This content was deleted by the author. You can see it from Blockchain History logs.

Dear, all. I'm glad to visit again and this time, I've come with a tutorial through my crypto talk and I hope you are doing great today. In the context for today, I will be discussing Spot Trading and the practical steps on how to carry out Spot trading on a centralized exchange would be included.

Graphics designed in Canva

Spot Trading

Just as the name sounds, in the crypto ecosystem Spot trading is the type of trade carried out on a spot, in other words, trades that are triggered with an instantaneous action. In this type of trade, buyers and sellers place orders on different assets with the desired preference of price, when the current price of the asset hits the buying or selling price placed by traders, it gets triggered and completed.

Spot trading is associated with order book which has the record of buy and sell placed by traders to trade their assets. The trades placed by different traders also provide liquidity for the trades on the asset in question to trigger orders. In short, on the spot trading platform, traders can place their orders (buy/sell) in the quest to get it triggered when the current buying/selling price equals the traders' price.

Key Highlights of Spot Trading

- Spot trading are used to make instantaneous trades.

- It is associated with order books that contain the record of buy and sell orders placed by the traders.

- When the current buying/selling price of the asset equals the traders' price, the trade is triggered.

- Spot trading is used for quick trades without delay as a user can choose to buy/sell at the current trading price and the trade would be triggered in seconds.

- It can be used for quick money movement without being affected by the volatility of any asset at hand. For example, trading your profits on an asset to stablecoin to properly book your profits.

How to Carry Out Spot Trading on a Centralized Exchange

We must teach this, several encounters show that even some users on a blockchain blogging platform like this still sell their rewards to other users within the platform, well it's good but most of these happen because some users don't know how to navigate through simple trades on centralized exchanges.

For this purpose, we would be using the mobile App of

Binance exchange to carry out the practical demonstration. Below are the steps;

