One issue that seems uncertain for Bitcoin and its limited supply is the long-term security of the network that comes from the inflation incentives.

Once the inflation for miners is very small where will the incentive come from?

All the bitcoin inflation is rewarded to miners to secure the network. More miners, better security. Less miners less secure and valuable network.

The hash rate is mainly driven by the BTC price, the current one and the speculative future price that bitcoin miners bet on if they don't sell.

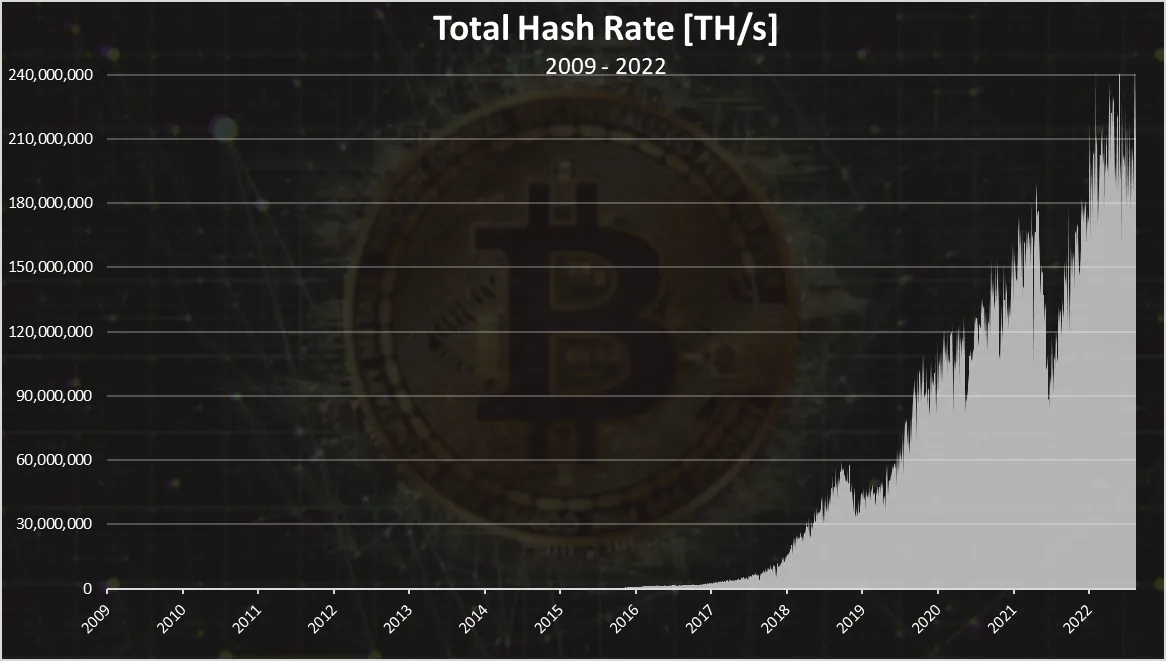

The hash rate, for the most of the time has been growing in the past. Here is the chart.

We can see that prior to 2017 the BTC hash rate is nonvisible on the chart. Then in 2017 it started increasing, had a small drop in 2018 and continued to grow again. In the summer of 2021, there was a large dip in the hash rate, because China banned the mining in the country. We can see that soon after it recovered and reached new hights again.

Bitcoin miner rewards will continue to be lowered as inflation goes down with each halving. In 2024 inflation will be cut from 1.8% to 0.9%, then in 2028 to 0.4% and in 2032 to 0.2%

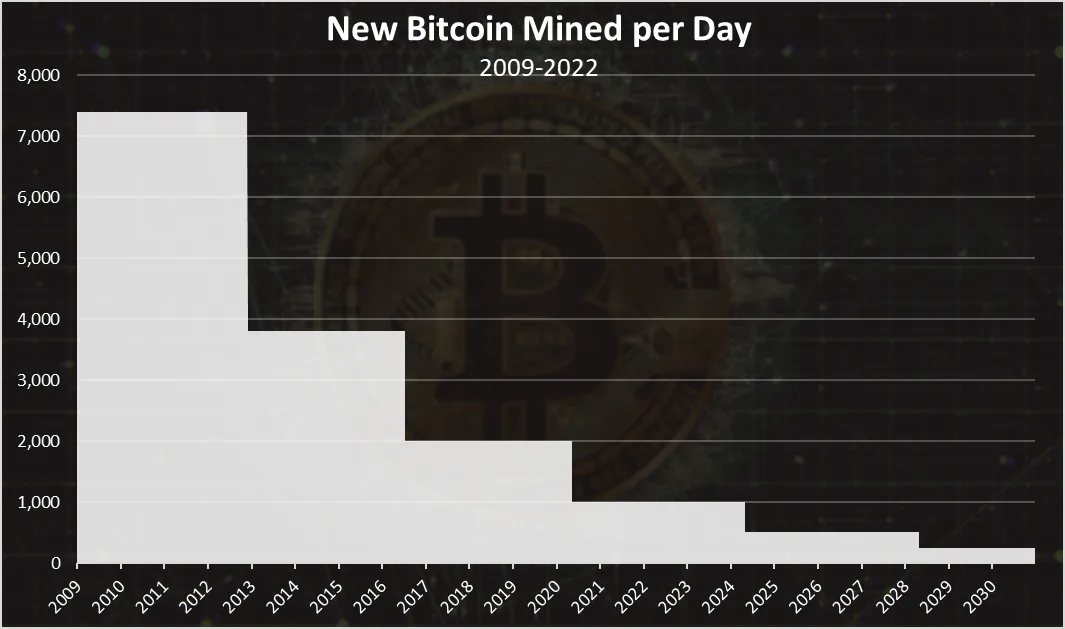

The chart for the new bitcoin mined per day looks like this.

