The 20% interest rate on HBD remains a lucrative option on the Hive chain, and debates around it continue to happen. One of the major things that is pointing out is that the 20% interest on HBD will inflate the HIVE supply, diluting the main token value.

The 20% interest rate was set back in April 2022, and we have now more than one year data on it. Let’s take a look at the numbers and extrapolate from them.

To start, it's important to understand where the HBD interest comes from.

It is an additional inflation on top of the regular inflation. Since HBD is a derivative of HIVE, this means we are increasing the base inflation rate for HIVE. However, the Hive inflation and supply have always been complex, with many details, particularly with HIVE to HBD conversions and vice versa. The conversion dynamics can result in an end result that is very different from what was initially envisioned. It is not a straightforward process where the new minted coins simply get added to the current HIVE base.

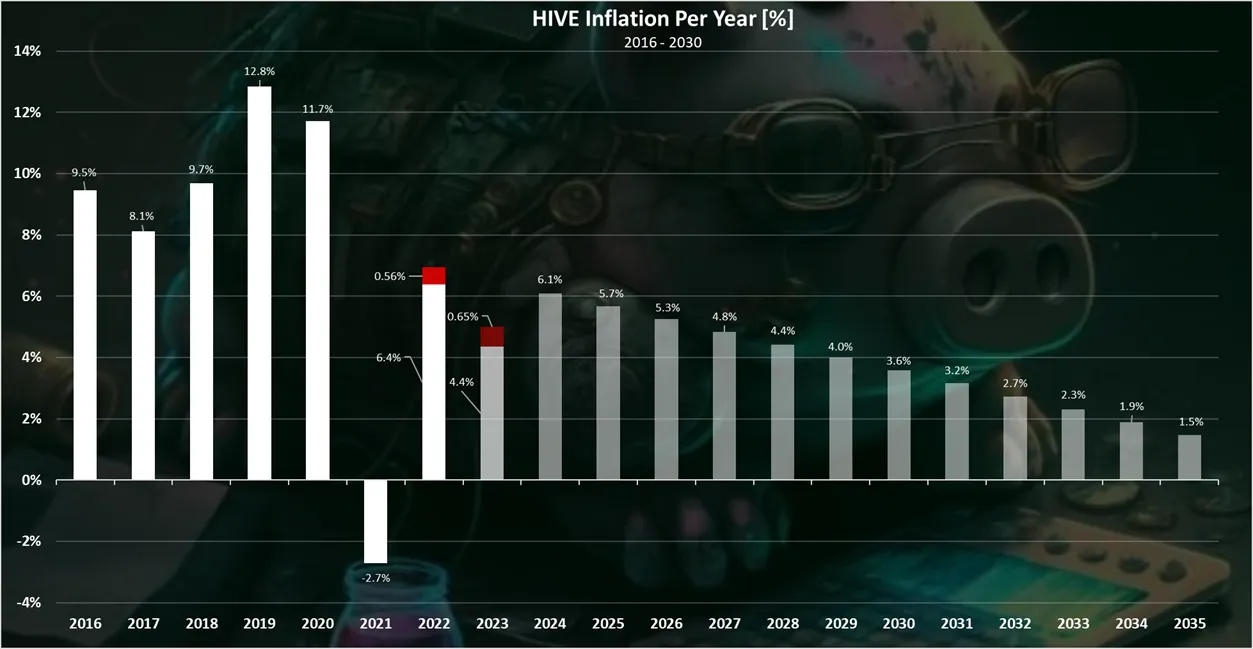

Currently, the regular inflation rate for 2023 is around 6.5%. However, for example, Hive inflation for 2021 was deflationary at -2.7% due to conversions. The realized inflation for 2022 was same as the projected rate at 7%, while in the first half of 2023, we are slightly under the projected rate of inflation, around 5%.

How Much HBD is Created from the HBD Interest?