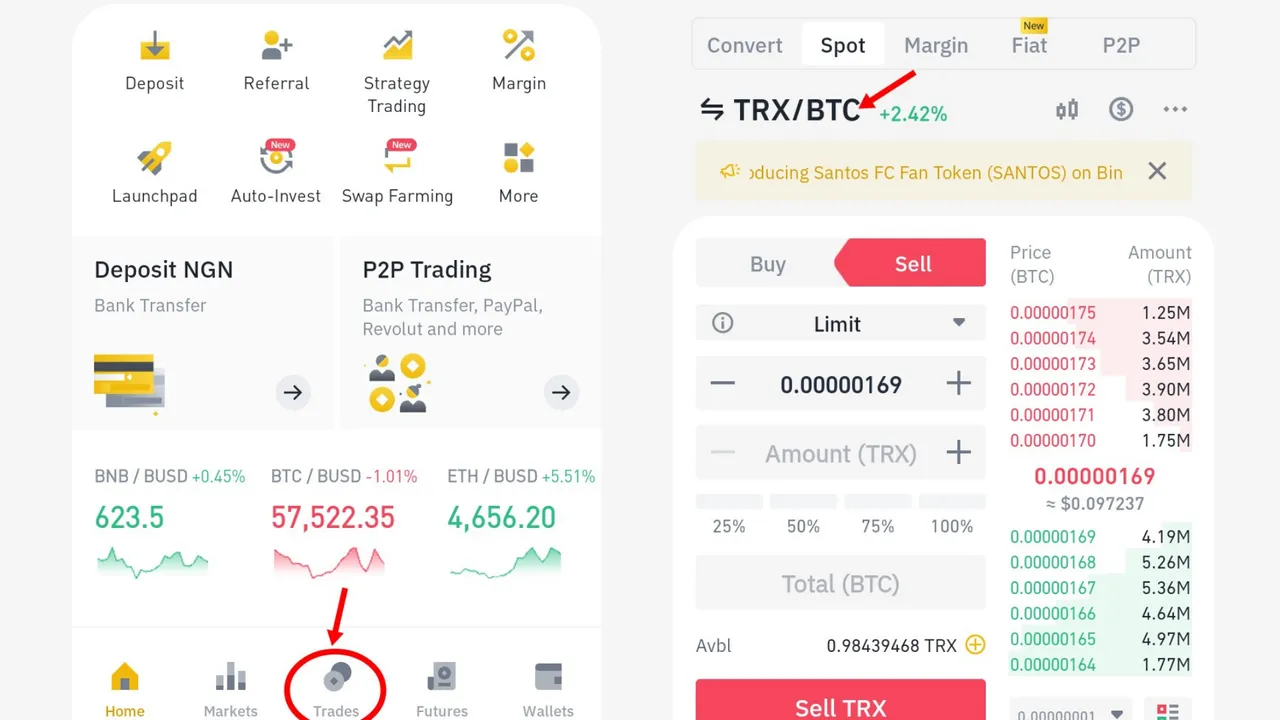

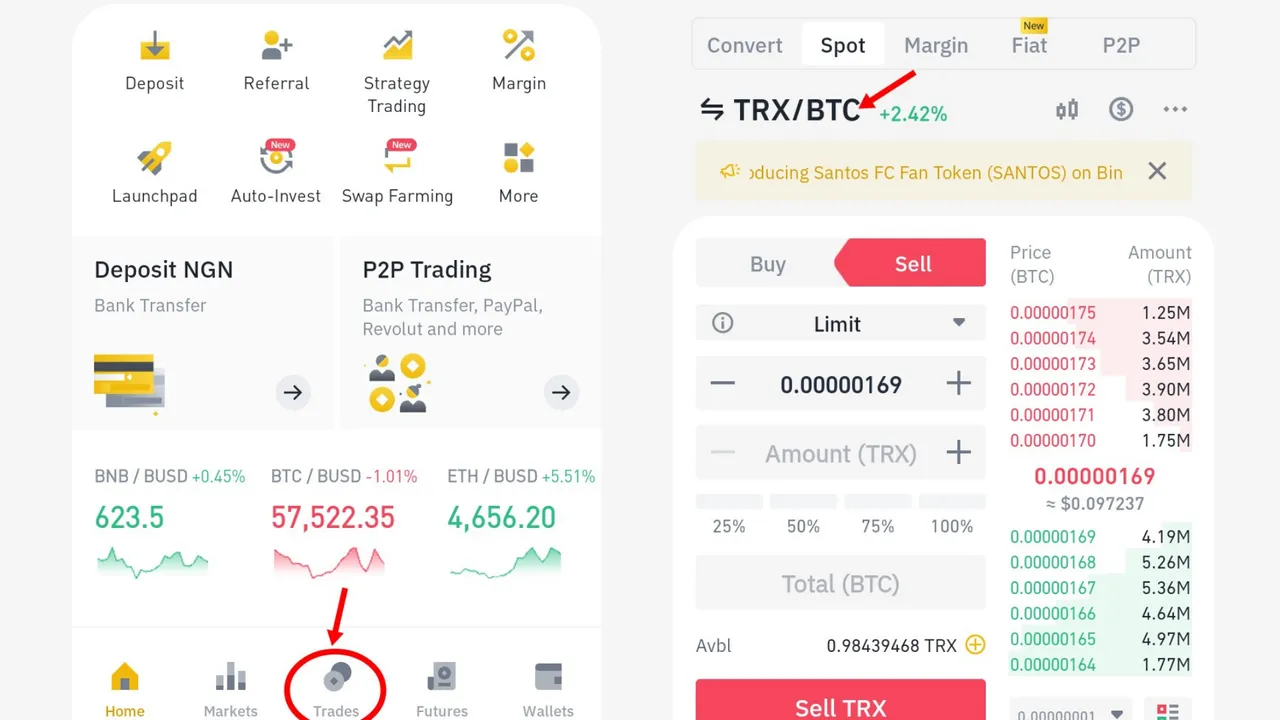

- Launch the App and from the bottom of the page, select trade, and ensure that the top shows that you are on the spot trade platform.

- Select the pair at the top of the page to choose any pair for trading.

