A couple of weeks ago I started a hodling challenge with the leitmotiv of accumulating some sats on a weekly basis (check the introductory post there).

Not happy with that, I thought about the possibility of depositing my freshly purchased sats into lending wallets like Celsius or Nexo which they're offering ~4% APY's payed out weekly or even daily.

It would be a nice return (in fact it is!), but it has 2 major drawbacks:

Fees & 'Not your Keys'.

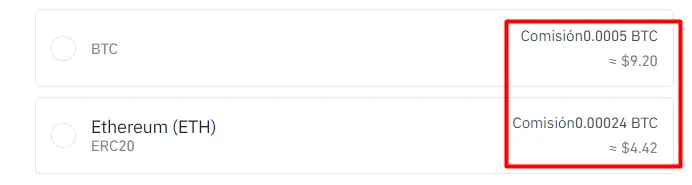

What's the point on receiving 0,1$ weekly as 'interest' If I'm paying 5-10$ every time I need to withdraw native bitcoin from Binance or other CEX? At the time of writing the Binance withdrawal fees are these:

Not to mention that you're hodling that btc on centralized entities. And not, I'm not saying that nance/celsius/nexo aren't 'trusted'. It's the fact that whenever possible I prefer to hold my bags on my own.

Neither short nor lazy a couple of days ago started to research possible ways to keep holding BTC on my own (custodial solution) and to receive the highest %APY possible on this BTC while saving the highest fees.

'What about Wrapped Bitcoin (WBTC)?'

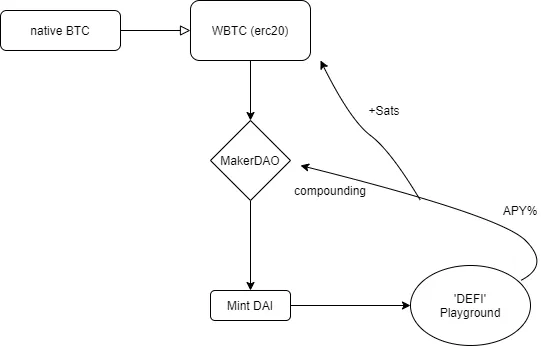

What if... I swap my native BTC for WBTC?

That was my first thought, because you're solving most of your problems:

-You hold WBTC, not other entity on your own (not perfect, but it's what we have at the moment).

-Lower fees, but still expensive.

-You can open a collateralized Vault in MakerDao, mint DAI with that WBTC... and start playing with some DeFi options on Ethereum.

This model solves most of the previous problems, but still looks better than it really is.

Ethereum tx fees are something very serious that you have to consider and if you're moving funds around a lot it eats up your potential APY% pretty fast (we're talking about a potential 5-15% APY BEFORE fees after all).

Maker DAO also has fees... meh. 19,5% stability fee? HAHAHA Cmon, we're talking about 'collateralized' loans. You need big quantities to make this model competitive. Suitable for BTC/ETH whales, not for me. I don't like to pay ~5$ just for moving funds around.

Then the lightbulb went on...

What about the 'Bitcoin-Backed' model in Binance Smart Chain?

If you never heard the term 'Binance Smart Chain', get started here.

At first thought about the possibility of grouping BTCB with some BNB in a Pancake Swap pool, but it defeats a bit the purpose of the challenge as I don't want the amount of BTC to suffer variations due to impermanent losses.

I want my BTC amount to remain fixed. And let's see what we can get from that point.

Then I started researching about Venus Protocol.

Meeting Venus

Keeping it short: '' Venus is a fusion of Compound.finance + MakerDAO.''

Which means that the project aims to offer (source):

Over-collateralized lending where users can borrow assets whose value is 75% or lower than that of the assets supplied.

Earn interest by supplying supported collateral assets to the protocol.

The ability to mint VAI, the protocol's default synthetic stablecoin pegged to the value of 1 USD.

All of this backed by Swipe, and by extension Binance. So at first sight it's legit. We're talking about forked versions of Maker and Compound and integrated into a single platform, but with almost zero fees/tx and few seconds confirmation times.

Wow. Much Impress.

Stepping up the Bitcoin Hodling game;

I decided to move my assets from Celsius to Binance Smart chain. Basically, I can do much more for much less.

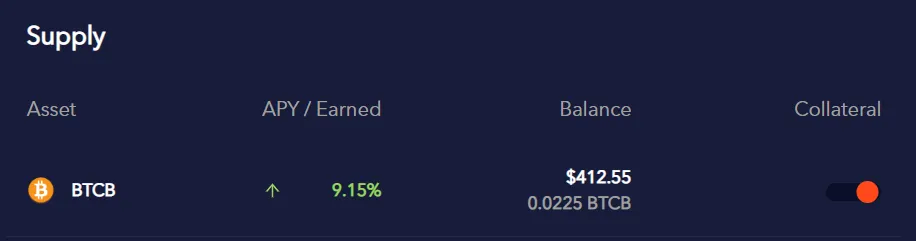

I deposited the exact amount that I had in BTC into my BSC wallet.

0.0225 BTC + 1 BNB to allow transactions to go through.

I'm now providing my BTC into the protocol; Check the APY's. I'm receiving it in Venus (XVS).

Not only that, I can use this supplied BTCB to mint VAI (Venus stablecoin; similar to DAI). And play Defi games without selling my BTCB.

As you can see I minted ~98 VAI to have a big collateralization margin. With the current borrow balance, my vault can afford a ~50% flash-crash in Bitcoin. Unlikely if you ask me (never say never).

The app still feels a bit buggy, but interacting with the chain at almost zero fees and near-instant confirmation times it's a pleasure.

To summarize

This thing opens up a whole world of possibilities. Let's recap the main advantages:

- The Bitcoin are in my wallet in a 'pseudo-centralized' chain. Like holding spot BTC in Binance. Not a perfect solution but still a competitive one.

- I'm receiving a 9% APY on my supplied bitcoin paid in XVS. this alone beats any other centralized competitor.

- I can mint extra VAI and keep playing around. I'll detail in next week report what I'll be doing with this extra 'Defi Playground' possibilities.

Can only say, This is sexy.

Are you going to try @resiliencia? Isn't this an 'upgrade' or not?

As always, be curious but take care when trying new tech.

You can follow me on Twitter