HBD is created from HBD in savings. To get the data, we need two things:

- HBD balance in savings

- interest rate

HBD Savings

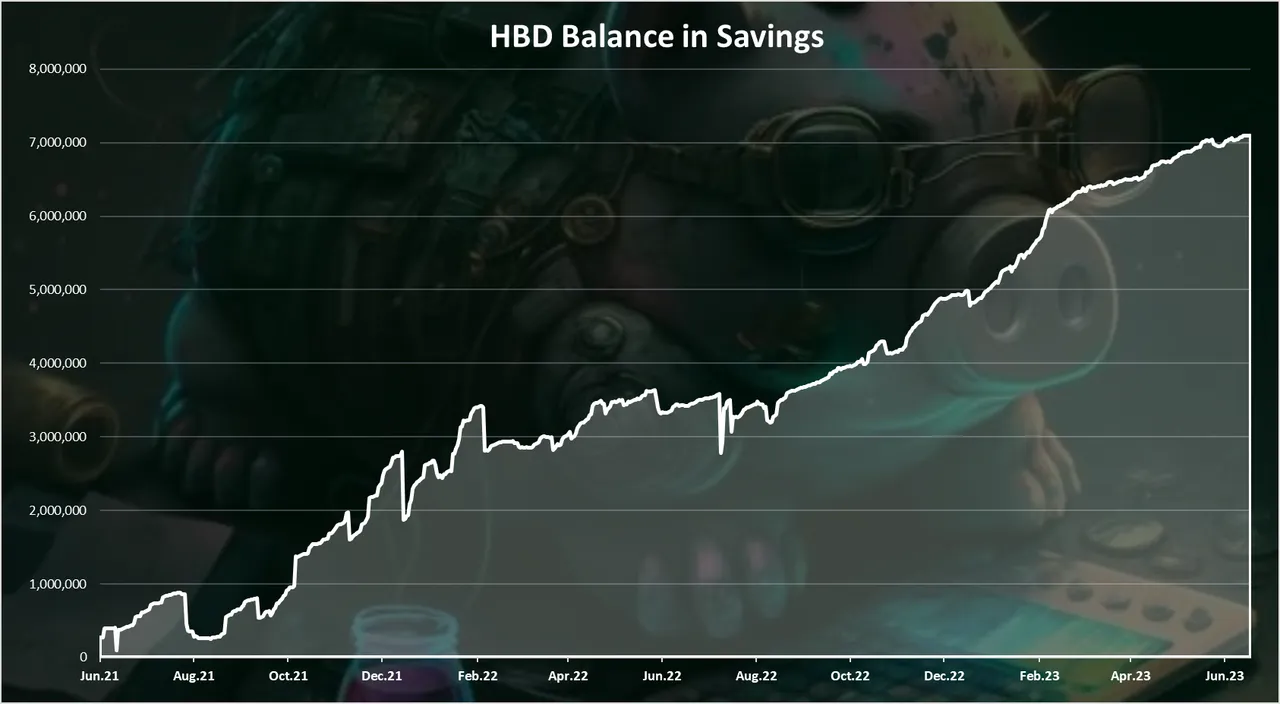

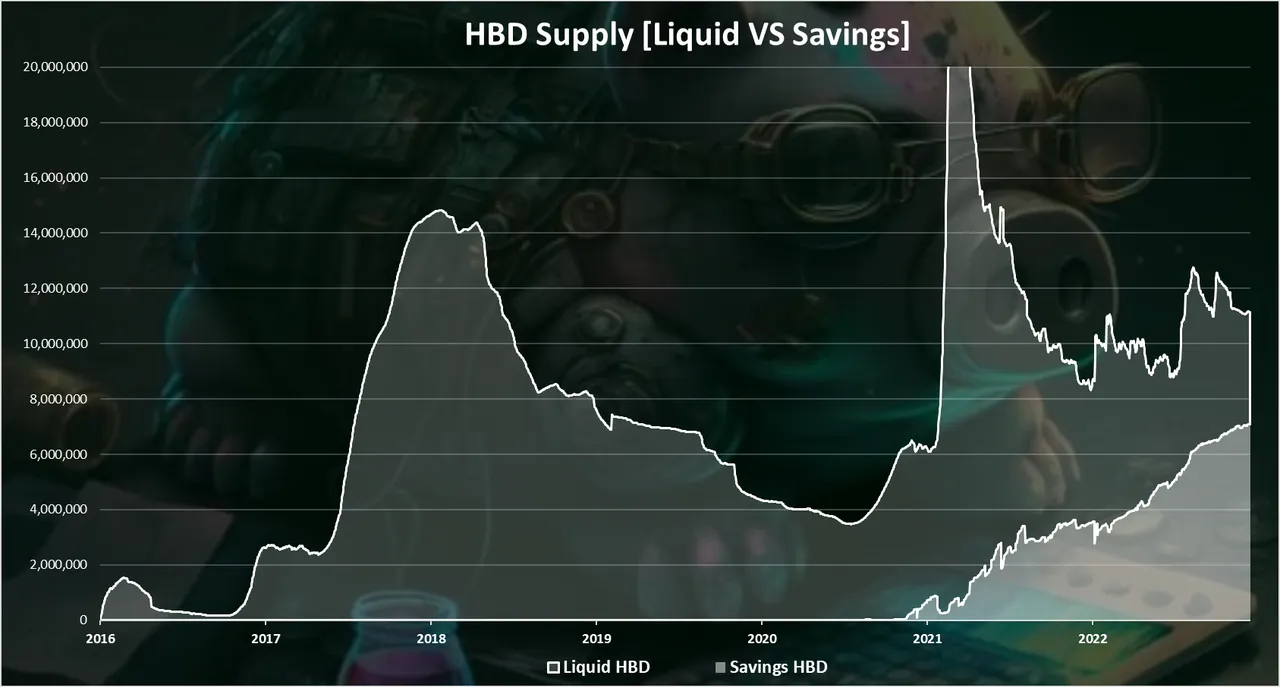

First the chart for the HBD balance in savings.

The HBD in savings has been consistently growing. At the beginning of the year, there