Source- Screenshot from Binance App

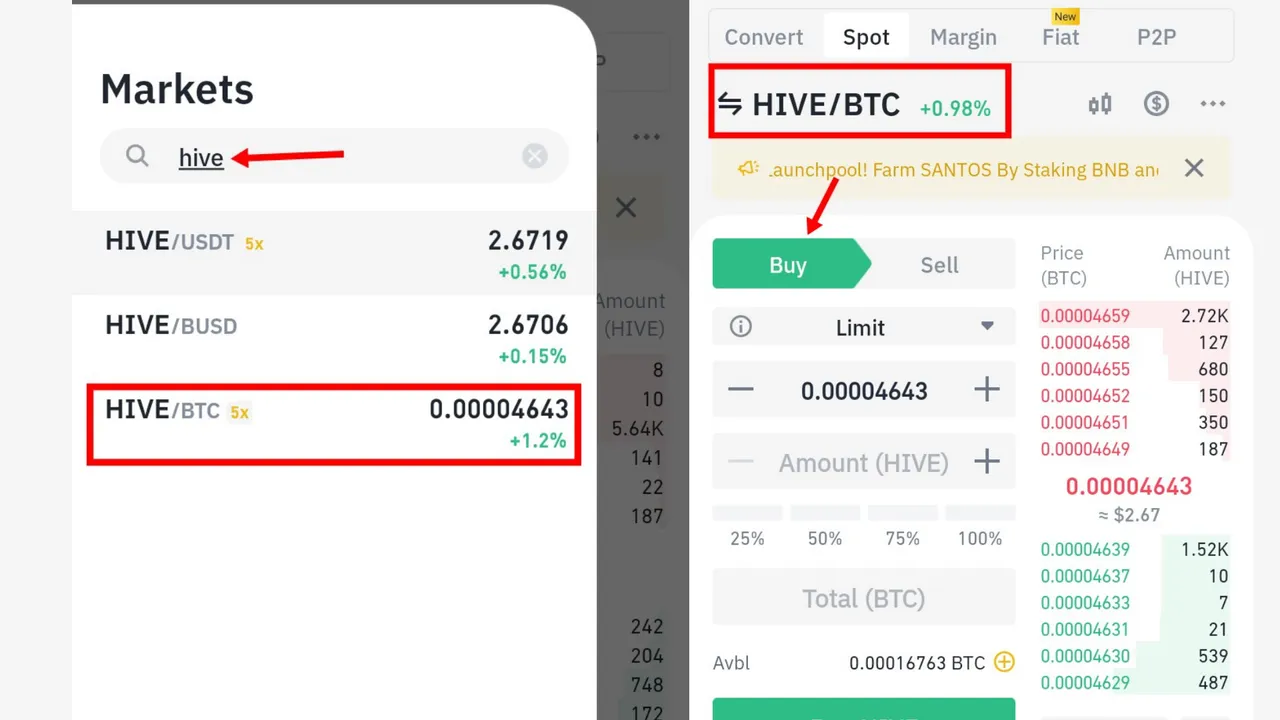

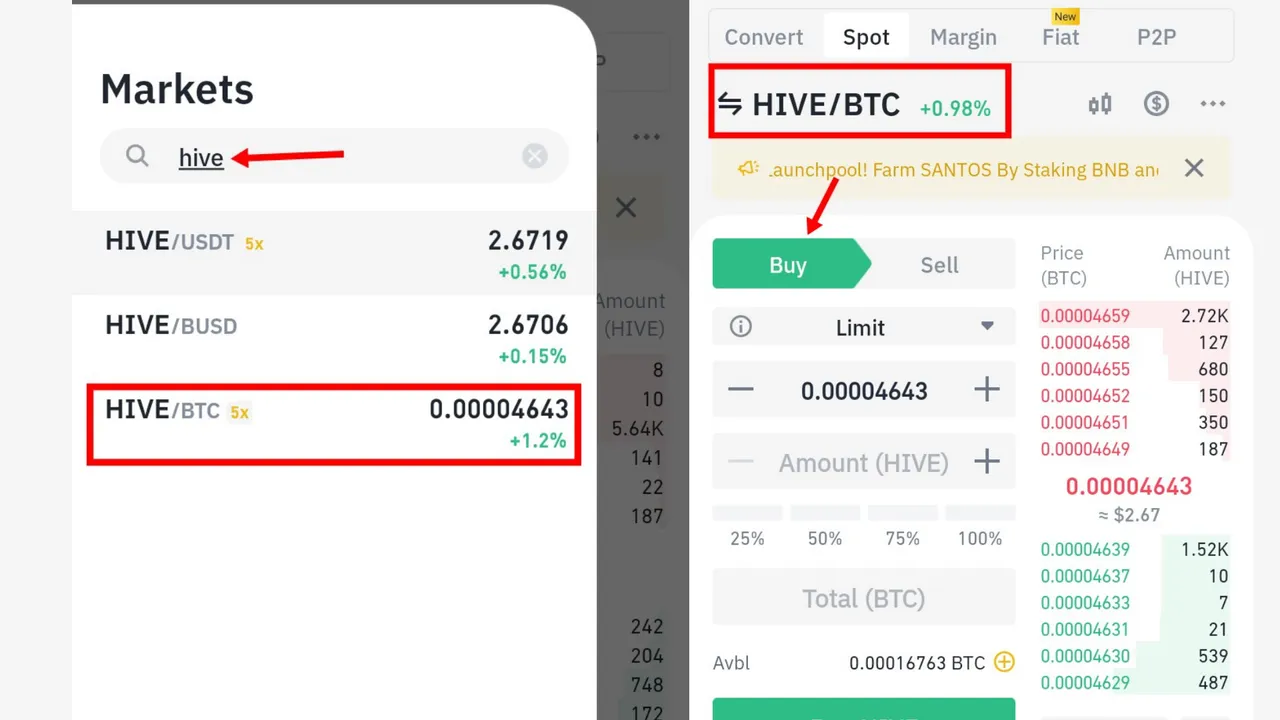

- Now search for any asset of choice depending on the ones you have in your wallet. For example, I searched HIVE and selected HIVE/BTC because I have BTC assets which is intended to be used to buy HIVE.

- The pair of choices is activated on the spot trading interface.

