Hey All,

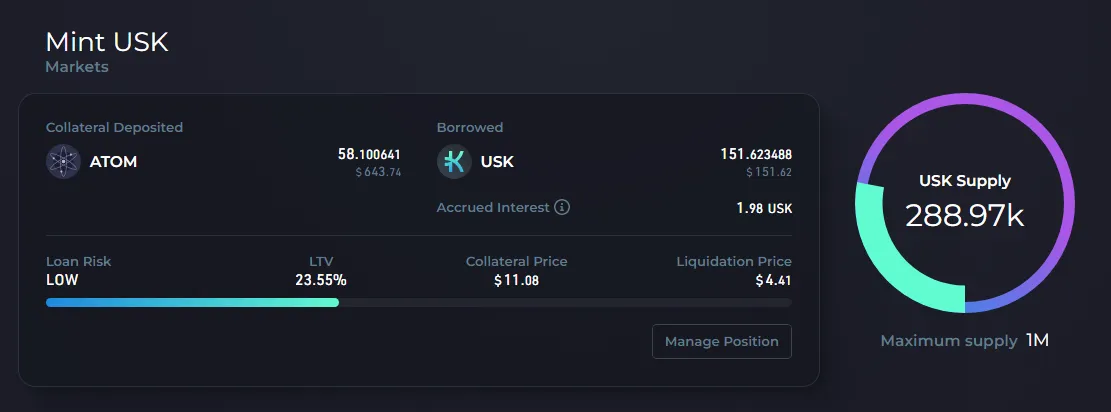

I had Collateralized my $ATOM to Mint $USK on KUJIRA APP BLUE worth $280+ to buy some of my favorite crypto assets. The current status of my collateral is that I still need to pay another $151+ in $USK to free up 58+ $ATOM locked in smart contract. In simple terms collateralizing your crypto assets helps you to take Loan on its behalf and until you pay back the loan the crypto assets will be locked in smart contract. In my case, I had locked 58+ $ATOM to mint $USK; which is the stable coin on KUJIRA blockchain to borrow $280+. I paid off some dollars earlier and here is my current Collateral Loan Position is as follows::

- Collateral Value = $643+ USD

- USK Borrowed = $151+

- New LTV = 23+%

- Liquidation Price - $4+

One need to be careful with Loan to value (LTV) percentages as it determines the amount of crypto one would need as collateral before one could get a loan. Precisely LTV in crypto lending basically helps minimize the risk on the lender's part. Higher the LTV higher is the risk and vice-versa i.e. lover the LTV lower is the risk for the loan taken. So ensure to monitor your LTV quite often and try keeping the percentages numbers for LTV as low as possible.