was around 5 million HBD in savings, and now we are at 7 million. More than 2M was added into savings in the first half of 2023, while in 2022 around 3M HBD was added into savings for the whole year.

The above is the principal for the HBD interest.

What About the HBD Interest Rate?

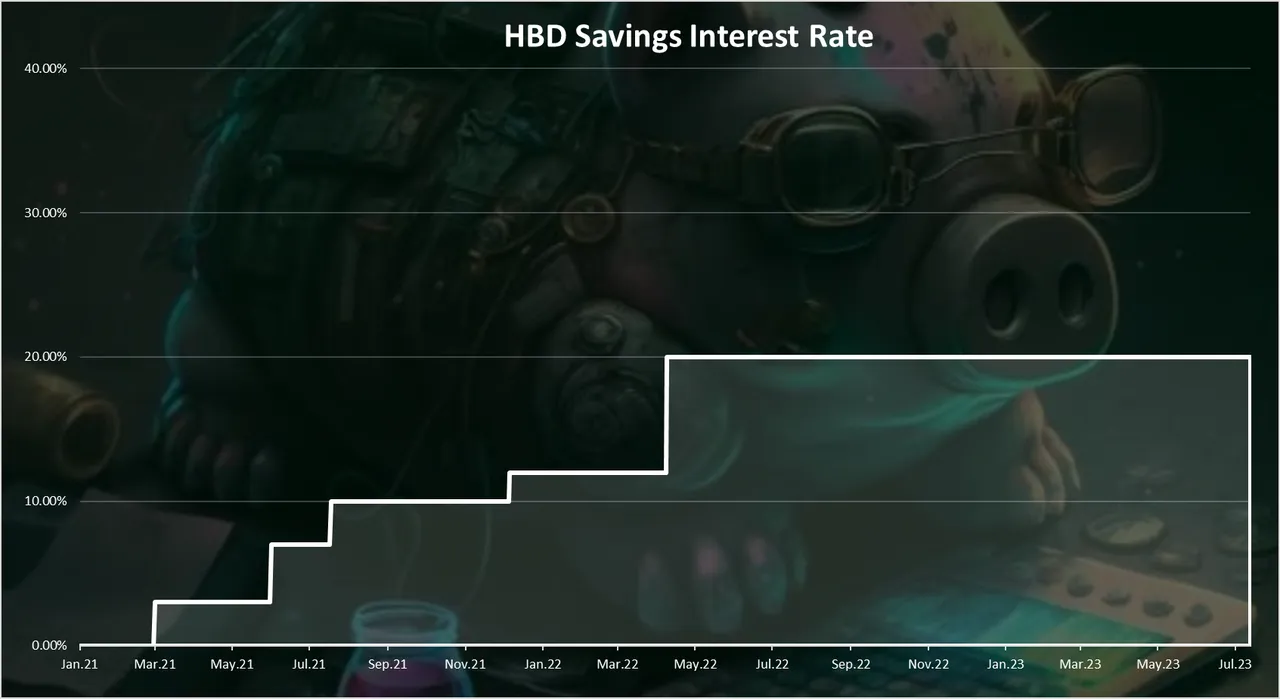

Here is the chart.