Source- Screenshot from Binance App

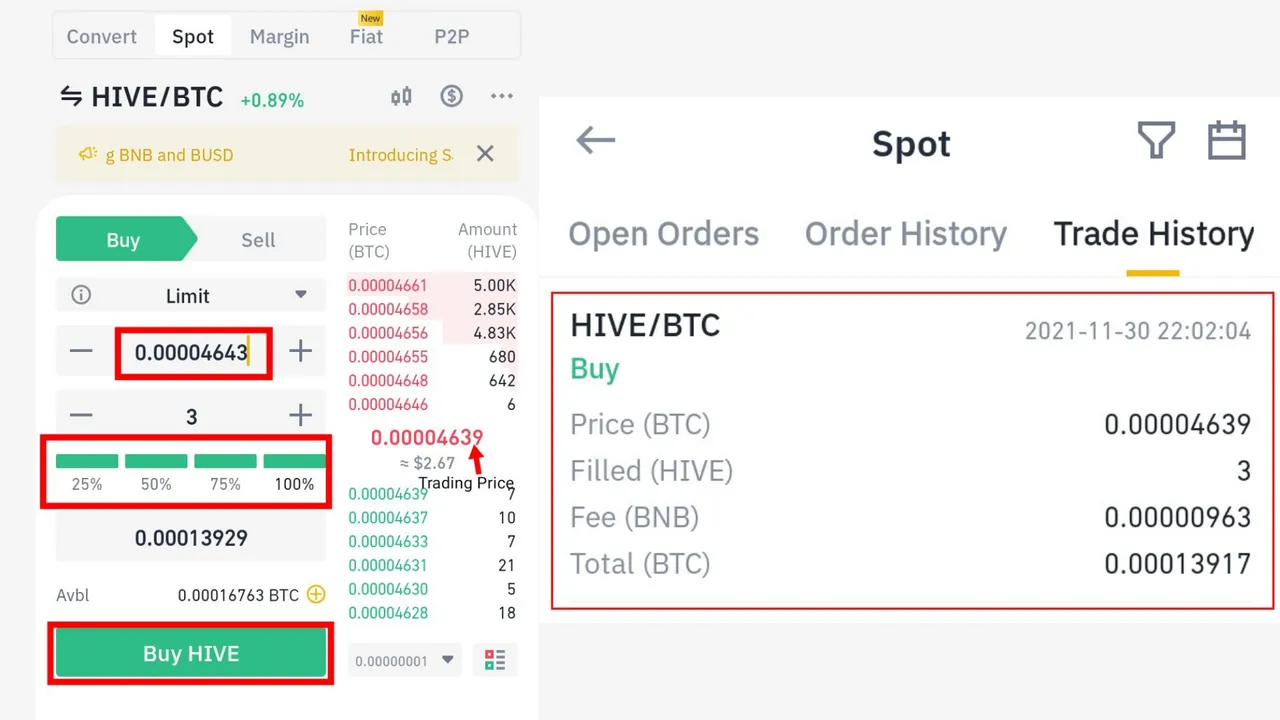

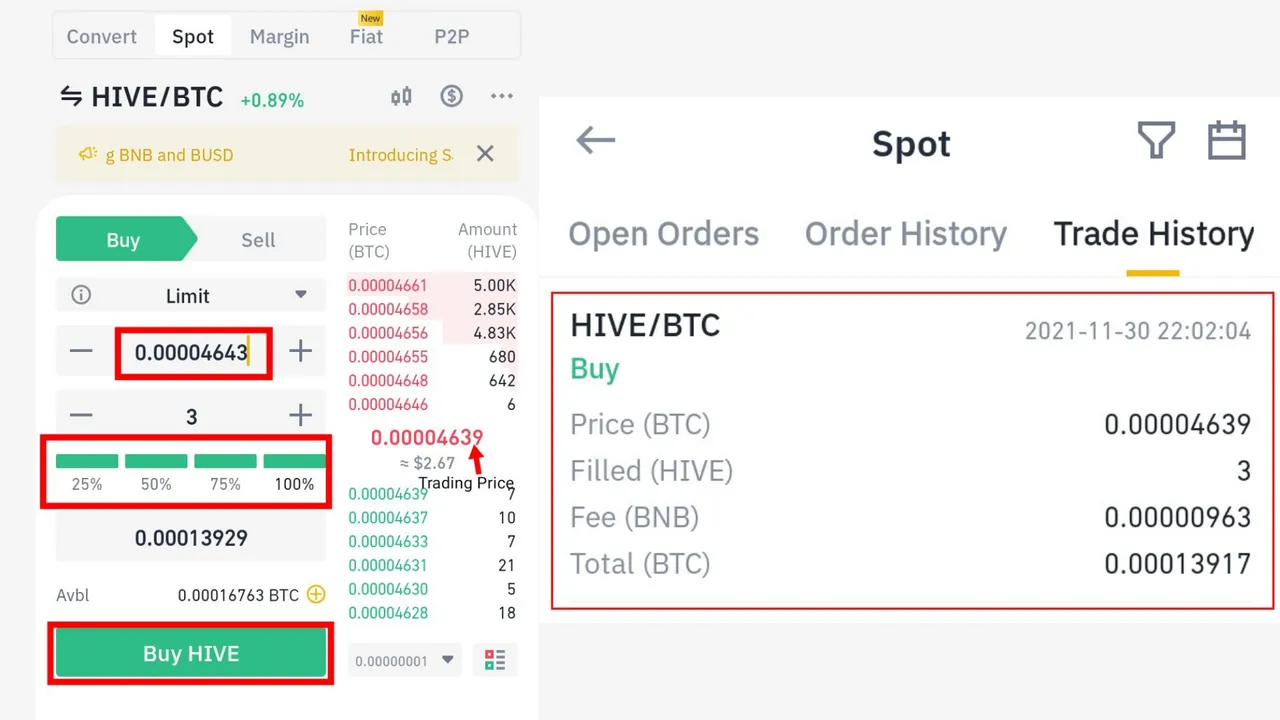

- For a buy trade, enter the buying price, the percentage of the asset you are using for the trade, and click on buy. Hint: Customize the price to the current trading price if you want a quick trigger of your transactions.

- The trade was complete as 3 HIVE was successfully bought.

Source- Screenshot from Binance App

If you intended to sell, the same steps above would be followed, only that you need to switch to sell on the spot trading platform.

Conclusion

To bring all to a conclusion, spot trading helps traders to trade their assets with no delay, in other words, with instant trade triggers. We have discussed spot trading in detail in this context including the practical on how t get it done, in my next articles, I will be discussing a few other things that one should know, be it beginner or experienced. See you in other articles of mine. Thanks for reading.