When the bitcoin mining started at first, the daily inflation was around 7.4k, and now we are less than 1k BTC per day. The inflation has dropped already a lot, and it will continue to drop to the low numbers.

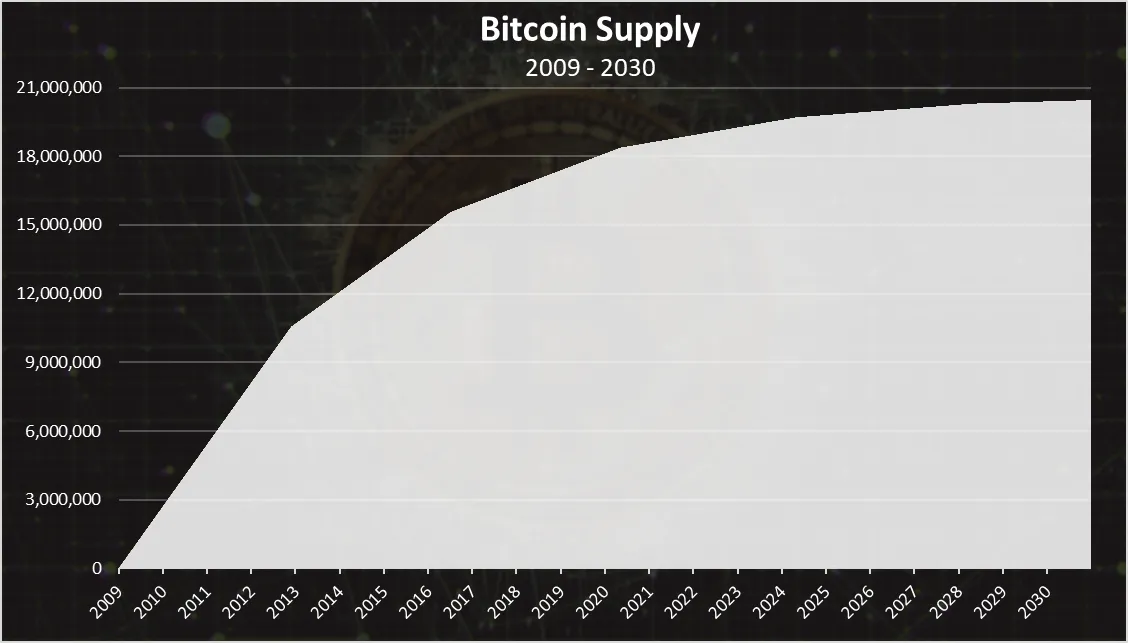

The chart for the supply.

As we can see the Bitcoin supply keeps flattening in time. We are now already at a point where the new supply is quite low to the exciting one. At the moment of writing this the Bitcoin supply stand at 19.13M out of the capped 21M.

All the assumptions are that Bitcoin is numbers goes up technology and that the bitcoin price will increase significantly in the future that will offset the reduction in the inflation.

BUT!

What if the BTC price doesn't increase. Or it increases but not at the levels that are needed to cover the costs for mining and secure then network further. What happens then? It seems that everyone is convinced that the BTC price can go up forever. One thing is for sure, and that is that nothing is guaranteed, and especially not the future price of a new class of digital asset.

In the long run the Bitcoin price will not be able to offset inflation reduction!

This is almost a fact.

While in the medium term (10 years) the probability that the BTC price will offset inflation reduction is higher, in the long run it gets lower.

As Bitcoin grows in market cap, doubling its price will be harder and harder. Lowering its inflation in the other hand is certain.

What then?

When inflation runs out as incetive, the other option are FEES!

Now I'm not totally sure how is the fee structure design on the Bitcoin network, but it seems that there is a big probability as inflation goes down, fees will need to go up.

There is another most important metric for fees to work.

Network activity

Bitcoin will need to be heavily used, and users willing to pay the high fees of the network. There needs to be significant economic activity!

This means Bitcoin needs to be adopted by the masses by then. This again is another speculative bet. Similar to the price. Maybe bitcoin will become the worlds reserve asset that will be used by the masses and thousands of apps running on top of it. But will it be that big that the fees are enough to provide the network security that is needed?

As mentioned, the cumulative fees are sum from the fees set by the network and the overall network activity. If the network activity is not high enough to provide the fees needed for incentive, there might be a need to increase the fees on a protocol level.

Benevolent mining

This is another option beside the fees. If the fees are not enough, Bitcoin can still continue to receive support and has benevolent miners who are willing to support the network at a cost. This might be the case if the bitcoin network is used by a wide area of businesses and institution that will have their capital and business connected to the network so they can’t afford the network to be vulnerable and not secure. While this is an option it is still putting a dent on the network as non-competitive. If a reliable enough network appears and it doesn’t carry the cost that the Bitcoin network has, users and businesses can switch easily. It will be needed for the Bitcoin network to be an irrepressible asset for a long time in order to receive this type of support.

Everyone is repeating the bitcoin mantra for the limited supply and the 21M cap. What needs to be added here is that the limited supply can work only if two other conditions are met:

• Bitcoin price keeps increasing enough to offset inflation reduction

• Bitcoin is heavily used with high fees

Both conditions are far from guaranteed. What if some of them is not met and all of the network security is brought under question. Things can go wrong very fast. Vulnerability for 51% attacks etc.

I for sure want Bitcoin to succeed in its long-term mission as the pioneer in the space. But I see this topic very little discussed in the crypto community. Its maybe because it is a longer in the future, ten years medium and decades long term. But these are real concerns. Time again will give us the answer.

What are your thoughts on this?

All the best

@dalz