We can see that at first the HBD interest rate was set to 3% back in March 2021. Then it was increased to 7%, and shortly after to 10%. At the end of 2021, there was one more increase to 12%. The last change was made in April 2022 when the HBD interest rate was set to 20%, and it has been there for more than a year now.

Now that we have the principal and the interest rate, we can calculate the interest in HBD.

Daily HBD Interest

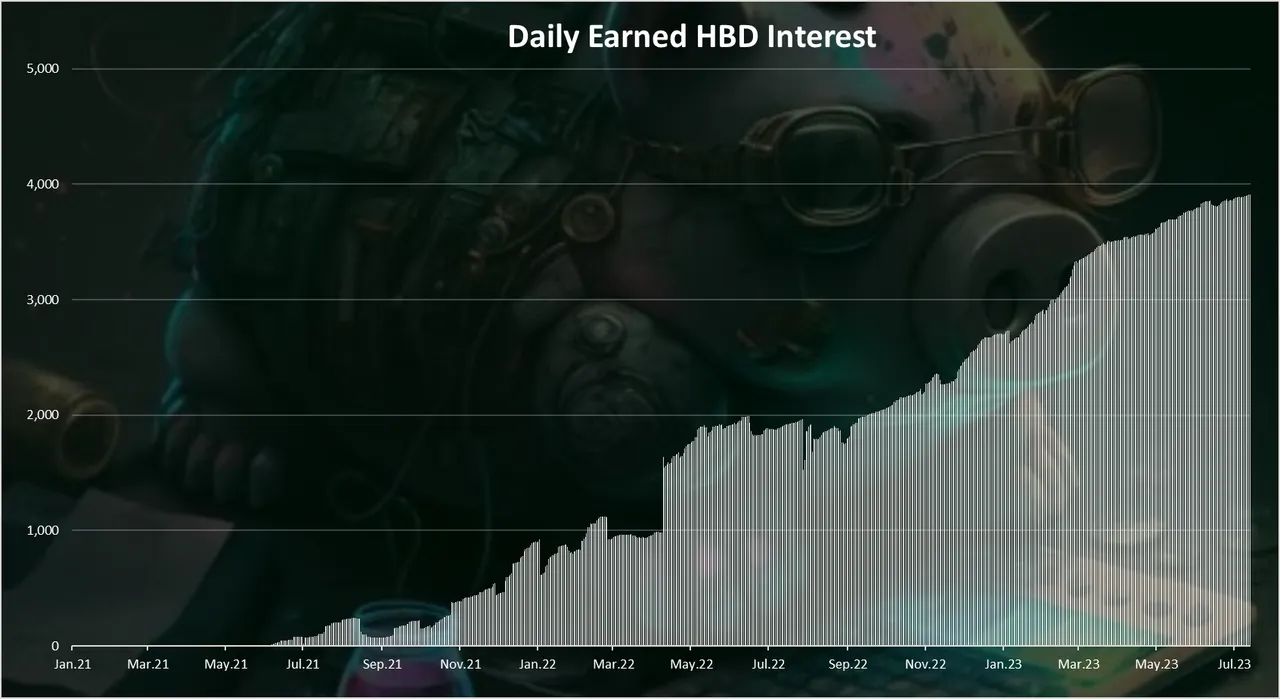

Here is the chart.

Note that is earned HBD from interest, not claimed. The claimed data can vary a lot depending on who is claiming when. The earned gives us more clear data.

The daily interest for HBD has been growing around the same rate as the HBD in the savings. We can see a bigger jump back in April 2022, when the interest rate was increased from 12% to 20%, and since then it has been following the amount of HBD in the savings, aka the principle.

We are now at 4k HBD earned daily from interest.