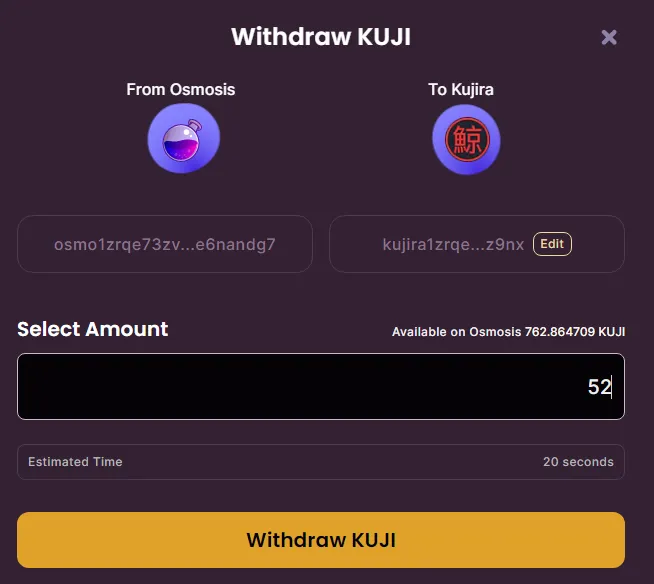

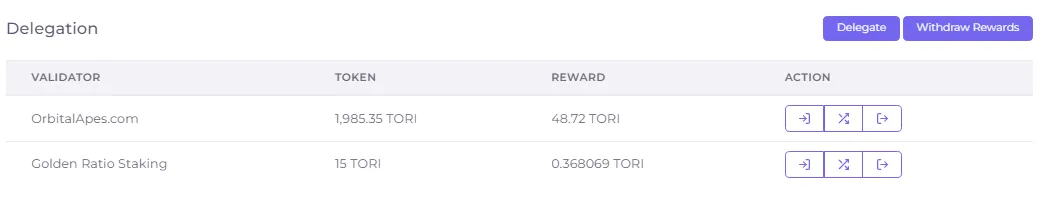

SOLD $TROI for $KUJI to Swap for $USK

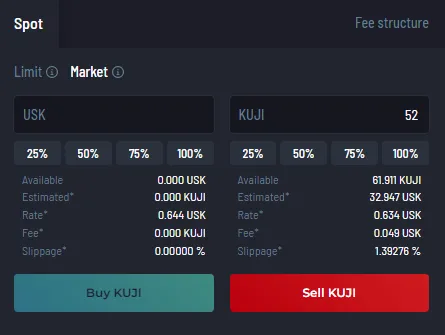

Coming back to the main topic of paying my Collateral Loan with $TORI Staking Rewards. Then here it is, I took all my $TORI staking rewards from Yesterday to swap them for $KUJI. As seen from the above image this got me close to 52 $KUJI; which I further went ahead to sell it in the internal market on Kuji Fin App to exchange it for $USK which is the stable coin that is peg to $USD on KUJIRA APP BLUE. The trade for 52 $KUJI got me 32+ $USK; can be seen from the following image::

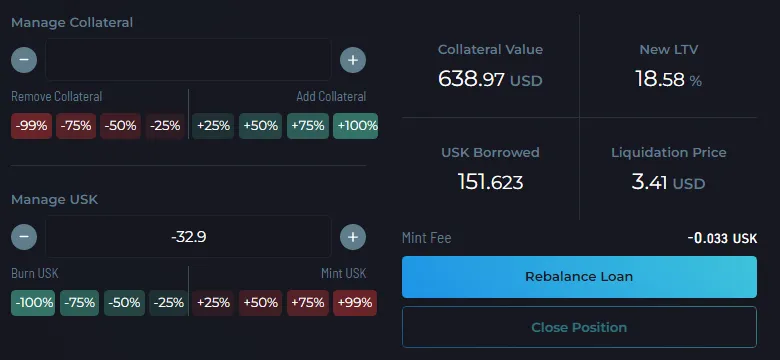

Now that I have $USK in my wallet. I am ready to pay off another $31+ for my collateral loan. Lets do that and then see how much my loan amount reduces too.

I had some $USK earlier in my wallet and hence I am paying off $32+ dollars for my loan. After entering the $USK to be paid, I clicked Rebalance Loan and this action lead to bringing my collateral loan from $151+ to $118+

As you can see immediately I paid $32+ my LTV and Liquidation Price both reduced and bring my $USK borrowed amount to $118+ now. The point now remaining is the will $TORI be able Pay off my Loan & Free Up my Locked $ATOM? Currently $TORI is going Guns with trading price above $0.70+ cents and has shown a tremendous bull run in its initial days of launch.

My $TORI Rewards Daily...

Getting close to 50 $TORI rewards daily with 2K+ $TORI staked and considering the current price of $TORI - I am confident that I should be able to close my Collateral Loan with $TORI Staking Rewards. Subject to condition that I dont change my plans and dont redirect the staking rewards in any other project. Plus the price of $TORI shouldn't crash or rather should be in a range bound of $0.50 - 0.70 then I should be able to easily close my collateral loan on KUJIRA APP BLUE. As a result this should give be back $635+ to invest in other projects. The one that I am looking forwards to invest is isn Splintershards (SPS) which is the governance coin of the game Splinterlands. If all goes by plan then I should be able to accomplish my GOAL for $SPS in having 200K+ SPS by the end of this year, 2022 much earlier... flingers crossed :-)

Can $TORI Pay off my Loan & Free Up my Locked $ATOM?

Image Credits:: kujira.app, frontier.osmosis.zone, fin.kujira.app

Best Regards