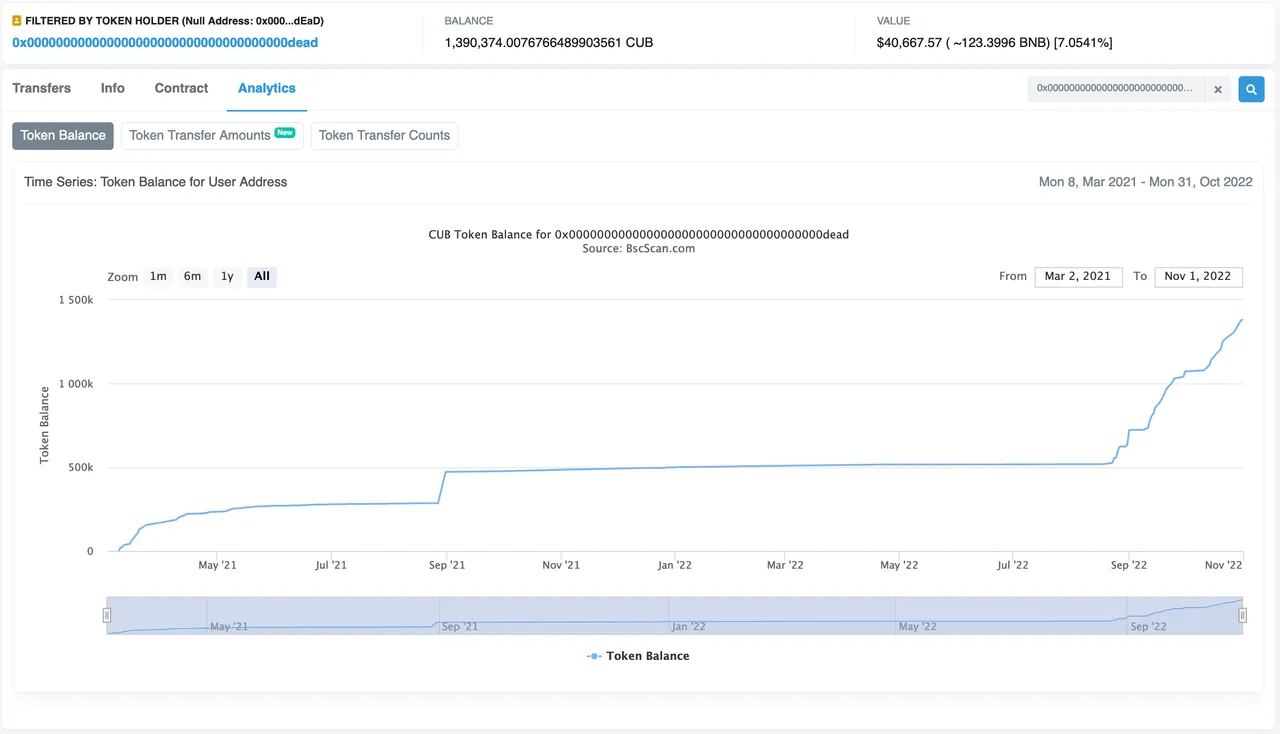

CUB Burns

Things are getting really crazy over at the CUB DAO... Look at this chart just take off up and to the right. We're at 1.39M CUB Burned and quickly approaching 1.5M.

2M is right around the corner, likely to hit in December.

Further Reading:

- Latest Reports From this Account: @cubdaily

- Latest CUB Burn Report From the LeoTeam: @leofinance/cub-monthly-report-or-october-2022-350k-cub-bought-and-burned-bhbd-and-bhive-liquidity-depth-grows-30

About CubDaily

I'll be using this account to report on the CUB stats each and every morning. Together we'll track the growth of CUB under the completely revamped ecosystem that LeoTeam has built called the Multi-Token Bridge.