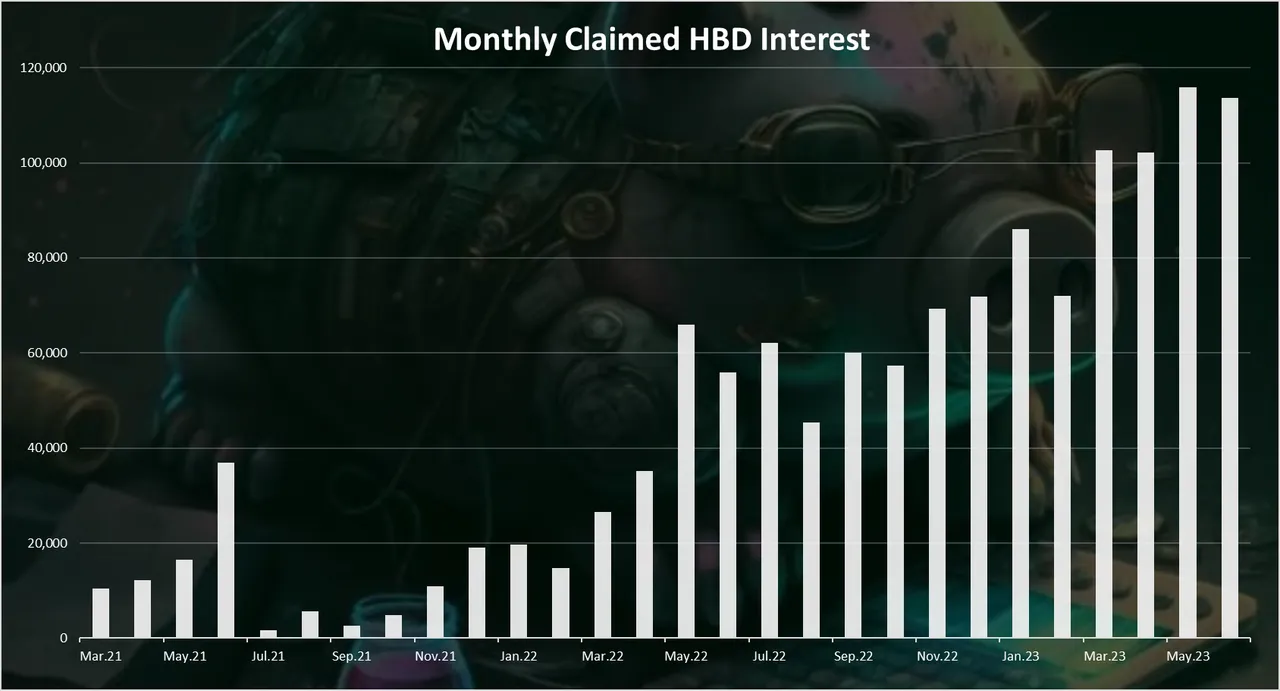

The monthly chart looks like this.

The amount of HBD interest now stands at 120k HBD per month.

Cumulative since the introduction of the interest rate there is 1.4M HBD paid as interest. On a yearly basis in 2023, the projected yearly interest is around 1.2M, while in 2022 this number was 640k.

Inflation from HBD

Ok so we got the absolute amount of HBD paid daily, monthly and overall. But what this means when we compared it with the overall HIVE supply and inflation.

