Summer is almost here, The temperature around noon starts to become oppressive.

And since it's already 11, it's time for a PWR monthly report.

There have been some changes in recent weeks. And I will use this report to (as usual) bring you up to date.

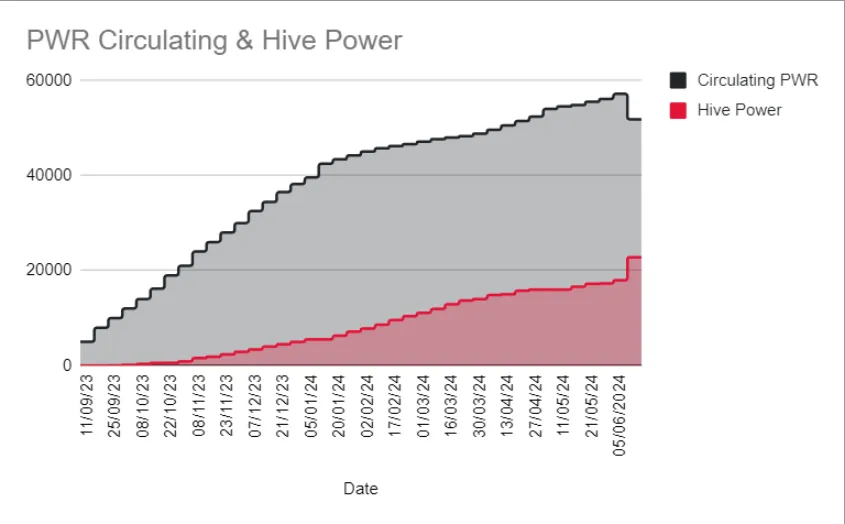

But first, the regular chart about emissions/holdings.

First surprise!

This week we have a massive variation in the amount of staked Hive and PWR issued. The reason is...

The 'Initial Liquidity' Account LP has ended.

As stated in the initial post, an initial liquidity of 5K PWR would be paired with 5K Hive (coming from my personal pocket) as an initial buffer to enable buyers/sellers in/out of the project.

- These initial 5K PWR + 5K HIVE have been sitting pooled from the @empo account since the beginning of the days of the project.

I'm very happy with how steady things have been in the last months regarding the pool. So I have taken the liberty of returning this liquidity a little ahead of schedule.

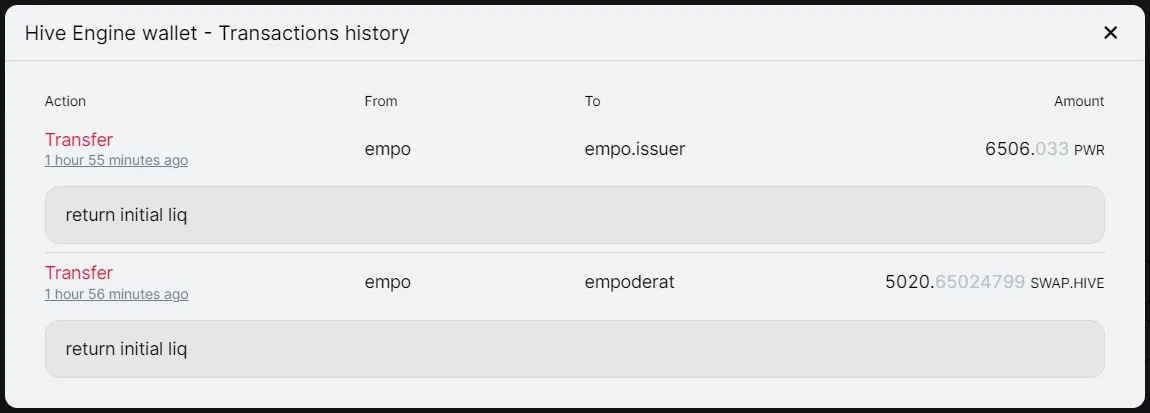

As you can see in the previous pic, 6500 PWR (5K + 1,5K acquired as LP rewards) have been transferred back to @empo.issuer.

This account is from where all the distribution happens, which in practical terms means that ~10% of the total supply have been recycled back and will be issued as delegation rewards in the following months.

hence you can see the drop in the chart above, since this PWR is not counted anymore as circulating.

What about the increase of HIVE Power?

Well, I realized that ('for now') allocating HIVE into a LP isn't the best way of using the Hive Power which is flowing through delegation rewards .

Although this LP gives us more stability (which is always welcome), it 'dilutes' the LP rewards back into the holding account and reduces overall the compounding effect (since this Hive is sitting idle into the pool). I have another reason which I'll disclose later.

TL;DR -> It's better to just stake it as Hive Power.

So, what i did is REMOVING the LP position from @vventures which at that time was worth around ~2100 PWR and ~2100 HIVE.

What I basically did was to OTC buy all of those PWR from my personal account at a 1:1 basis. ( the tx are marked with ''intern tx'' in the memo for transparency).

Long story short, @vventures received 4K HIVE which have already been staked.

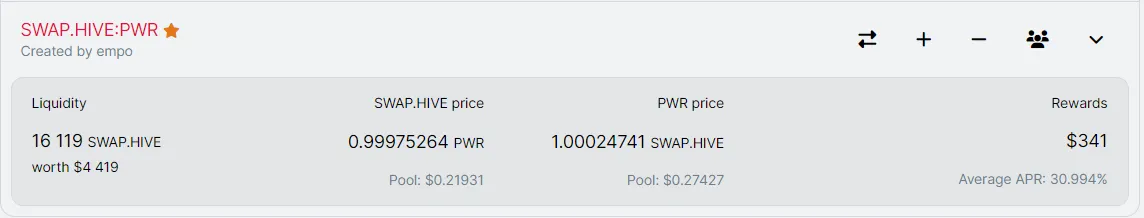

No PWR has been sold through the pool, the price is around the peg and the APR has been increased up to ~30% (basically because overall liquidity has also been slightly reduced.

(still more than enough to sell regularly your delegation rewards, plus I'm topping up frequently from my own funds).

Current Status of the Holdings of the Project:

@empo.voter (the delegation & curation account) keeps providing @vventures (the holding account) with a weekly flow of curation rewards.

@empo.voter currently holds ~7K HP which is in a permanent power-down (~500 HIVE week at the moment).

@vventures keeps adding and it's at ~22K HP (16K last month). Massive jump for the reasons stated above.

Time to keep compounding, with Hive this low I don't want to sell any!

Btw; I have something else to say :) which I suppose you'll like

Hive Dividends

If you read me, you will know that over the last few months I have been thinking a lot about how to correctly implement dividends with Hive in PWR.

Well, I think I've finally found a formula I like.

Therefore, I am pleased to formally announce that a 1.0 version of PWR dividends will begin distribution in approximately ~3 months.

The date coincides with 11 September, so give a week more as buffer and you can count with 17th September at the latest.

You'll MUST be required to be a LP.

APR's yet to be determined.

*You can expect an in-depth post as the date approaches. *

And... that's it for this report. Hope you're all are fine (I've been very inactive around here lately, extra busy irl).

Cheers!

Vote for my witness, because 100% of my witness rewards go to @vventures.

https://vote.hive.uno/@empo.witness