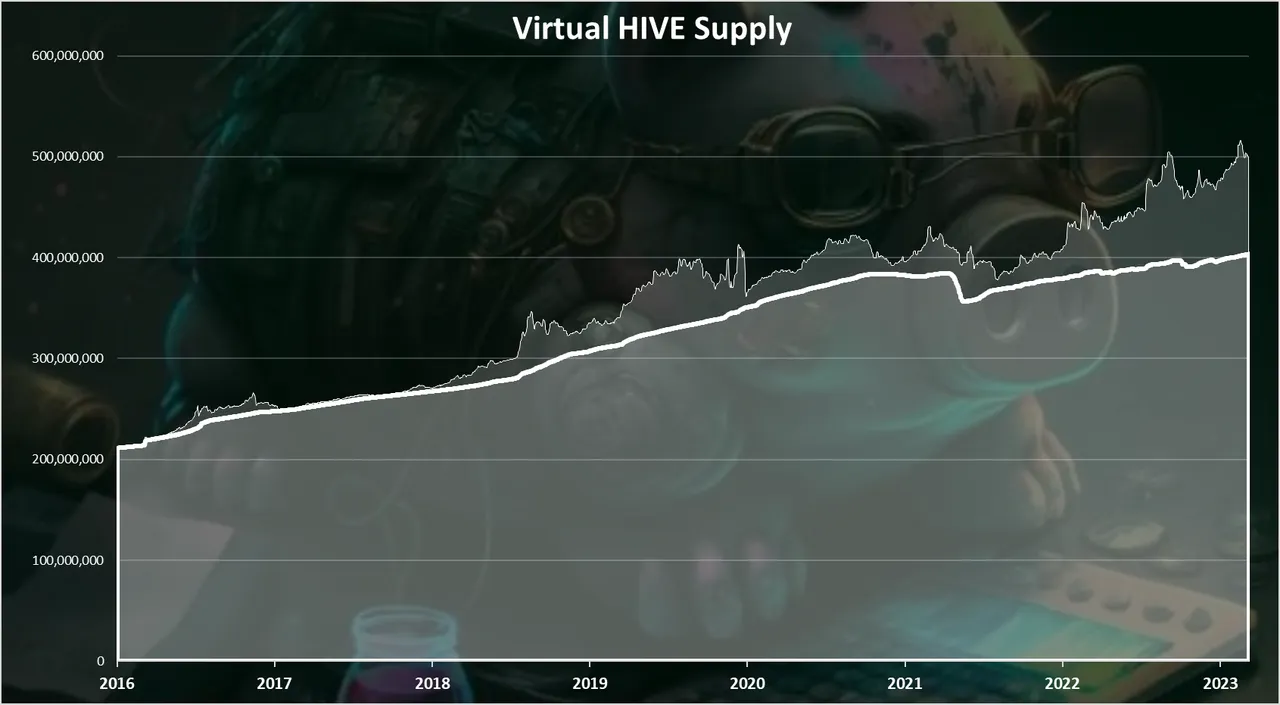

We are now at 404M HIVE supply.

What is the share of the HBD in this overall HIVE inflation? I have already done the share for 2022, in a previous post, and that has been around 8% on top of the regular inflation, or in absolute numbers 0,56% for 2022.

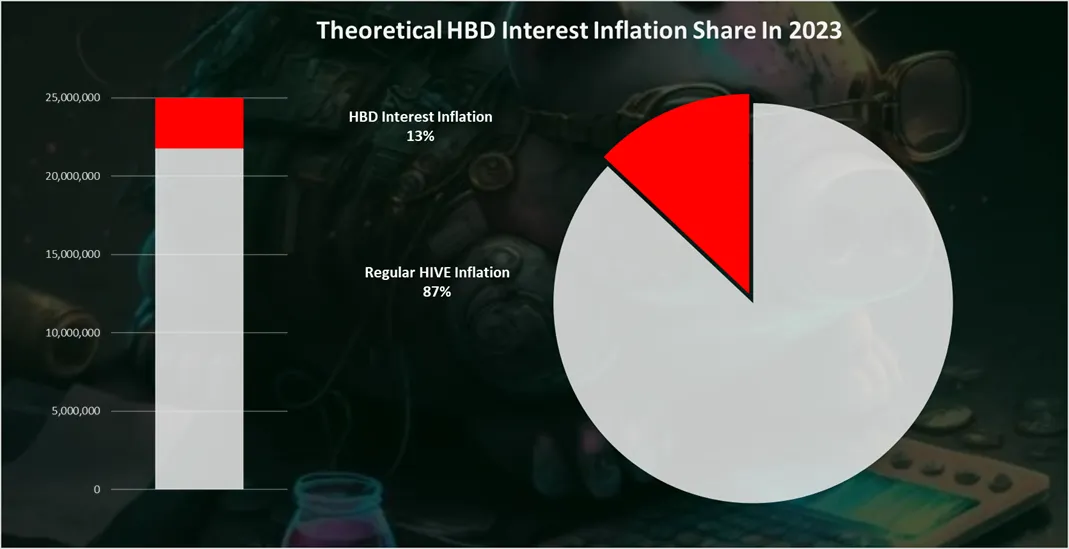

As we have seen the projected HBD from interest in 2023 is around 1.2M. To convert this in HIVE we need the HIVE price. The proper method here would be to take the HBD interest generated on each day and convert it to HIVE with the price for that day. Meaning a sort of average. But let’s go with the current price that is around $0.37 and it is the same as the average price for 2023.

When we convert the 1.2M HBD in HIVE at a price of 0.37, we get a 3.2M HIVE. Meaning from the 25M HIVE projected inflation for in 2023, a 3.2M should come from HBD interest.

This of course is a theoretical number, because not all the HBD interest will be converted to HIVE and at the $0.37 price, and we are still just a half year trough. For comparison in the first half of 2023 there is an addition 8M HIVE created, that is lower than the 12.5M projected for a half a year.

The chart pie for the HBD inflation share looks like this.

An additional 13% on top of the current inflation. This is a share of the inflation.

When we take a look at inflation rate for HIVE we get this.

Up to 2023 the numbers are realized, and after that, they are projected.

We can see that the realized inflation for 2023 from the HBD interest is at 0.65%.

For 2022 it was 0.56%.

This again is a scenario where the HIVE price is at 0.37$ and all the HBD is converted to HIVE. In reality this will be a mix and we cannot properly allocate what share of the HBD interest was actually converted or not. Most of it will probably remain as HBD.

If we set the price of HIVE double than that is today then the inflation form the HBD interest will be half from the number above, and if we set the price of HIVE lower at $0.15, for example then the inflation from HBD interest will be double from the number above or more than 1%.

Important note about the additional HIVE inflation from HBD. While in this post we talk always about the additional inflation from the HBD interest, its important to note that the HBD supply is limited, any significant HBD supply can come from HIVE conversions to HBD, burning HIVE in the process, and lowering the regular HIVE inflation. This has been happening on a different scale in the last two years. So while the interest is putting more HBD in the supply in the same time it incentives HIVE burning making it deflationary.

Projected Inflation from HBD Interest

How will things evolve going forward?

In the first two years of this experiment we can notice that the realized inflation from the HBD interest in 2022 is around 0.5%, and in 2023 is should be somewhere around 0.6%. Will this numbers continue in the future?

There always more than one option for this. If things remains as they are, same amount of HBD in savings, same interest rate, we can expect around the same numbers maybe with slight increase due to compounding, say 0.1% each year, meaning, 0.7% the next year and so on.

But a steady scenario in crypto is not likely. On the upside we would expect more HBD in the savings, conversions from HIVE to HBD, making HIVE deflationary. For additional 10M HBD at the current price we need to burn 27M HIVE at the current prices. This will inevitably push the HIVE price up, lowering the potential inflation from HBD interest. As mentioned a two fold increase in the HIVE price will push down the inflation from HBD interest to 0.3%, from the current 0.6%, and if it increases more it will lower this percent even more, to 0,2%, or sub 0,1%

On the downside we can have a decrease in the HIVE price, and if we have a slow compounding in the HBD in savings (this will take years), we can have more than 1%, or even couple of percentage inflation from HBD interest, 2% or 3%. In an extreme case scenario this can get even worse, but I doubt we will be getting there, probably the interest rate will be reduced at this point.

HBD Supply

When we take a look at the overall HBD supply we get this.

The liquid HBD supply is now at all time low and it is increasingly difficult to add more HBD in the savings without the need to push HIVE. There might be a slow increase in the amount of HBD in savings, but drastic changes cannot happen.

This is simply because of the fact that the HBD supply is constrained and small. There is no pre-mine or any type of source from where a significant amount of HBD can come on the market without the need to get HIVE first. The most liquid market for HBD now is the internal market, where the stabilizer provides HBD from the DHF, but it usually does that at a premium, locking HIVE in the process. Of course, the conversion option is the ultimate liquidity for HBD, but that one directly removes HIVE from circulation.

The main conclusion from the above is that even with the sharp drop in the HIVE price that happened in 2022, the inflation from the HBD interest remains relatively small at 0.54% in 2022, and 0.6% in 2023. This is not an actual number but a theoretical.

Going forward all things remaining the same, this number might be around the 1% (plus/minus 0.5%). Again, only a theoretical number, HBD demand can offset this. We are now with much lower freely available HBD supply then it was at the start of 2022. Most of it is in savings. Because of this HBD might be more sensitive for demand, as there is no freely circulating HBD. HBD demand offsets the interest, as it pushes HIVE.

In the mid-term, five year, the interest from HBD is not putting significant pressure on HIVE and is manageable. The exact output will depend on markets dynamics, that we can not predict.

The risk might increase in the long term if the price of HIVE remains stagnant and depressed for a prolong period of time. The interest might start to put some pressure than. If there is any increase in the HIVE price, the HBD interest can go a long way.

Predicting how things will go is extremely hard, and there is a big possibility for mistake. The crypto market can be very volatile and unpredictable. All the things above boils down to the HIVE price. Higher HIVE price, means we all good, lower prices increase the risk.

At the end there is always the HBD haircut rule that is the ultimate protection for HIVE from HBD.

All the best

@dalz